After 20 years in the retail and consumer goods sector, I became a research analyst and market strategist for Capital Ladder Advisory Group. Since 2011, I have published some 400+ articles surrounding mainstream retailers like Bed Bath & Beyond, Target, Costco and more. I've covered consumer goods corporations such as Apple, Keurig Green Mountain, SodaStream, Skullcandy, Fitbit and more. To date, I've garnered over a hundred media references to my analytics including Forbes. Presently, I am a contracted consultant to many retail and consumer goods companies in North America and manufacturing entities in China and Korea.

Welcome back to this weekend’s Research Report! This weekend’s Report is in PDF format due to issues the Host was having with a new, upgraded server that did not make it possible to upload pictures and JPEGs. The issue has been rectified, and our reporting will revert to the usual format next week. For now, please read…...

If there is 1 thing I’ve learned from the markets over my 23 years, it’s that down is going to happen; accept it for value opportunity. Don’t try to stop it! Down is good; down is buy low. When viewed any other way, the resulting outcome is usually “down and out”. ~Seth Marcus To watch…...

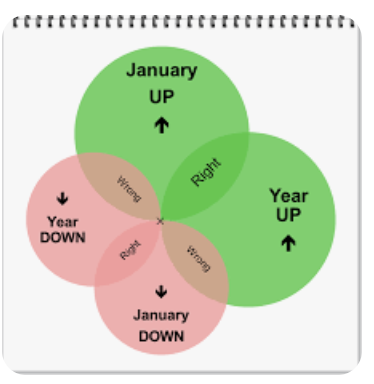

Based solely on calendar patterns, January’s S&P 500 gain is a mild positive for stocks over the remaining months of the year. Since 1926, a positive January has been followed by S&P 500 average performance of 8.5% over the next eleven months, compared with an 11-month gain of just 4% after a January loss. There’s…...

Good Sunday and welcome back Finom Group investors and traders. “Steady as she goes” or “So far so good?” Time will tell, right? How many old adages can you fit into an opening sentence; I think we just found out! Maybe I (Seth Golden) have been doing this for too long, which in and of…...

With the S&P 500 having recently ascended to a fresh record high after such a strong 2023, it’s natural for investors to worry that valuations have become over-extended. On traditional valuation measures, valuations do appear high and it does seem reasonable to expect more moderate stock market returns going forward. Here we walk through several…...

Welcome back investors/traders! After a rocky start to January 2024, both price and equity market sentiment have renewed bullishness in the 2nd half of January. The momentum from late 2023, demanded some degree of market consolidation in 2024, but ultimately proved exactly what the markets needed for the next leg higher and to new all-time…...