If you hadn’t heard it by now, the 10-yr. Treasury note achieved a 3% yield during yesterday’s trading session. The move spooked investors, even as most economists, analysts and investors expected to achieve the watermark level and somewhat higher in 2018. With a 3% 10-yr. being achieved investors assumed a risk-off sentiment, sending the major averages down by more than 1.5% on the day. The Dow Jones Industrial Average fell 424.56 points, or 1.7%, to 24,024.13 to end the day, booking its fifth consecutive decline. The S&P 500 index fell 35.73 points, or 1.3%, to 2,634.56. Including Tuesday’s trade, the S&P has been in correction territory for 52 trading days, its longest such stretch since 2008, according to WSJ Market Data Group. The Nasdaq Composite Index declined by 121.25 points, or 1.7%, to 7,007.35, ending with losses for a fourth straight session, its longest streak since February. The tech sector was hit hard as FANG stocks continued to be routed by investors fearing that higher borrowing costs would crimp profits for tech stocks.

Although the selling on Wall Street was heavy yesterday, it was on very light volume, as has been the case during risk-on/rally days. Additionally, the selling pressure was rather orderly. The Arms Index, a volume-weighted breadth measure that usually rises above 1.000 when the stock market falls, as sellers of declining stocks tend to be more aggressive than buyers of advancing stocks, was at just 0.902 for the NYSE yesterday during the trough of the market sell-off. When the Arms Index rises above 2.000, it usually suggests panic-like selling.

While rising bond yields tend to be a sign of a growing economy, given the low rates and FOMC’s policy of low rates and ample liquidity, the shift to a higher rate environment is overpowering the sentiment surrounding earnings and the economy presently. Maris Ogg, president at Tower Bridge Advisors, played down the importance of 3% yield on 10-year Treasurys in a recent interview.

“10-year yields at 3% or even 3.5% is not that terrible since it’s a reflection of growing economy. But because there is so much uncertainty regarding inflation and Fed policy, investors may not pay the same multiples high for future earnings as they had done until now,” Ogg said.

It’s a forgone conclusion that higher rates and reflation are at-hand, as the economy can withstand such increases in prices. But investors generally find themselves reevaluating and repositioning for risk during periods of higher rates and yields. The 10-yr. Treasury yield at 3% means that risk-free government paper can compete better with assets perceived as risky like stocks. The average dividend yield for stocks trading on the S&P 500 index is 2%, while the dividend yield for the average Dow component is 2.4%. When positioned against a 10-yr. Treasury yielding 3% at this stage of the economic cycle, that friction can cause investors to re-evaluate their overall investment composition.

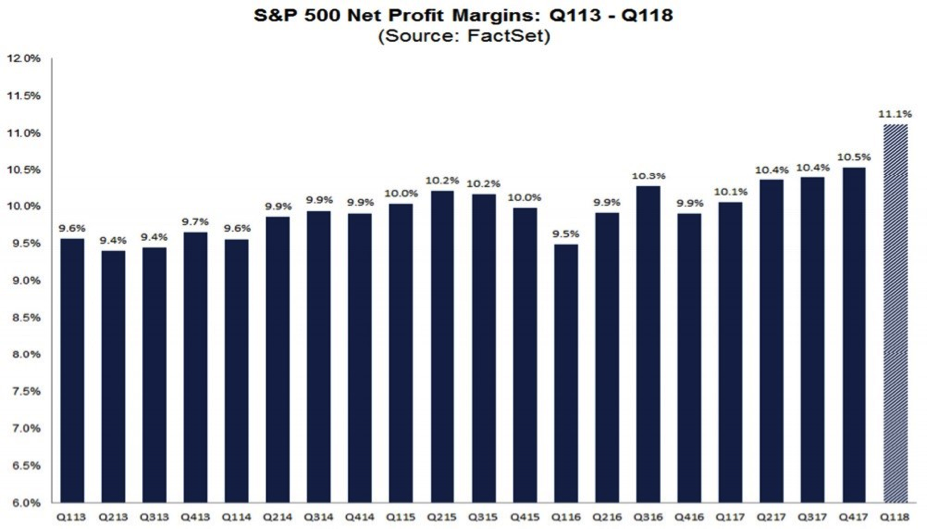

Higher 10-year yields imply that borrowing costs are climbing, making it more expensive for corporations to deliver earnings unless their businesses commensurately increase their performance along with the rise in rates. Such is proving to be the case with the S&P 500 Q1 2018 reporting season. Much of this better than reporting season, however, is being dismissed as a one-off event, partly due to the balance sheet stimulus provided by lower corporate tax rates.

As bond yields are rising alongside Q1 2018 earnings coming in better than anticipated, price-to-earnings multiples are being compressed lower. The S&P 500 PE has come down in recent months, with the 12-month forward PE at 16.5, down from 18.5 at the beginning of the year, according to FactSet. It’s a pretty remarkable and unique set of circumstances that are presently lowering the PE.

The recent sell-off in bonds has already driven the 10-yr. yield past several charting levels. It surged above its 50-day moving average, 100-day moving average and 200-day moving average last week. Strategists at Société Générale said the S&P 500 could fall below 2,000, around a 44% drop, if the 10-year yield hit 3.5 percent. Fortunately, they added a significant bid for safe assets should keep the 10-year yield from maintaining a foothold above 3%, as investors fleeing a selloff in risky assets like stocks would take shelter in government paper, pushing yields lower. But it’s important to represent that persistent central bank bond selling should place a floor underneath yields. Foreign central banks have reportedly sold more than $38 billion of Treasurys in the week ending April. 18, the biggest divestiture since 2013, according to Nomura Securities.

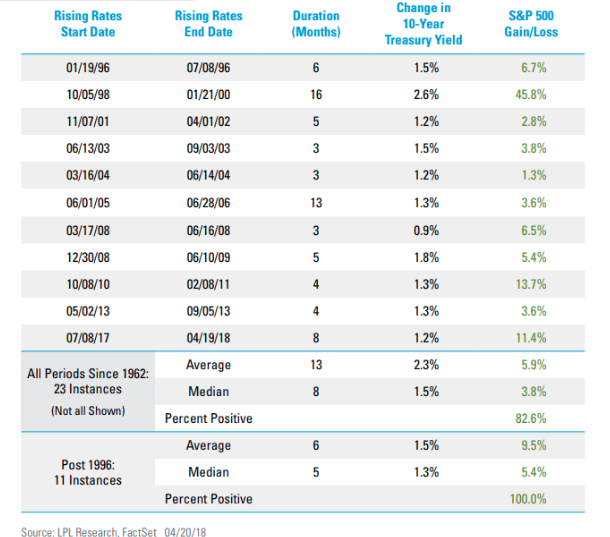

So what’s next in the New World Order that finds investors weighing the risk of bonds vs. equities? History shows that going back to the 1990s, there have been six extended periods of rising rates, with an average increase of 182 basis points. Over those periods, stocks have seen an annualized percentage return of nearly 17 percent. John Lynch, chief investment strategist at LPL Financial, recognizes the historical context for equity returns during a period of rising rates with the chart below, which shows stocks have tended to perform well during periods of rising rates.

While history offers the facts of what has occurred, it fails to predict what will occur in the future and against what many refer to as the greatest central bank experiment of all-time, Quantitative Easing.

It’s relevant to define the current economic cycle as one that comes with higher corporate earnings, rising rages (finally), rising rates and borrowing costs, but also higher net profit margins. As Finom Group discussed in its latest research report this weekend, U.S. corporations are experiencing their highest net profit margins since 2013. As one can see in the chart below, the 11.1% blended net margins in Q1 2018 are at their highest level since FactSet began calculating margins in Q3 2008. Moreover, the chart also identifies that net profit margins were grinding higher even before the implementation of tax reform suggesting that Q1 2018 would have been a record for profits even without the tax cuts.

With equities continuing to sell-off in the pre-market trading session Wednesday and as bond yields are continuing to rally from Tuesday, we’ll take a look at geopolitical issues also in focus. U.S. Treasury Secretary Steven Mnuchin is headed to China in “a few days” to negotiate on trade, President Donald Trump declared yesterday, as trade tensions between the two superpowers remain at an impasse.

“We view the openness to negotiations as a positive first step that could move the two sides to potential solutions on some issues,” Ed Mills, Washington policy analyst at Raymond James, said in a Tuesday note. “But there are many issues to resolve and plenty of potential pitfalls along the way.”

Rate hikes, bond yields and rate hikes are the headlines thus far for the week. They are overshadowing record-level profits and profit margins. B. Riley FBR chief market strategist Art Hogan cites trade wars and the 3% yield jitters may prove temporary, but investors are in need of paying attention to them nonetheless.

“A trade policy mistake is probably the biggest fear we have in the marketplace right now, and rightfully so,” he said Monday on CNBC’s “Trading Nation.” “We have a lot of momentum in front of us, and the only impediment has been a fear of a mistake — either a monetary policy mistake or a trade policy mistake. I think that fundamental story continues to be very strong,” Hogan said, adding the next 12 months look “pretty fantastic.”

As rising yields will largely continue to be the topic of the day, investors should also keep in mind that big tech earnings will roll-out after the closing bell from the likes of eBay, PayPal, AMD and Facebook. Boeing will also release its quarterly results ahead of the market’s open.

Tags: SPX VIX SPY DJIA IWM QQQ