After 20 years in the retail and consumer goods sector, I became a research analyst and market strategist for Capital Ladder Advisory Group. Since 2011, I have published some 400+ articles surrounding mainstream retailers like Bed Bath & Beyond, Target, Costco and more. I've covered consumer goods corporations such as Apple, Keurig Green Mountain, SodaStream, Skullcandy, Fitbit and more. To date, I've garnered over a hundred media references to my analytics including Forbes. Presently, I am a contracted consultant to many retail and consumer goods companies in North America and manufacturing entities in China and Korea.

If there has been a lesson from the markets over the last several weeks and since the mid-July all-time highs, it’s that investors and traders never want to find themselves overreacting to… anything!🎯 There will always be concerning economic situations and data, concerning headlines and commentary, which will all attempt to drive investors and traders…...

Well, it definitely got worse before it got better, or got flat for the week. This was largely our expectation for the week-that-was, and as the week kicked into high gear with a dramatic sell-off Monday morning. Much of the Monday sell-off was attributed to the “Yen Carry Trade”, which was deemed to have unwound…...

J.P. Morgan’s Mike Ferolli Fundstrat’s Tom Lee Bank Of America’s Savita Subramanian...

Some macroeconomic storm clouds are brewing. Markets are fleeing for shelter in Treasuries, leaving behind almost everything else, including their prized LargeCap tech stocks and recently acquired SMidCaps. Here’s the market action as of midday: The Nasdaq officially entered a correction, down more than 10% from its record high reached roughly a month ago. The…...

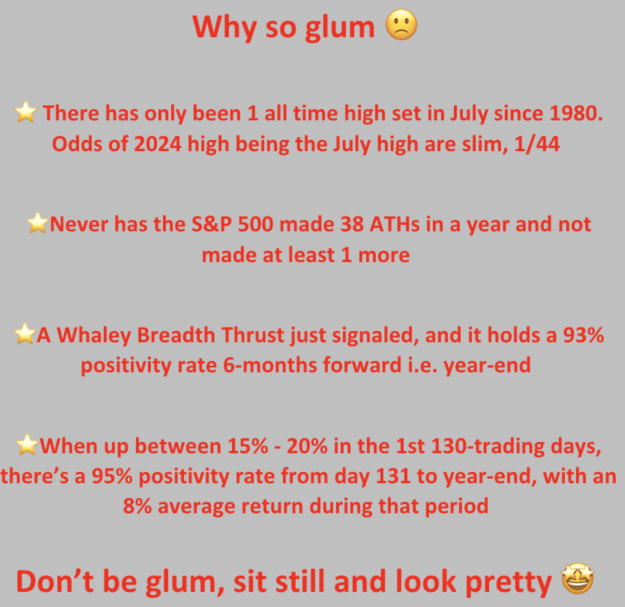

The Major Trend Index held at a Neutral reading for the week ended July 26th. A second consecutive weekly decline in the S&P 500 failed to knock down our Technical composite from its bullish perch at +4. In fact, that category saw twice as many upgrades (10) than downgrades (5) as the market continued to…...

Another difficult week for the large-cap indices like the S&P 500 (SPX) and Nasdaq Composite (COMPQ), which both fell for a second consecutive week. The S&P 500 declined roughly -.8% while the Growth-heavy Nasdaq declined roughly -2% for the week. The strength that the markets have been experiencing from the Small-cap Russell 2000 (RUT)… continued!.…...

If it’s been said once it has been said millions of times, “everyone would be a buyer if stocks were cheaper, but when stocks are cheaper they simply lose buying confidence.” With investing capital, investing capital mind you, it seems as though most investors will find an excuse NOT TO BUY in favor of “capital…...

by Tom Lee The major event over the weekend is the failed assassination attempt against former President Trump. This is a huge blessing that the assassin did not succeed. Data from betting markets, including RealClearPolitics.com show Trump’s chances of winning the White House surge to 65%, the highest level since the start of this election…...