After 20 years in the retail and consumer goods sector, I became a research analyst and market strategist for Capital Ladder Advisory Group. Since 2011, I have published some 400+ articles surrounding mainstream retailers like Bed Bath & Beyond, Target, Costco and more. I've covered consumer goods corporations such as Apple, Keurig Green Mountain, SodaStream, Skullcandy, Fitbit and more. To date, I've garnered over a hundred media references to my analytics including Forbes. Presently, I am a contracted consultant to many retail and consumer goods companies in North America and manufacturing entities in China and Korea.

The best hedges are cash and time, which work in tandem! The answer to fear of downside risk is not opening a NEW POSITION (hedge); there is simply no logic in such an exercise when fear of downside risk/losses is the premise! Risk of taxing one’s portfolio gains increase with a positioned hedge. Risk of…...

A lot has been going on in markets – aggressive Fed talk scaring investors, runaway commodity prices, war in Europe, COVID reopening in some parts and closing in other parts of the world. One should not be entirely surprised that all of this resulted in investor sentiment falling to 30-year lows (e.g., AAII % bulls…...

No Clear Path to Easier Financial Conditions Financial conditions are a key transmission mechanism for monetary policy and geopolitical shocks to effect the real economy and profits. Monetary policy tightening, for example, works by raising private sector borrowing costs on mortgages and corporate debt to slow growth and inflation. That process is well underway. The…...

Our goal as a trader is to push aside FOMO. Create a bubble for yourself, shut out the noise! Don’t look at other traders! Focus on what is important to your portfolio. If you cannot do this, you’ll forever be chasing the unachievable! ~ Seth Golden If you would like to watch the weekly State…...

When stocks and bonds send mixed signals, we listen to stocks more attentively. The underlying message is clear: Stay Defensively oriented because growth is going to disappoint. 1Q was tough but even worse under the hood. We chew on some charts to consider as we enter a pivotal earnings season. Listening Carefully…The internal message from…...

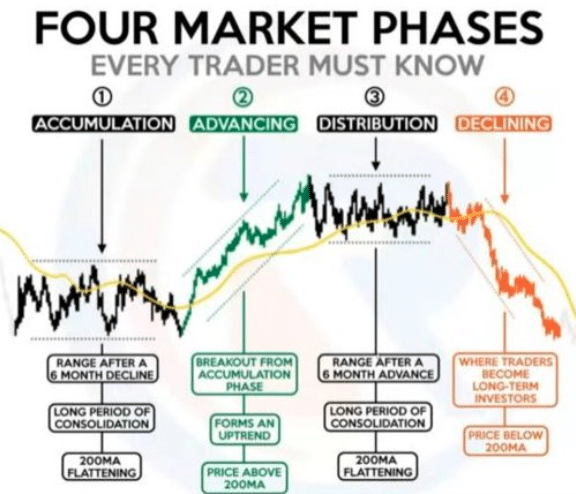

Research Report Excerpt #1 This is not a sell-everything and run for cover moment. It’s mechanical, and if history is any guide, a longer-term opportunity for the bulls that I offered this past week: At this time, I’d invite investors/traders to go back and review where the longer-term equity market trend stands. Watching the day-to-day…

A 3-week winning streak for equities came to an end for the S&P 500 (SPX) this past week. April is generally one of the best performing months of the year, but it’s reasonable to suggest that investors are now more heavily considering the latest message from Fed Presidents and the recent FOMC minutes. The message…...

“I recommend the S&P 500 index fund and have for a long, long time to people,” billionaire investor Warren Buffett said at Berkshire Hathaway’s annual shareholders meeting last May. If you would like to watch our weekly State of the Market, please click the provided link. Have a great trading week everyone! Corrections are usually short/steep from…...

Single-family house prices have been rising at record rates, raising the question of whether they have become disconnected with fundamentals. In October 2021, U.S. home price appreciation reached an annualized pace of 20% almost double the rate in 2012 when housing was rebounding off its lows of the global financial crisis (GFC). Yet, in our…

Cross-asset Strategy: While the geopolitical crisis and policy tightening are overhangs, risk assets have a number of supports that include strong activity momentum pre-shock, supportive labor markets, an ending COVID headwind in DM, and easing China policy stance. The early stages of Fed tightening should not be seen as a negative for stocks, as equities…...