After 20 years in the retail and consumer goods sector, I became a research analyst and market strategist for Capital Ladder Advisory Group. Since 2011, I have published some 400+ articles surrounding mainstream retailers like Bed Bath & Beyond, Target, Costco and more. I've covered consumer goods corporations such as Apple, Keurig Green Mountain, SodaStream, Skullcandy, Fitbit and more. To date, I've garnered over a hundred media references to my analytics including Forbes. Presently, I am a contracted consultant to many retail and consumer goods companies in North America and manufacturing entities in China and Korea.

Research Report Excerpt #1 Like any rally, we want to understand the beginnings of the rally. Did the downtrend find some key level of support or was the rally headline-driven, something in the media headlines? It could be either, of course, but this one did seem to develop from a key level of technical support…

Many investors and traders were left feeling quite dejected the previous week, as a 6-week losing streak for the major averages turned into a 7-week losing streak. The streak of unprecedented and unpredictable markets remained overcast, and severely punishing all investors. If it is often darkest before the dawn, within the benefit of this past…...

Trading this market can be quite frustrating, with historically high likelihood setups repeatedly failing. I keep myself sane by always remembering, great trading/PM skills are not built on the things that go right, but on managing the things that go wrong. ~Wayne Himelsein If you would like to watch our weekly State of the Market…...

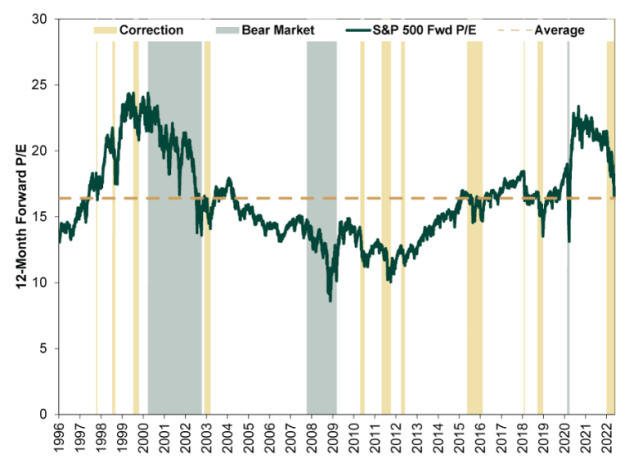

Research Report Excerpt #1 We often hear that if you bought the peak in 2000 or peak in 2007 you would have had to have waited X number of years until the index got back to break-even, or its former high. While that’s a measured understanding of price, that doesn’t have to be the measured…

Welcome back traders and investors! I thought it a better way to kick-off this weekend’s Research Report, given the unwelcoming price action by equity markets through 2022. Unwelcoming price action today, but I hope to remind all open-minded and savvy investors that the term unwelcoming is subjective and demands perspective. The markets are in downtrends,…...

EVERY BEAR MARKET EVER FOMO turns into, GIDOT (glad I don’t own that), everyone claims they were raising cash ahead of time, everyone references 1987, 2000, 2008 or 1929, everyone quotes MikeTyson’s, “everyone has a plan until they get punched in the mouth and everyone thinks the selling will never end. If you would like…...

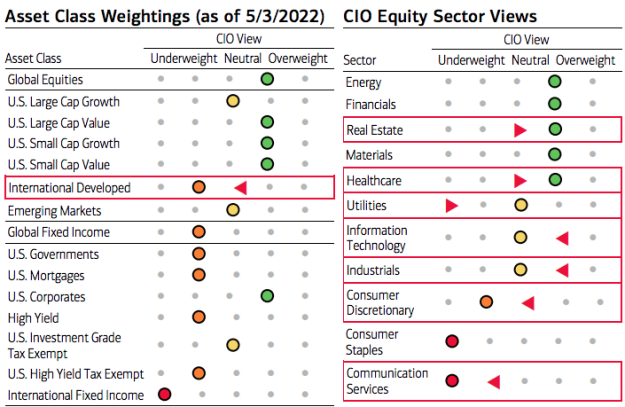

‘Fire’ AND ‘ice’ persist in the US…Monetary policy continues to tighten as confirmation emerges that growth is slowing (PMIs decelerating, earnings revisions deteriorating, and GDP growth contracted last quarter). The S&P 500 is still not priced for this backdrop, which we expect to continue. We’re in the midst of a hotter but shorter cycle in…...

By the team at Merrill Lynch Macro Strategy—Global Growth Weakening Fast, Fed On Track To Make Matters Worse: The escalation of the Ukraine/Russia conflict has caused growing worries about the prospects for world peace, food and energy supplies, global growth, and financial market conditions. Heightened risk aversion has resulted in a typical flight to the…...

Bears from 2009-2021: “A crash is coming!” Bears in 2022: “I told you so!” ~Douglas Boneparth NOBODY knows precisely WHERE markets will land. NOBODY knows WHY it will precisely land where it will, when it does. NOBODY knows and BEHAVES according to what they know inside their portfolio either. Doubt is universal, skill…...

Paul F. Desmond Lowry’s Reports Inc. 26 February 2002 Ask one hundred investors whether this is a bull market or a bear market, and you are likely to find their opinions split evenly down the middle. No one is really certain that the September 2001 low marked the end of the bear market and…...