There’s nothing I dislike more than a 1,000+ (DOW)-point rally, coming after a nearly 5,000-point decline. Don’t get me wrong, it’s better than the continuation of the decline, but it only serves to validate the characterization of a bear market. In other words, that type of market move is indicative of a bear market. As it pertains to the magnificent “relief rally” in the markets yesterday, here are some of the issues that caught my attention and my opinions surrounding the rally. Keep in mind, everything that needed to rally on Wednesday, rallied. Oil rallied, bonds sold-off and the USD strengthened, but nothing extraordinary.

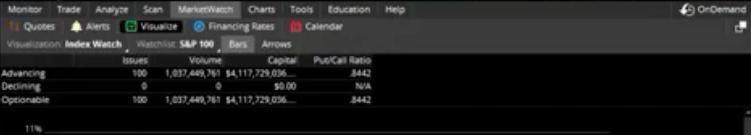

So as I mentioned and what one can probably gather from the opening tone of this morning’s daily market dispatch is that I don’t have a great deal of confidence in the Dow’s biggest rally… ever! The first issue is pretty obvious; everything went up. We’ve talked about dispersion vs. correlation in many articles in the past. When we have a high degree of dispersion, that’s the sign of discriminate market participation. Healthy dispersion in the market suggests normal stock, ETF and or general investing behaviors at work…stock picking if you will. But that’s not what happened on Wednesday.

As shown in the screenshot above, the market rally was extremely correlated; completely indiscriminate buying and short covering is what took place in the market’s extreme rally. To put it bluntly, “That’s not sustainable”! People were buying anything and everything they could get their hands on. Why? Buying of extreme proportions counterbalances selling of extreme proportions. We mentioned in recent articles that equities have reached extreme oversold conditions, as evidenced through several indicators, levels and sentiment readings. It was only a matter of time before a snap back market rally took place.

Another reason to dismiss, to some degree, the market rally on Wednesday is that at the very, very, very end of the trading day investors came in and bought protection in droves.

The VIX declined for much of the day with a huge tick higher in the final 90 seconds of trading, indicating that the protection that had been sold through the day, was being repurchased in the final minutes of trading.

As it was with the ride down from market highs and into bear market territory, volumes were light on Wednesday. Additionally, liquidity still played a large role in Wednesday’s snap back rally, as correlations steadily picked up. None of what we witnessed in the market Wednesday was the sign of a healthy market or lent itself to market stabilization. It’s important, when making decisions for future capital allocation to keep this in mind, as the market can remain volatile in the interim.

“Except that “the most violent, fast, parabolic countertrend rallies mostly occur inside bear markets,” veteran market technician Jeff Bierman said in an interview. “This was a ‘dead-cat bounce’ short squeeze that was engineered by the high-velocity algorithms. The market went up too far, too fast to believe it is more than a one-day wonder.”

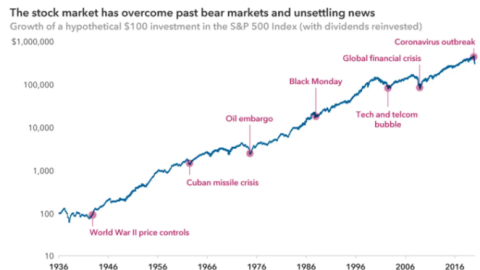

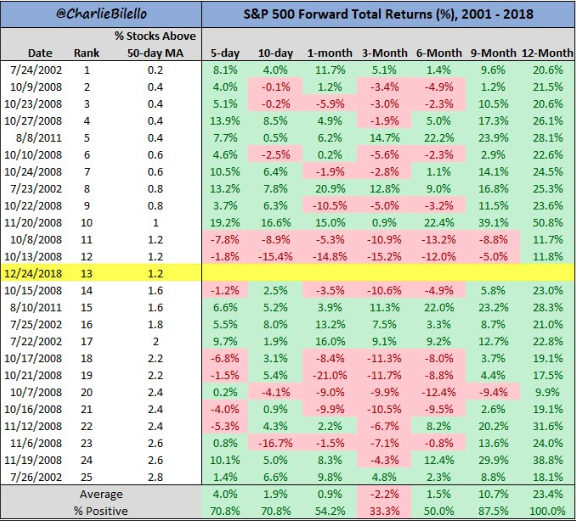

While I can appreciate that it seems as though I’m throwing cold water on an otherwise spectacular market performance, it’s simply to put things into their more appropriate context. With that said, here’s some more optimistic statistical data for the long-term investor to consider.

The S&P 500 entered Wednesday at one of its most extreme oversold levels in history. From similar extremes since 2001, stocks were higher 100% of the time 12 months later with an average return of 23 percent. That’s a pretty stellar statistic that reinforces the long-term prospects for the market.

Entering the trading day on Thursday December 27, 2018, equity futures are decidedly negative by greater than 1.25% across the board. European indices had no follow-on affect from the rally on Wall Street and Asian markets had a mixed session. There is no certainty as to how the day will conclude on Wall Street, but volatility will certainly be part of the forecast. With the VIX still above 30, that implies the market will move greater than 2.2% intraday and not necessarily in a straight line.

I continue to maintain that what is occurring in the market is a detachment from the fundamentals. The bear market scenario for which we find ourselves is not indicative of corporate earnings or the underlying economy which is likely to grow some 3% in 2018 and slow to roughly 2.5% in 2019, which is still above potential. Slowing growth is expected. The market swoon and advanced selling in the 4th quarter of 2018 can equate to fears of even slower growth in 2019 and/or flat to negative earnings growth…coupled further with uncertainty surrounding White House trade policies. Some are even of the opinion that a recession is being priced into the market even though nobody is actually forecasting a recession for 2019. Speaking of market/economic outlooks…

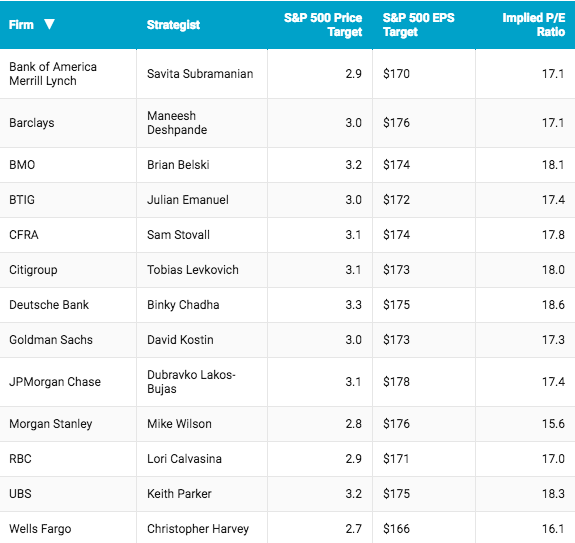

Most analysts and strategist have significantly higher S&P 500 price targets for 2019. Wells Fargo (WFC) strategist Christopher Harvey reduced his expectations for the stock market in 2019, making him the least optimistic forecaster of the big banks. Pretty much every major institution on the Street sees the market higher in the year ahead. Christopher Harvey cut his price target for the S&P 500 from an original outlook of 3,079 to a much lower 2,665. That’s a 13.4% reduction that the bank’s head of equity strategy attributed largely to fears of an over-aggressive Federal Reserve. I’m of the opinion the Fed is just about done if not altogether done with their respective rate hike cycle. The Fed now has enough market and economic reaction data to go on in order to understand the impact from further rate hikes should they choose to do so. They’ve seen how the nearly doubling of interest rates has cooled the housing and auto sectors in 2018. Additionally, they now see that even with the 4 rate hikes in 2018, they’ve failed to hit their inflation target mandate for the year as PCE has fallen over the last 4 months.

Regardless of what I think concerning the outlook or probability of future rate hikes, Harvey’s peers all agree that stocks are heading higher, from Morgan Stanley’s (MS) 2,750 price target all the way up to Deutsche Bank’s 3,250 for the large-cap index.

Keep in mind, all analysts had the S&P 500 moving higher in 2018 and all found their projections failing to meet expectations. In short, it is extremely difficult to forecast markets especially when FOMC and White House policy are uncertain.

It’s only natural to focus on the negatives as markets decline, right? We seem to forget about the potential positives or resolution that can exonerate all that ails the market. World-renowned market investor and strategist Doug Kass takes to task this very notion in a recent article. He penned some of the possible market catalysts for 2019 that could provide market stability and give rise to new market highs. (See Top 10 positive catalyst list below)

- An announcement by the Federal Reserve that it plans to transition from the rigid language of “gradual increases” to a more flexible economic data and market dependent policy. Investors immediately interpret this message to mean that the Fed will (1) cease interest rate increases (in 2019) based on the tightening financial conditions, and (2) will likely slowdown the reduction in the size of their balance sheet.

- Europe extends QE and it gets authority to buy European stocks. Mario Draghi decides not to retire next year.

- China introduces a major easing policy that has substance, clout and power.

- Treasury Secretary Mnuchin resigns and is replaced by Hank Paulson.

- The U.S.-China trade war ends with a full resolution.

- Democrat Joe Biden and Republican Mitt Romney, aiming at bringing back national unity, jointly declare they are running on the same ticket for President and Vice President in 2020.

- The Mueller investigation concludes that the President was guilty of collusion and obstruction. Trump immediately resigns and Mike Pence becomes the President of the United States.

- The SEC initiates broad reform aimed at curbing the dominance of high frequency (quant) strategies and products and reestablishing theuptick rule. Passive investing begins to lose market share to active investing.

- On the same day that Berkshire Hathaway (BRK.A) (BRK.B) announces a premium bid for 3M (MMM), KKR and Blackstoneannounce separate $25 billion acquisitions. Apple (AAPL) follows this M&A explosion with a proposed leveraged buyout, (also) partially financed by Berkshire Hathaway.

- On the same day, 1Q2019 earnings for Amazon (AMZN) and Alphabet (GOOGL) report substantially better than expected results.

Although the market has taken back SOME of its losses, much that has plagued the market during the current downturn still looms heavily among the investor crowd. The Fed is not likely to raise rates in 2019 unless economic certainties and global trade are normalized and pointing toward further growth that can sustain a rate hike. Unfortunately, the market is in wait and see mode when it comes to Fed activity, even as they walked back some of the rhetoric that indicated 2 rate hikes for 2019 and a continuation of quantitative tightening.

The trade feud between the U.S. and China remains with a deadline to achieve a deal. If a deal is not reached by March, further tariffs could be implemented. On that front, China and the United States have made plans for face-to-face consultations over trade in January, the Chinese commerce ministry said on Thursday. A U.S. trade team will travel to Beijing the week of Jan. 7 to hold talks with Chinese officials, Bloomberg reported on Wednesday.

Moreover, while near-term pain is likely for market investors, the long-term outlook remains more positive in my opinion and supported by economic and corporate fundamentals. Keep in mind this important point of market participation.

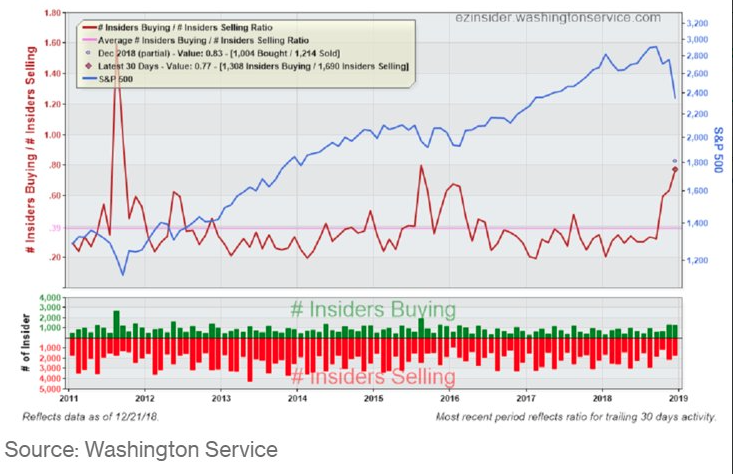

As shown in the chart/table above, as the S&P 500 has undergone this corrective phase with investors losing appetite for equities, corporate insiders have been buying heavily. Corporate insider buying is at the highest level since August 2011. Where the general investing public is wrought with fears surrounding forward looking earnings, insiders seem pretty optimistic based on their activity level.

Ivan Feinseth, chief investment officer at Tigress Financial, discusses the outlook for U.S. equities, the economy and why he sees opportunities in industrial and retail stocks within this Bloomberg interview.

Unfortunately, a sustainable market rally may demand earnings validation and earnings season won’t begin in earnest until late January. Until then, the market can remain quite choppy, volatile and found with a negative bias. Hedging remains at a premium and found optimal during such times of market stress.

Tags: AAPL SPX VIX SPY DJIA IWM QQQ XLE XLF