Stay away from politics! At least that is what we’ll be trying to do today even as the headlines pour through the media. From the Pennsylvania district race to yesterday’s Presidential firing of Rex Tillerson it’s politics, politics and more politics. I often find that if you tune out a good deal of the political noise, or at least push it off to the side for a more dedicated time and focus, trading and investing is amply improved. So let’s do that!

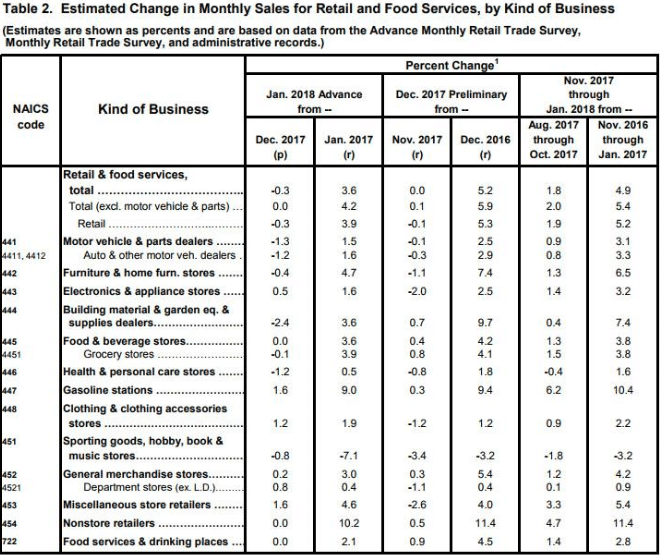

Today’s investor-focused headlines should be aligned with the economic data of the day and that data will come at 8:30 a.m. in the form of monthly retail sales. January retail sales disappointed investors by falling .3% MoM, but rising more than 3.5% year-over-year. The YOY growth is one of the biggest reasons the market shrugged off the underachieving MoM results. More importantly, the department store segment of the monthly retail sales report continued to come in strong with growth MoM and year-over-year. For a review of the segment or category breakdown, below is the Census Bureau’s table for January monthly retail sales.

After a rather tame and expected result from the latest CPI reading delivered yesterday, all eyes will be focused on monthly retail sales this morning. Economist polled by MarketWatch expect MoM retail sales to rebound and grow by .4 percent. Retail names were higher yesterday in anticipation of a rebound in the monthly sales report.

And what update on consumption and retail sales wouldn’t be complete without an update on the ongoing saga at Toys R Us. Toys R Us is in the process of drafting the court motion for its liquidation plan, a source familiar with the situation told CNBC on Tuesday. A liquidation will most likely result in the closing of all of Toys R Us’ 800 stores in the U.S. After years of pressure on the Toys R Us business from discount retailers like Wal-Mart and Target, coupled with the onslaught from Amazon, the retailer appears to be unable to survive going forward. With nearly 20% of the markets category sales, the liquidation could lead to greater sales from the named competitors and others who recently embarked upon the toy sales category like J.C. Penney. J.C. Penney rolled out a condensed toy department inside its stores late last year, building upon its dollar/sq. ft. strategy and with multiple toy brand labels.

In other retail related news, Wal-Mart has announced it plans to expand its grocery delivery service to another 800 chain stores by the end of 2018. It will offer shoppers same-day delivery of fresh produce, meat and seafood, along with non-perishable items. The expansion of grocery delivery was inevitable and expected to reach across the totality of the chain in the coming years. The announcement comes just weeks after Amazon added two cities to its new Amazon Prime grocery delivery service, bringing the total number up to six. Other retailers such as Kroger and Target have been partnering with third-party providers such as Instacart, Deliv and Shipt. Speaking of Target…the Fast Money, CNBC crowd seems to think TGT shares are a good buy when compared to the likes of WMT as discussed on the show yesterday. The Fast Money pitch noted that TGT was undervalued on a PE basis when compared to WMT. What the team didn’t state was that it is trading right around its historic PE ratio. I would be of the opinion that shares of TGT will appreciate in price, however, in 2018 and from present levels. Maybe not today and maybe not tomorrow, but on the whole of the year.

The bottom line in retail starts with the top line. Top line results for retailers struggled through much of 2017. Retailers were forced to liquidate inventories of unsold or undersold goods, finding with that activity gross margin contraction that also impacted net income and earnings. But in the 4th quarter of 2017, sales found strength from tax reform passage and low-level comparisons on a YOY basis. The trend appears to be carried through in the 1st quarter of 2018 for retailers, but let’s quickly take a look at what retailers and restaurants have already reported for the 4th quarter of 2018 according to Thomson Reuters.

- Fourth quarter earnings are expected to increase 8.2% from Q4 2016.

- 81% of companies in the Thomson Reuters Retail/Restaurant Index have reported Q4 2017 EPS.

- Of the companies in the Retail/Restaurant Index that have reported earnings to date for Q4 2017, 69% have reported earnings above analyst expectations, 9% matched, while 22% reported revenue below analyst expectations.

- The Q4 2017 blended revenue growth estimate is 7.9%.

- 68% have reported revenue above analyst expectations, and 32% reported revenue below analyst expectations.

Depending on today’s release of the monthly retail sales report, certain retailers could once again capture share price appreciation. I say once again because many retailers that have reported their Q4 2017 results have found their share price faltering. That list of faltering share price includes TGT, WMT, KSS, JCP and more. One can suggest that the recent share price declines are a mere retracement of multiple expansion that found most of these retail names rallying since November 2017. Macy’s share price went from $17 to over $30 during that period. Moreover, TGT and WMT, which rallied strongly over this period, both, reported a miss on bottom line expectations for the Q4 2017 recently. Expectations did ramp higher coming out of the holiday period and will likely remain elevated in the first half of the year. At Finom Group, we like retailers such as Target, J.C. Penny, T.J. Maxx and Costco to name a few. We are less optimistic about Dillard’s and Macy’s longer term. With that said, I will be looking for an opportunity to trade certain of the aforementioned retail names depending on the retail data today.

Tags: JCP M SPY DJIA IWM QQQ TGT WMT XRT