After last week’s measured action against extremes, U.S. equities look poised to rebound. The downturn in U.S. equities last week ended a streak of 404 trading days without a 5% pullback in stock prices from the previous high. That marked the longest such streak in market history, an extreme. The S&P 500 closed on Friday at 2619.55, rallying 1.5% and off it’s 200 day moving average just below 2,540. The broad index fell some 5% for the week.

European stocks are also rising. Stocks bounced in Asia, with the Shenzhen Composite climbing 2.7 percent. The yield on 10-year Treasury notes continue to inch higher Monday to 2.875 percent.

President Trump is expected to roll out a plan to spend $200 billion in government money over 10 years on grants to states and cities to improve highways, airports and other infrastructure. Hopes for increased U.S. infrastructure spending and the added stimulus it might provide for the economy have been credited as drivers for the stock market rally that has been underway since Trump was elected.

What kicked off all of this selling pressure in equities has largely been the fears surrounding bond yields on the rise. The trigger or catalysts was likely the latest Nonfarm Payroll report whereby job growth remained strong, but wage growth was that much stronger. In the January Nonfarm Payroll report, average hourly earnings were up 0.3%, matching estimates and reflecting an annualized gain of 2.9 percent. That was the best since mid-2009 however, the average workweek fell two-tenths to 34.3 hours which somewhat inflates the data. Nonetheless, wages rising this much and after a prolonged period of wage stagnation was the tipping point for equity markets which had finished the month of January with strong gains.

Given the tug-of-war that is foreseen to continue between stocks and bonds in 2018, the data highlight of the week will be January consumer price inflation, due Wednesday. If it comes in slightly ahead of expectations, spooked investors could trigger yet another stock selloff. A survey of analysts polled by FactSet are forecasting headline inflation to rise 0.3%, and core inflation, which strips out food and energy costs, to gain 0.2 percent.

Two schools of thought will compete for investor attention in 2018. The first argues that the rise in bond yields, specifically the 10-year Treasury, is more a factor of a strong economic and corporate earnings backdrop. The second argues that while yields rising may very well be on the heels of improved economic conditions, it matters little as it may force the Federal Reserve to hike rates more expediently as to curb the affects from inflation. Both schools of thought are put forth with great historical precedence and merit and, in truth, are accurate in their own regard. At the end of the day and with respect to rising rates and reflationary concerns, investors will make their determination based on where they can extrapolate the most yield with lesser risk. At present, even should the 10-year yield tip slightly over the 3% watermark, the S&P 500 is still projected to garner a greater investment yield in 2018. Additionally and given the nature of the recent rise in the 10-year yield, the rapidity for which its yield has risen has proven a risk-off atmosphere for equities recently. The tide may turn, however, and as the S&P 500 multiple has been curtailed through the recent correction.

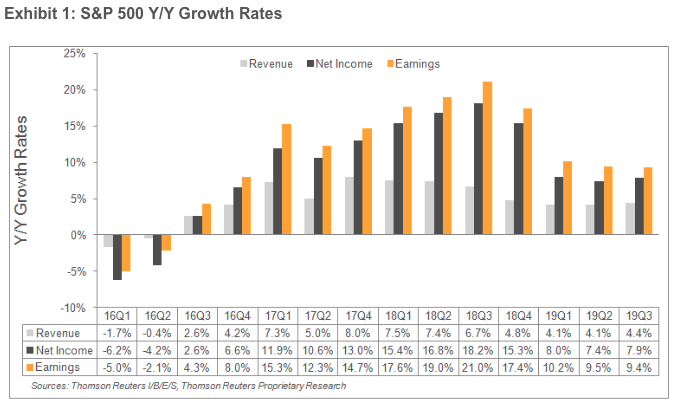

The S&P 500’s valuation has dropped sharply due to the recent correction. S&P 500 earnings per share are expected to jump 17% in 2018, to $156.88 from an estimated $132.40 last year. In 2019, S&P 500 earnings are expected to grow another 10% to $172.67.

Jim Caron, portfolio manager at Morgan Stanley Investment Management, said he expects the range for the 10-year now to be 2.50 to 3.25 percent.

“The answer to this will reset the level of risk premium, or risk tolerance for other asset prices,” Caron said in a note. “It seems the risk premium is being reset to a new, higher level. This is not a bad thing; it’s a normal and common readjustment in the market. Once we find that new range and understand the tolerances, then it’s back to business as usual.”

The table below represents expectations for revenue, net income and earnings growth of the S&P 500 through 2019 and provided by Thomson Reuters.

I’m of the opinion the recent correction, while finding many investors on the wrong side of the curve, is the sign of a healthy bull market. Others share that opinion to some degree. Opinions on rising yields and rates will continue to way heavily on market movement throughout 2018, but most analysts still see markets higher by year-end and higher than 2017 by 5-10 percent.

With the market correcting and yields rising, the Fed’s rate hike schedule will come into question. Will it be the projected 3 rate hikes or possibly 4 rate hikes in 2018? Despite the belief that equity markets don’t play a role in Fed decisions on rate hikes, we have both a Fed Futures market and a Fed that has played into the markets hands for nearly a decade.

Investors should expect more volatility in the markets during 2018 and with a higher median VIX reading than the 11 average in 2017. Near term market stability should be found with the SPX recently finding temporary support. Having said that, a retest of the support level below 2,550 is likely over the next 3-6 month period.