After 20 years in the retail and consumer goods sector, I became a research analyst and market strategist for Capital Ladder Advisory Group. Since 2011, I have published some 400+ articles surrounding mainstream retailers like Bed Bath & Beyond, Target, Costco and more. I've covered consumer goods corporations such as Apple, Keurig Green Mountain, SodaStream, Skullcandy, Fitbit and more. To date, I've garnered over a hundred media references to my analytics including Forbes. Presently, I am a contracted consultant to many retail and consumer goods companies in North America and manufacturing entities in China and Korea.

Leading economic indicators continue to slip lower. Yet, bulls, who rightly counseled against “fighting the Fed” during the free-money era, have ditched their own sound advice. Predictably, their focus has migrated to the lagging indicators (like employment numbers), although even that last bastion of strength seems ready to buckle. (Commentary from Doug Ramsey of The…...

Our weekly State of the Market video and macro-market weekend Research Report are postponed due to holiday weekend. In the meantime, below is some pertinent data and analysis to keep front of mind as we embark on the back half of the year. For easy access, click the link for the corresponding video presentation. Have…...

Another quick snapback for markets after breaking a 5-week win streak for the S&P 500 (SPX) and 8-week win streak for the Nasdaq Composite (COMPQ). If you’ve doubted the validity of the “buy-the-dip” market regime of 2023, we would think investors are increasingly adopting the reality of the markets’ performance year-to-date. At Finom Group, we…...

If Risk Management is priority #1… Is that Opportunity Risk or is that Downside Risk? The threat from the former is historically greater than the latter. ~Seth Golden If you would like to watch this week’s State of the Market video, please click the provided link. Be on the lookout for this weekend’s Research Report.…...

The Fed’s June announcement of a pause with further rate hikes to come has extended the uncertainty of whether an inverted curve and persistent policy tightening will ultimately lead to a recession. The business cycle is a critical investment issue because the relative returns of many assets depend on the state of the macro economy.…...

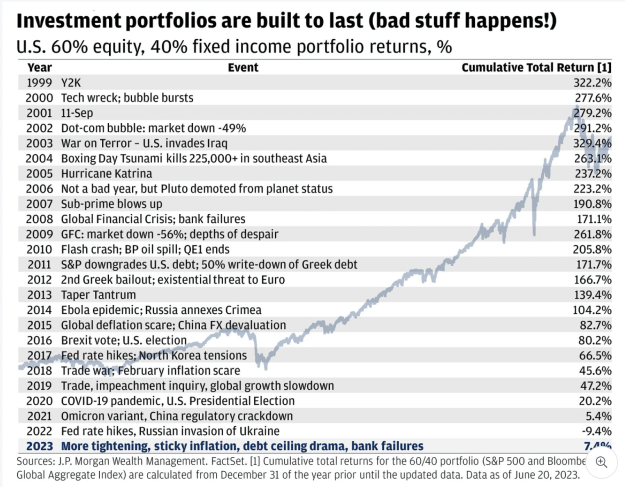

By J.P. Morgan Wealth Management There’s no shortage of worries batting around: the Fed is holding resolute on its call for two more rate hikes, U.S. regional banks still face challenges like the possibility of higher capital requirements, the Bank of England and Norges Bank delivered their own heftier-than-expected 50 basis point hikes this week…...

“It is difficult to get a man to understand something when his salary depends upon his not understanding it…” ~ Upton Sinclair by Barry Ritholtz June 2023 Since the financial crisis, we have seen repeated attempts at attacking indexing all of which have failed — both legislatively and in terms of investors voting with…

Macro Strategy—Equity Market Climbs A “Wall Of Worry” Yet Again: Moderating domestic demand growth, big energy price declines, loosening labor market conditions, and softening wage growth have boosted confidence in a “soft landing” scenario for the U.S. economy, in which the Federal Reserve (Fed) manages to bring both growth and inflation back to moderate, sustainable…...