After 20 years in the retail and consumer goods sector, I became a research analyst and market strategist for Capital Ladder Advisory Group. Since 2011, I have published some 400+ articles surrounding mainstream retailers like Bed Bath & Beyond, Target, Costco and more. I've covered consumer goods corporations such as Apple, Keurig Green Mountain, SodaStream, Skullcandy, Fitbit and more. To date, I've garnered over a hundred media references to my analytics including Forbes. Presently, I am a contracted consultant to many retail and consumer goods companies in North America and manufacturing entities in China and Korea.

In lieu of our regularly scheduled State of the Market video analysis, this week we offer a general public video to review some of the market conditions and macro developments since August. Oversold conditions and a traditionally weak September market offered certain signals for investors to consider, while the economy continued to “chug along.” (video…...

Fiscal constraints limit policy response at a time when cyclical risks persist. Market breadth reflects this dynamic as the S&P 500 defends key technical support. We share takeaways from our roundtable with industry analysts, our latest consumer survey and our Dividend Playbook report. Fiscal Dominance Remains on Center Stage…We continue to think the current backdrop…...

The analysis and Research within comes via the monthly Macro-Memo from RBC Capital Wealth Advisors: We have been predicting a recession for quite some time. The possibility first came into focus in the spring of 2022, and we believed a recession could be imminent as long as a year ago. That raises two questions. How…...

The weekend is where many a discipline and devoted investor/portfolio manager spend most of their free time in the exercise of macro-market research and/or due diligence, as it is more profoundly referenced. With that in mind, I hope Finom Group members receive this week’s “Research Notes” in effort to serve your devotions well. We’ve discussed,…...

“The most important financial lessons aren’t learned slowly during bull markets. They are seared into your brain in bear markets” ~Brian Feroldi If you would like to watch this week’s State of the Market video, please click the provided link. Third party Research from RBC Capital will be issued this weekend. Seth Golden will be off…...

1. The economy is holding up better than expected, but recession risk remains. In the third quarter, easing inflation and stronger economic growth helped fuel optimism for a soft landing. However, monthly data suggest economic momentum is slowing, and we may not be out of the woods just yet. Business spending has held up more…...

Welcome to another trading week. In appreciation for all of our Basic Membership level participants and daily readers of finomgroup.com content, we offer the following excerpts from within our weekly Research Report. Our weekly Research Report is extremely detailed and has proven to help guide investors and traders during all types of market conditions with…

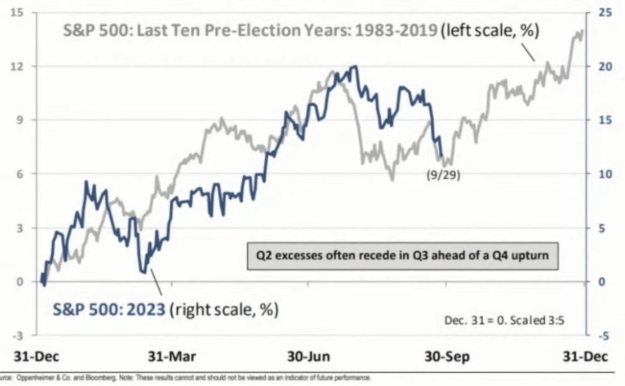

Thank goodness that is over with; September and the historically weaker returns associated with Q3 are complete! The period that just ended did very much live up to its historical performance, disrupting certain other quantitative data sets/studies along the way. It has proven quite remarkable just how seasonally obedient the market has performed in 2023,…...

On markets, not much has changed since our August Rasputin piece. While most leading indicators point to weaker US growth by Q1, the expected decline is modest as potential recessions go. Tighter Fed policy is partially offset by large fiscal deficits, US industrial policy (incentive-driven spending on infrastructure, energy and semiconductors), strong corporate and household…...