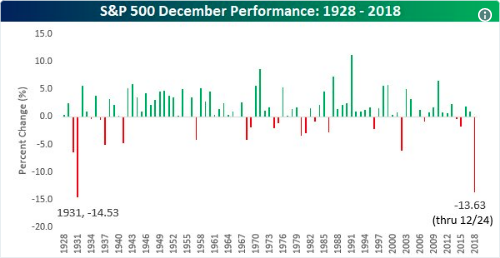

As investors return to the market from the Christmas Holiday, they are bracing for further market deterioration. Forced liquidations have plagued the market over the last several weeks, resulting in the worst Christmas Eve trading day ever.

The S&P 500 index (SPX) fell by 2.7% Monday, marking the first session before Christmas that the broad-market benchmark has booked a loss of 1% or greater. The Dow Jones Industrial Average (DJIA) finished down 653 points, or 2.9 percent. The Nasdaq Composite Index (NDX) logged a 2.2% loss. That also marked the worst Christmas Eve or worst drop on the trading session just before Christmas in its shorter history, with the next worst drop the 0.95% decline logged in 1973.

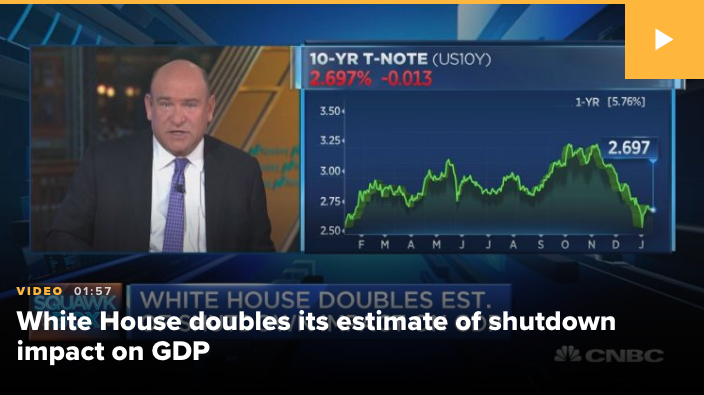

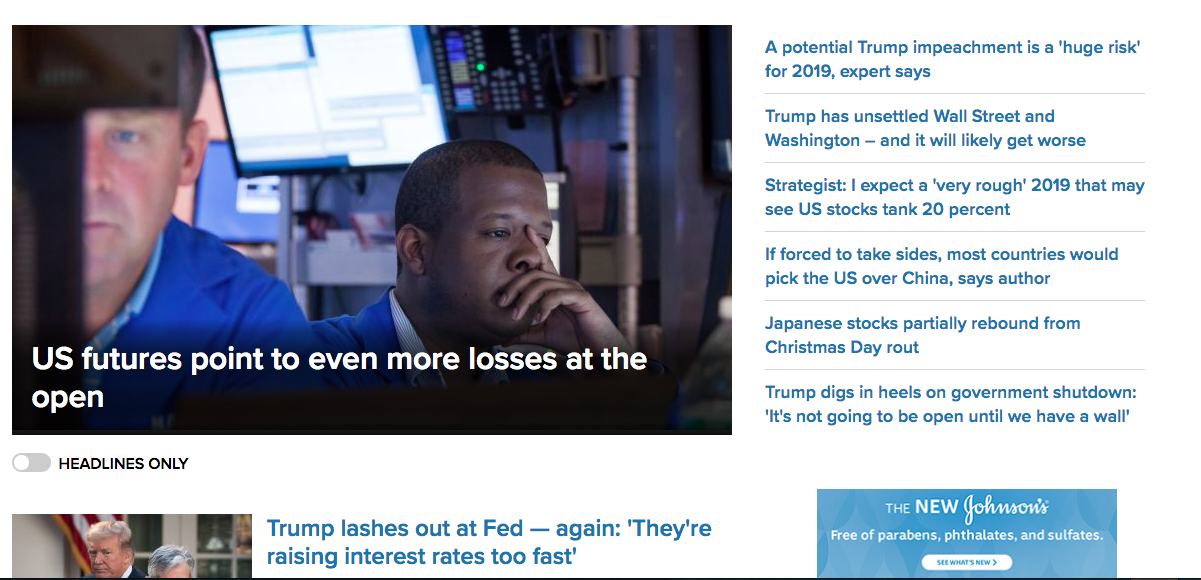

The market and investors are expressing a complete lack of confidence in the Federal Reserve and White House Administration. The headlines that proliferate in the media have no choice but to validate such declarations as both entities continue to draw attention to themselves.

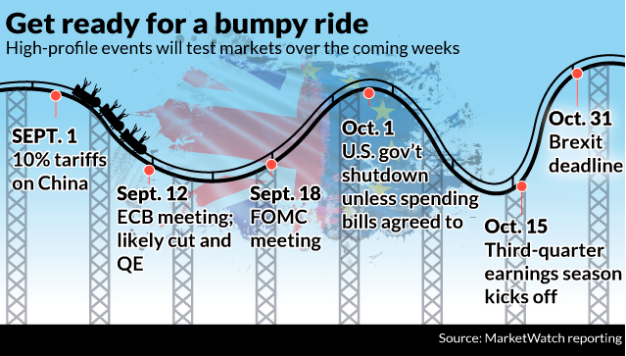

Investors are finding it increasingly difficult to trust S&P 500 earnings forecast for 2019 given the global growth slowdown that is partly blamed on tariff wars and certain dislocations of global alliances. Even with apparent tweets from President Donald Trump that suggest ongoing trade talks with China are going well and China reportedly mulling a crackdown on forced technology transfer, the market doesn’t have confidence that a deal can be reached within the 90-day trade truce period.

“China is reportedly considering a new law on foreign investment that would emphasize the illegality of forced tech transfers — the practice of which has been a major complaint from Washington amid the ongoing tariff battle between the world’s two largest economies.

Multiple local outlets reported on the under-consideration law, and Beijing-based news agency Caixin said Sunday the current draft calls for the prohibition of local governments “forcing foreign businesses to transfer technology or illegally restrict(ing) their market access.”

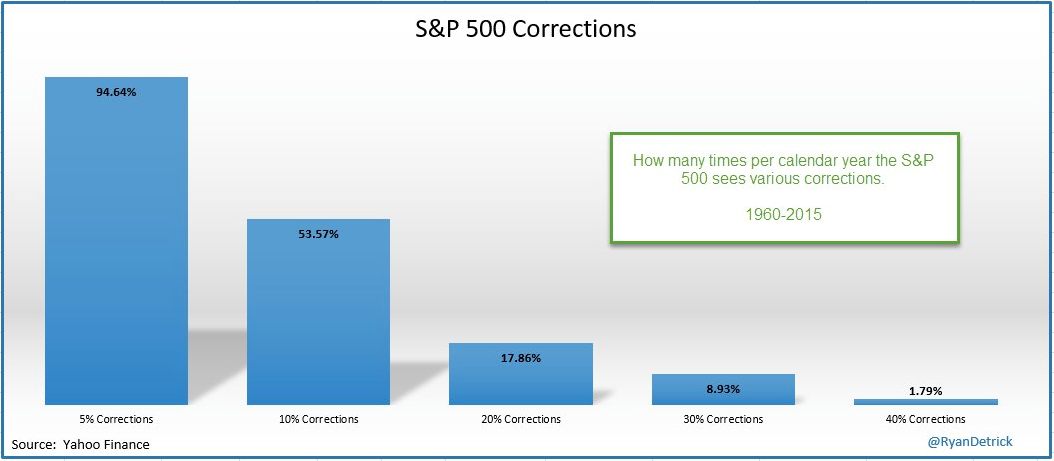

With the S&P 500 declines on Christmas Eve the broad based index of equities is now in bear market territory, having fallen 20% or more from its peak level of 2,940. Such corrections are rare during a calendar year.

As shown in the chart above from Ryan Detrick of LPL Financial, a 20% correction only happens about 17% of the time in any calendar year since the 1960’s. Furthermore, 30% and 40% corrections are even more rare. Having said that, the current market circumstances and macro-environment are also extremely rare. In reviewing the 20% correction having taken place, we can safely say that the market is completely detached from the economic realities, yet another extremely rare occurrence. Finom Group can safely reiterate that the market route is a crisis of confidence given the fundamental economic strength filtered through economic data and corporate earnings strength.

In a consumer driven economy, the consumer drives economic output and corporate earnings. Last Friday, the government’s data showed a continued strength in consumption trends through the Personal Income and Expenditures data. The government said that consumer spending rose 0.4% in November. Additionally, spending in October was revised up to 0.8% from the prior estimate of 0.4 percent. Incomes rose 0.2% after a 0.5% gain in October. This was below forecast of a 0.3% increase.

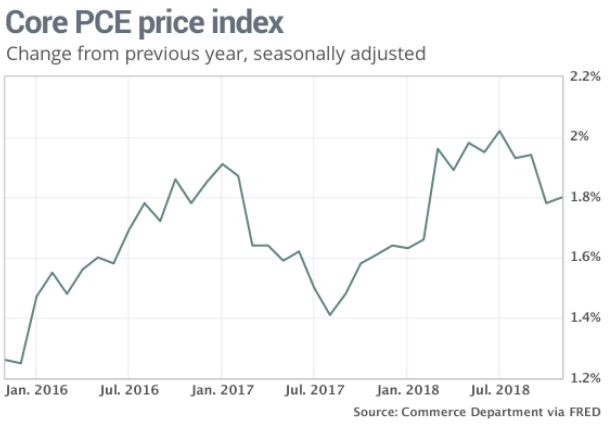

Inflationary pressures, as measured by Federal Reserve’s preferred core PCE gauge, picked up a bit. The closely followed core rate that excludes food and energy inched up a notch to a yearly rate of 1.9%, the highest in three months. The year-over-year rate was 1.6% in November 2017, so there has been a modest-pick up over the past year although this remains below the Fed’s 2% inflation goal.

The data point to a strong holiday shopping season, which should translate into solid fourth-quarter gross domestic product. Consumer spending is expected to rise at only a slightly slower pace than the 3.5% rate in the prior three months.

In terms of holiday spending, the data continues to point to positive sales trends over the holiday period. Total U.S. retail sales, excluding automobiles, rose 5.2% from Nov. 1 through Dec. 19 compared with last year, according to Mastercard SpendingPulse, which tracks both online and in-store spending with all forms of payment.

As in recent years, online sales continued to grow faster than sales overall, rising 18.3% during that time and accounting for 13% of total sales, the highest percentage ever recorded by Mastercard. In-store sales grew 4.3% during the same period. Another tracking firm, Adobe Analytics, found that a record $110.6 billion was spent online during the same period measured by Mastercard, a 17.8% increase compared with last year.

The stock market isn’t reacting favorably to good economic data and otherwise good corporate earnings. The good news has been bad news for the market, especially post the latest FOMC rate hike. Cause for concern is on the rise amongst investors and the stock market is expressing extreme oversold conditions. Before we get to some of those oversold conditions we take a quick look at some of the many concerns that are front of mind among investors and analysts.

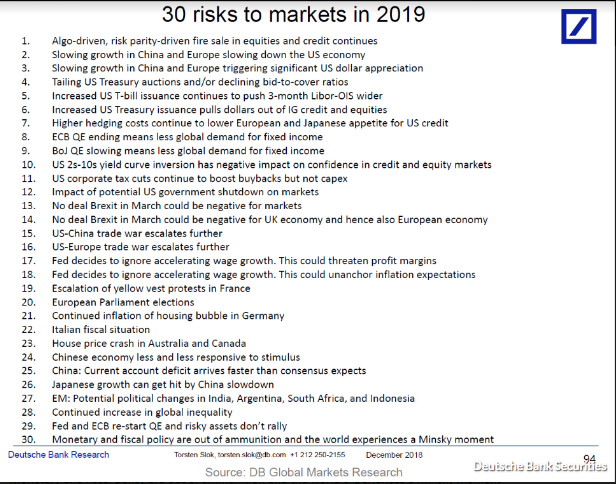

In a research note published Friday,Deustche Bank Securites Chief International Economist Torsten Sløk named “30 risks to markets in 2019,” with “algo-driven, risk parity-driven fire sale in equities topping the list.

Like Finom Group already offered within this daily market dispatch and recent research reports, the market is detached from the typical equity market drivers, earnings and the economy, Sløk’s comments below agree with this assessment.

“I have a Ph.D. in economics. I am the chief international economist at Deustche Bank Securities, and I spend all day thinking about the explanations of why the stock market goes up and down,” he said. “Usually there’s a good explanation, be it from earnings revisions, new economic data or surveys of sentiment.”

The very unique thing about markets since October is that we have on all three fronts seen little change whatsoever,” he said. “If you look at all these data, it is just really strong, and it can’t justify the decline we’ve seen in the stock market.

If you can’t explain why the market is moving, you should be suspicious of the moves the market makes,” Sløk said, adding that the rise of algorithmic trading and rules-based investment strategies like risk-parity investment funds can likely take the blame for the outsized moves in the market we’ve seen in recent weeks.”

While the bears are certainly taking a victory lap in 2018, the reasons that have led to the current bull-turned-bear market scenario are nothing for which they’ve promoted for several years. No, debt has not sent the S&P 500 into a bear market. No, the Fed unwinding of its balance sheet has not contracted economic conditions. No, margin debt and consumer net wealth have not contributed to the bear market. It’s simply a technical correction spirited by a crisis of confidence that may or may not come to fruition in 2019. The market is pricing in flat earnings for 2019, if not a recession in the back half of the calendar year. The resulting bear market has brought about oversold conditions and an increase in market volatility as gauged through the VIX.

The S&P 500 bullish percent index (the percentage of stocks on a P&F buy signal) has fallen to a level not seen since the March 2009 low. Kind of ridiculous when comparing earnings and the economy of then with that of today or the forecasts for 2019.

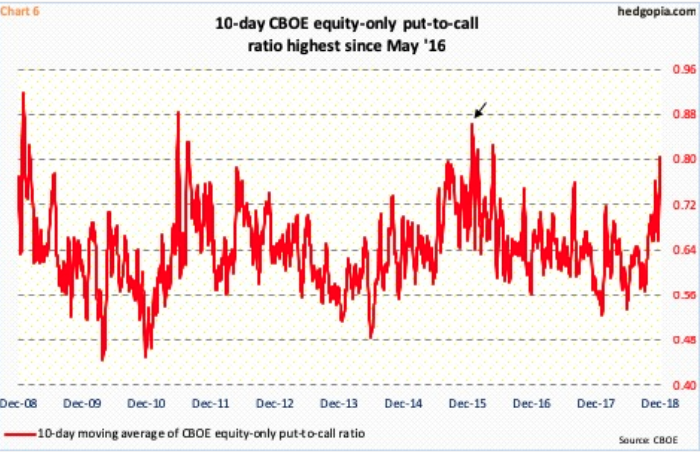

The Equity-only put/call 10-day MA is also reaching extreme levels that tend to result in a market bounce.

The same can be said about the current VIX/VXV reading. The ratio of VIX, which measures market’s expectation of 30-day volatility implied by S&P 500 options, to VXV, which does the same but goes out to three months. It ended last week at 1.15, the highest weekly close since February this year. This will eventually unwind, also resulting in a market bounce.

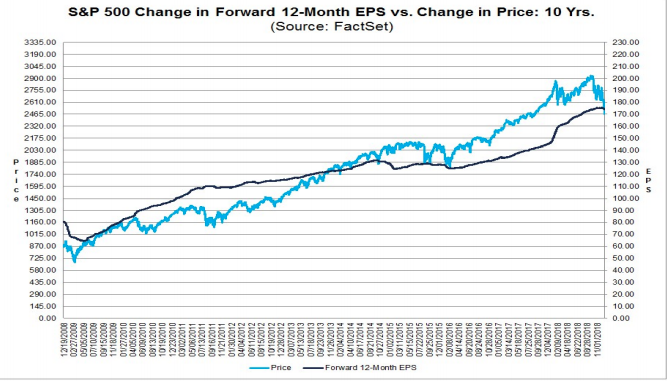

For long-term investors, the present market correction may present a good opportunity to both rebalance and or put additional capital to work. The long-term risk reward proves more favorable given valuations. The lone caveat is the uncertainty surrounding 2019 earnings. But one year is not representative of long-term investing of course. The forward 12-month P/E ratio for the S&P 500 is 14.2. This P/E ratio is below the 5-year average (16.4) and below the 10-year average (14.6).

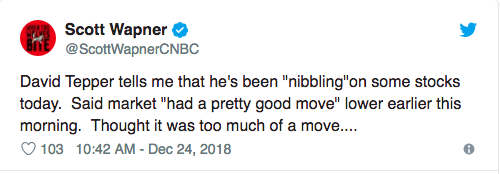

Based on all the damage that has already occurred to the market, we think the valuation has become vastly more attractive and with many stocks expressing greater dividend yield than before the market correction. This is yet another sign that the market is oversold and due for a bounce near-term. Hedge-fund star David Tepper says that the stock market’s violent Christmas Eve selloff has compelled him to “nibble” at beaten-down stocks.

Others are quickly coming to the same conclusion as Tepper, believing the correction is due for a bounce and stability in the coming trading sessions. The Leuthold Group chief investment strategist Jim Paulson believes Wall Street panic is in its later stages.

“You’re hearing a lot of calls for recession, you’re hearing a lot more people calling this a bear market,” he said Friday on CNBC’s “Trading Nation. ” “We’ve done a lot of damage here with sentiment.

Tags: SPX VIX SPY DJIA IWM QQQWe’re getting close to the bottom,” Paulsen said, adding that it appears negative sentiment is “getting close to burning out.”