Research Report Excerpt #1

Speaking of Friday’s pullback, Finom Group has identified what may have caused or catalyzed Friday’s downturn, the biggest Permanent Open Market Operation (POMO) of the Fed’s bi-weekly calendar cycle. This is what is commonly known as the Fed’s Quantitative Easing operation for which every 2 weeks the Fed is buying assets in a single day of roughly $12.5bn. For whatever reason, and since it began in April 2020, institutional investors have sold into this particular POMO operation. Finom Group’s chief equity strategist Seth Golden has highlighted this many times in the past:

Finom Group anticipates the now 3-week long consolidation phase to continue into May, based on a variety of seasonal factors. The significant market breadth has resulted in time consolidation, which is preferred above price consolidation. A follow-up to this expectation is that we also anticipate more new, record levels for certain of the major averages, including the Nasdaq (COMPQ). In a nutshell, this points to choppy price action akin to what we’ve seen over the last 3 trading weeks, whereby record highs have been achieved, but ultimately the major averages have gone sideways through time. While our track record for forecasting is strong, be it intermediate or long-term, we’re not impervious to misinterpreting the macro-environment, which can skew the market’s performance from it’s prevailing trend.

Research Report Excerpt #2

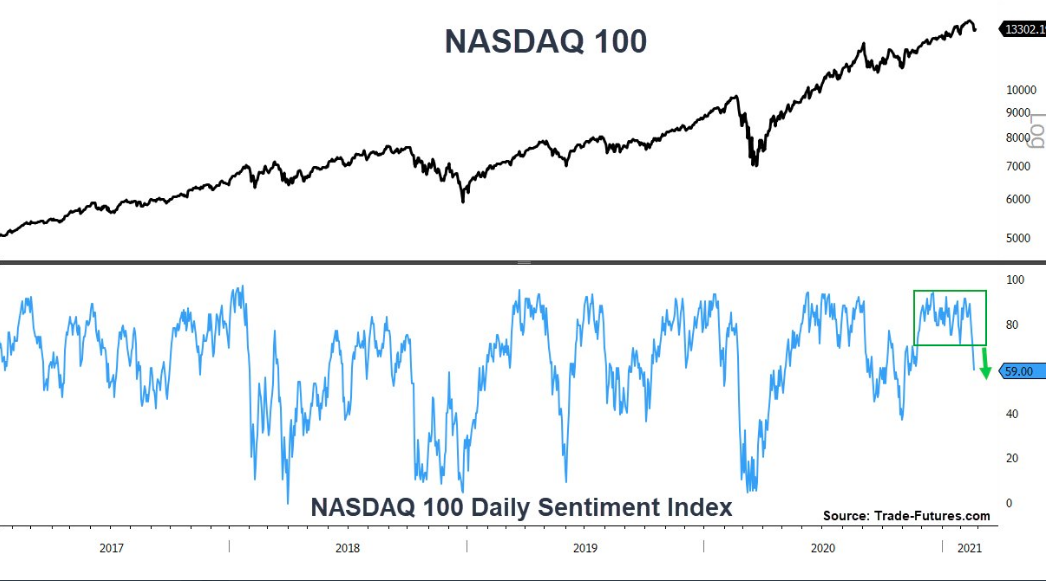

The Nasdaq Daily Sentiment Index fell below 60 for the first time in more than 3 months toward the end of February. Historically, long streaks of elevated sentiment always led to more gains for the NASDAQ over the next 3 months.

What we care mostly about, however, is how the index performs after the DSI falls below 60 for the first time in at least 3 months. Here are the results, based on a recent study from Troy Bombardia:

Research Report Excerpt #3

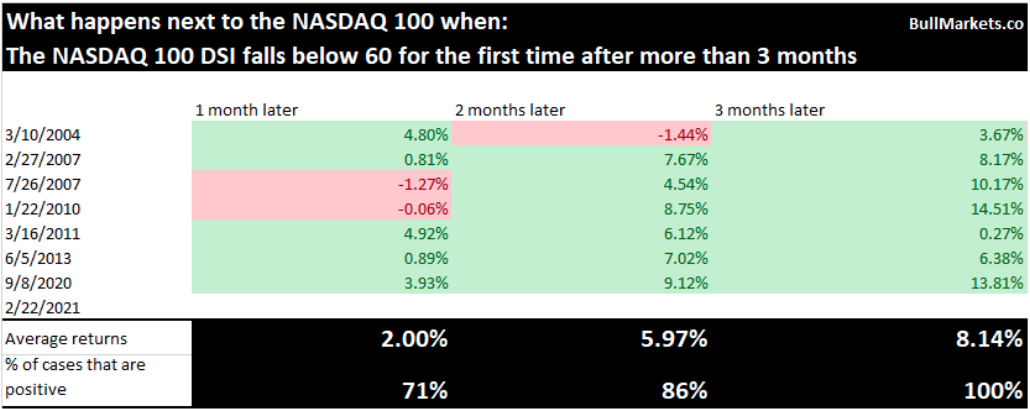

Our last study will come from Wayne Whaley himself, the famous quant and mathematician who discovered and named the Whaley Breadth Thrust and TOY Barometer. In his hunt for the most reliable statistical edge for determining the S&P 500’s forward returns, he found that the dates between November 19 and January 19 of the following year lent to the most probable outcomes.

Indeed, the bullish signal was fired for 2021. The only thing left to discover is how the forward quarterly and annual return will unfold for investors. The statistical data for the TOY Barometer is displayed in the most updated table below from Wayne Whaley himself:

- If we start with the Q1 return when their is a bullish signal, the positivity rate is high (29-7) and the average quarterly return is 4.53%. In 2020, the S&P 500 delivered just over 5%.

- The positivity rate dips a bit in the Q2 period, which we are currently in. The average quarterly return is still positive at 3.97%. The S&P 500 has already delivered a 3.25% return through April, with 2 months left in the Q2 period.

- Following “bullish” TOY Barometer signal, S&P 500 forward 12-month returns (1/19 this year to 1/19 next year) are 34-2 positive, for average gains of 16.40%. This also suggests another ~5% upside for 2021.

- For full video narrative of the Toy Barometer, our YouTube video link

- Article link to Toy Barometer by Finom Group

Research Report Excerpt #4

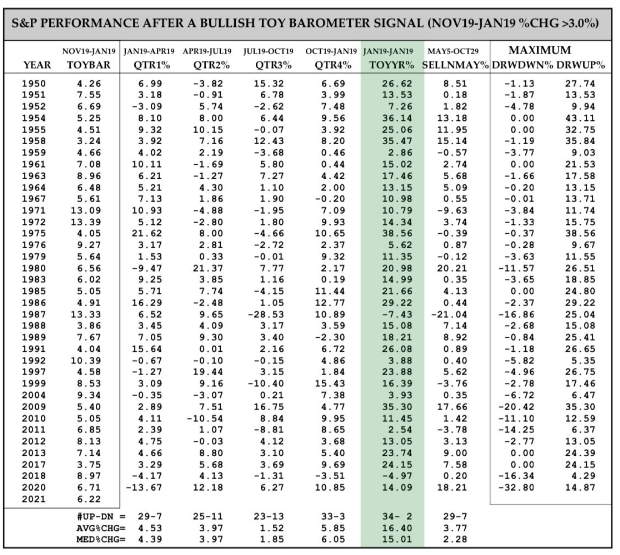

But when it comes to market returns and proving a successful investor/trader long-term, that is what it takes; a cool, calm and level-headedness. Investing demands an understanding that price volatility is simply the price we pay for expected returns. Nothing goes up in a straight line and may our crypto currency friends have a better understanding of that than most investors. If you choose to invest in the crypto world, you know that volatility is simply part of the path to forward returns, higher prices.

If volatility is already the expectation, the investor/trader is unlikely to make rash decisions when price volatility rises, producing lower prices. Stay the course; returns are for the cool, and not for those who panic sell into price weakness!

Research Report Excerpt #5

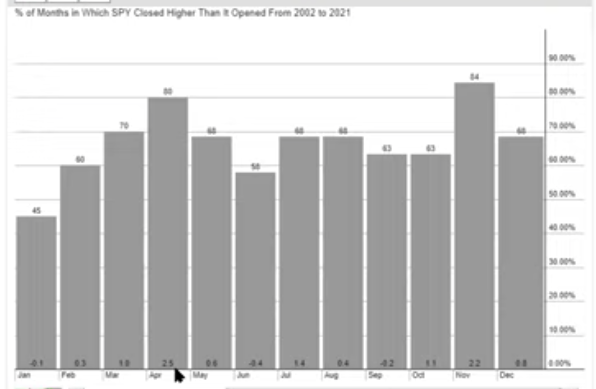

Something I also like to always know when it comes to the seasonality data; what is the percent positivity rate for the month or period. If we go back 20 years, May has offered a better return than the last 10 year period (both positive). The chart below, however, informs investor as to the percent positive rate going back to 2002. The percentage of times the S&P 500 or SPY has been positive has been 68 percent over the stated time period. In other words, May has delivered positive returns amongst the 4th best months of the year. See what I mean about “Sell in May and go Away” as being widely misunderstood?

As far as takeaways for investors here, we should think across longer-time frames as investors, but act more locally on price action in my opinion.

Research Report Excerpt #6

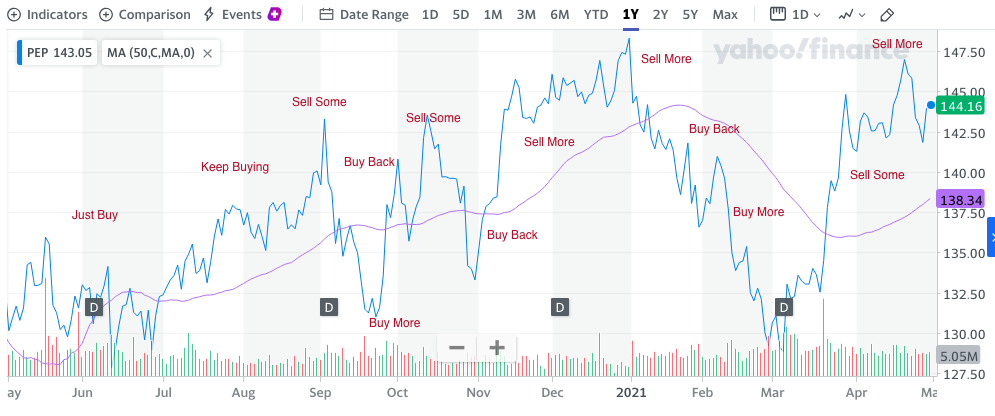

In the tweet above, Michael Kantrowitz of Cornerstone Macro offered this exact sentiment. Take a look at my reply, for which Michael understood to be accurate. You will indeed underperform the market by holding Consumer Staple stocks in a passively managed portfolio over time. You’ll likely get some help with some hefty dividends, but they still lack enough firepower to outperform or even market perform. But in an actively managed portfolio, Consumer Staple stocks can be the active fund managers best friend. Let’s take PepsiCo (PEP) for example, which I’ve owned since 2020 and traded 33 times via official trade alerts for Finom Group members.

Recall our previous disseminations about price volatility proving the price one pays as an investor seeking returns on capital invested? No, that is not Bitcoin, it is in fact the 1-year chart of PEP. When we look at PEP on an absolute basis, indeed it is down year-to-date by nearly 3 percent. Massively underperforming the market. If all an investor did was buy and hold this name they would have gained nearly 9% over the last 1-year period and another 3.5% with the dividend. The investor would have underperformed the market by roughly 5 percent. The active portfolio manager, however, would have bought each bout of price volatility and sold the upside moves that frequently occurred. If we only considered 2021, in the chart above, had the active portfolio manager bought on the way down from January through February, they would had the opportunity of capturing a 15% return at the most recent peak, not including a 1% dividend, thus outperforming the S&P 500 year-to-date return.

Research Report Excerpt #7

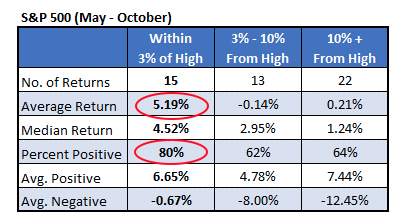

he S&P 500 is very close to its all-time high, within 1% of it in fact. When the index has ended April within 3% of its all-time high, the next 6 months have tended to be strong. In that case, the S&P 500 gained an average of 5.19% and was positive 80% of the time. Otherwise, the returns have been weak, averaging right around breakeven.

Research Report Excerpt #8

The blended earnings growth rate for the first quarter is 45.8% today, compared to an earnings growth rate of 33.8% last week and an earnings growth rate of 23.8% at the end of the first quarter (March 31).

Insight/2021/04.2021/04.30.2021_EI/S%26P%20500%20Earnings%20Growth%20Q1%202021.png?width=920&name=S%26P%20500%20Earnings%20Growth%20Q1%202021.png)

If 45.8% is the actual growth rate for the quarter, it will mark the highest year-over-year earnings growth reported by the index since Q1 2010 (55.4%). The unusually high growth rate is due to a combination of higher earnings in Q1 2021 and an easier comparison to unusually weak earnings in Q1 2020 due to the negative impact of COVID-19 on numerous industries.

Research Report Excerpt #9

Seeing as how the market dipped to end the trading week, it reminded me of something we had disseminated in our March 7, 2021 Research Report. At that time, the market had been consolidating price through February’s end and into week 1 of March:

“When in a downturn people automatically start to get anxious. They forget that earnings drive the market over time. They become gripped by fear and the fundamentals are overtaken by price action and translucent charts/technicals. Every time the market falls a little, we worry it’s going to fall a lot. Every single time! The news changes and the stocks differ, but the feelings are always the same. It’s no different this time. And on the other side of this Nasdaq and S&P 500 correction, you’ll wish you had bought the dip if you aren’t doing so already; and why?

- Earnings are trending HIGHER and HIGHER!!

- The principle of investing is to buy low and sell high

- Credit markets are very liquid

- The yield curve is steepening

- Fiscal and monetary supports remain firm and firming further

- Household balance sheets are in the best shape since the 1970s

- Personal Savings rate is near all-time high again

- Covid vaccinations are accelerating

- The market is up annually, 73%+ of all years.

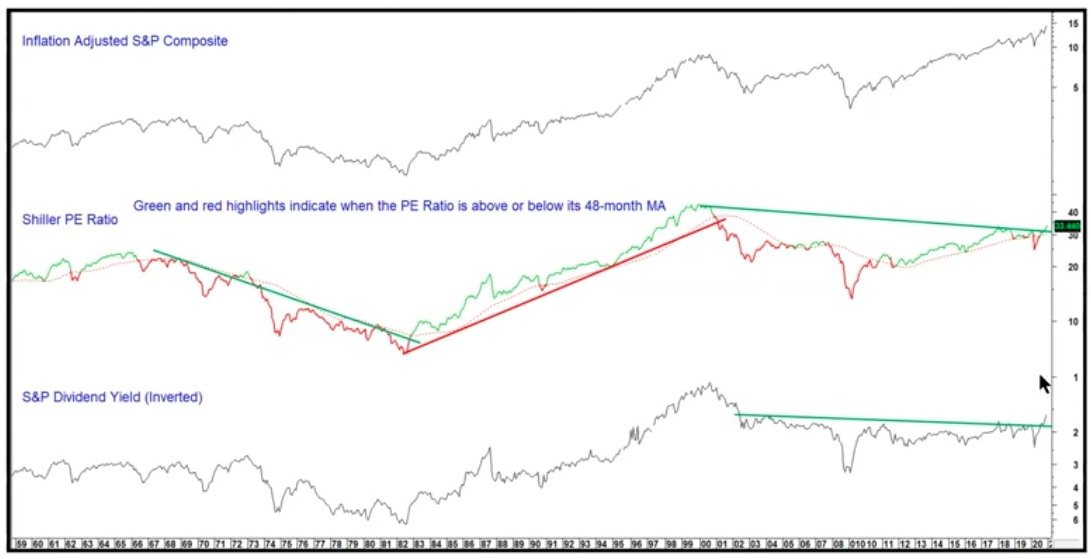

And if valuations are still your chief concern, despite the bullet-points referenced above and for which I could probably add another 5 more, here’s a chart of valuations that identifies the path of least resistance. It’s called a breakout folks, and when they happen as they did from 1982… don’t be on the wrong side of history as they say (middle panel, Shiller PE Ratio)!”