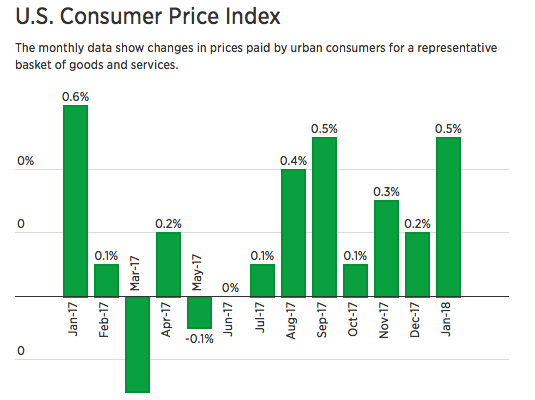

Well, the economic data released today was anything but favorable and yet the market, for now, is seemingly shrugging off the data. Everyone was waiting with bated breadth for the inflationary data coming into today’s market trade, hoping for a benign reading. But what they got was worse than expected in the way of CPI. The Consumer Price Index rose 0.5% last month against projections of a 0.3% increase, the Labor Department reported Wednesday. Excluding volatile food and energy prices, the index was up 0.3% against estimates of 0.2 percent. Headline CPI rose 2.1%on an annualized basis against expectations of 1.9 percent. Core CPI increased 1.8% vs. estimates of 1.7 percent.

Most individual measures with the CPI showed gains, with a spike in fuel oil of 9.5% and a gain of 5.7% in gasoline leading. Gasoline is up 8.5% over the past year while fuel oil has surged 22.5 percent. Food prices rose 0.2%, with food away from home up 0.4 percent. Fruits and vegetables increased 0.5%, with fruit up 1.9% and vegetables down 1.2 percent. Additionally, clothing/apparel also jumped 1.7% during the reporting period.

The initial reaction to the CPI reading was met with fierce selling pressure on equities and found bond yields rising. But the selling quickly gave way once the markets opened. On the heels of the hotter than expected CPI data, the markets priced in a higher possibility for a 3rd rate hike before the end of the year. The chances are now at nearly 62% for a move in December.

With rates on the rise, this is also factoring into home buying decisions. The average 30Y mortgage rate rose 7bps this week to 4.57% – the highest level since January 2014. The increase in the 30-year mortgage rate impacted the latest reporting from the Mortgage Bankers Association. The industry group’s index on mortgage request volume fell 4.1% to 399.4 in the week Feb. 9. This was the lowest reading since 390.2 in the Jan. 5 week. Home loan rates have increased in line with U.S. Treasury yields on concerns about rising inflation amid an improving global economy.

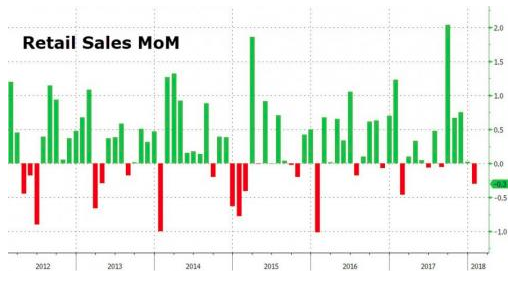

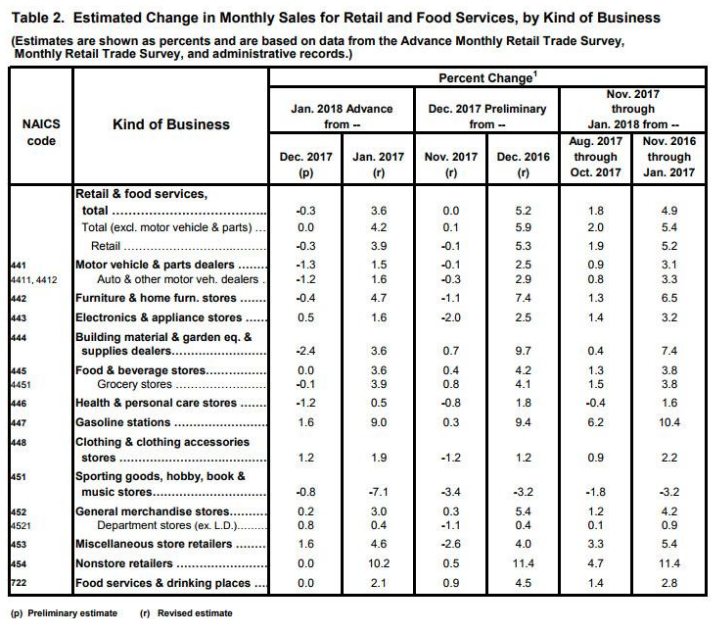

Equally abysmal with regards to the latest economic data released today were monthly retail sales. January retail sales fell unexpectedly in their biggest drop since last February, declining 0.3 percent. Combined with inflationary concerns, these data points may tamper expectations for Q1 2018 GDP. Stripping away volatile auto sales and retail sales ex-autos were unchanged, far below the 0.5% expectation.

“This is a temporary pause in consumer spending following a strong holiday sales season,” said Stuart Hoffman, senior economic adviser at PNC Financial Services.

Department store retail sales were a bright spot in the latest reporting cycle and continued their trend of positive results since last November. Department store retail sales rose .8% MoM and .4% YOY. Nonstore retail sales were unchanged MoM but up a whopping 10.2% YOY. Sporting goods and music sales were the worst segment during the reporting period, down -.8% MoM and -7.1% YOY. Also of great importance was the revision to the December retail sales results from up .3% to unchanged.

The market’s reaction to the economic data has some investors scratching their heads, even as the 10-year yield touches 2.90% on the day. With equities on the rise and the VIX down some 21% and below 20 presently, this is the hand the market is dealing so far.

Tags: SPY DJIA IWM QQQ VIX

So strange action…futures down like 250 pts right after inflation uptick and finally goes up…hmm..its been like gambling each day even though you know the importance of the news:-(… Tough to trade