After 20 years in the retail and consumer goods sector, I became a research analyst and market strategist for Capital Ladder Advisory Group. Since 2011, I have published some 400+ articles surrounding mainstream retailers like Bed Bath & Beyond, Target, Costco and more. I've covered consumer goods corporations such as Apple, Keurig Green Mountain, SodaStream, Skullcandy, Fitbit and more. To date, I've garnered over a hundred media references to my analytics including Forbes. Presently, I am a contracted consultant to many retail and consumer goods companies in North America and manufacturing entities in China and Korea.

Over the weekend the Federal Reserve, saying “the coronavirus outbreak has harmed communities and disrupted economic activity in many countries, including the United States,” cut interest rates to essentially zero and launched a massive $700 billion quantitative easing program to shelter the economy from the effects of the virus. Unfortunately, the stock market recognizes that…

Things are getting ugly and policymakers are swinging into action. We now find ourselves in the extraordinary position that interest rates in the US, euro-zone, Japan and the UK have now returned to close what central banks in each case believe is their effective lower bound. As the scale of the economic and market disruption…

This article appeared first in the Wall Street Journal by Nick Timiraos Updated March 15, 2020 5:03 pm ET The Federal Reserve slashed its benchmark interest rate to near zero on Sunday and said it would buy $700 billion in Treasury and mortgage-backed securities in an aggressive bid to prevent market disruptions from aggravating what…

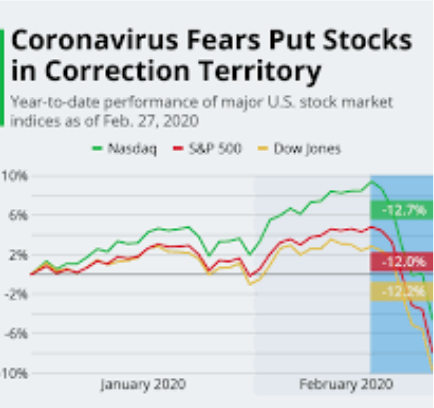

For most investors and traders, last week was one of the worst weeks in market history that they experienced or at least the worst since 2008. When it was all said and done, the S&P 500 (SPX) lost another 8.8% for the week and is now down some 16% for the year. Additionally, since achieving…...

Welcome to this week’s State of the Markets with Wayne Nelson and Seth Golden. Please click the following link to review the SOTM video. The coronavirus, has taken equity and bond markets by storm and while both rose in previous weeks, only bonds are rising since last week and now found with yields at record low levels and wildly volatile equity…...

The equity market has been coping with the COVID-19 outbreak across developed markets for the last two weeks, forcing investors to guesstimate the impact to demand, supply chain disruptions and credit. The Saudi/Russia oil price war that broke out over this weekend (oil collapsed by 25%, largest decline since ’91) turned an already fragile backdrop…...

A quick Finom Group housekeeping note: Due to travel engagements this coming weekend, we will be foregoing our weekly Research Report this weekend and be back on schedule in the following week. Our usual SOTM video will be due out Thursday evening! Does it seem like “forever ago” that we were looking ahead to 2020…

It was the worst day for the market since 2008 and a day that wiped out the gains from the last 12 months. Keep that in mind… the last 12 months. When you see that number it should be understood that much of the historic data that positions an occurrence in the market, followed by…

“A collapse in stock markets, co-ordinated policy statements and emergency interest rate cuts: the events of the past week have inevitably led to comparisons to October 2008. But the differences are as significant as the similarities. To understand why it’s helpful to think about the underlying economic forces that are at play. The crisis of…

The bounce back in markets this past week was quite telegraphed in the historical data we presented in the previous weekly Research Report. When it was all said and down, the S&P 500 (SPX) finished up 0.61% from last Friday, but remains down 8.00% year-to-date. The back-and-forth market activity this week was found with large…...