After 20 years in the retail and consumer goods sector, I became a research analyst and market strategist for Capital Ladder Advisory Group. Since 2011, I have published some 400+ articles surrounding mainstream retailers like Bed Bath & Beyond, Target, Costco and more. I've covered consumer goods corporations such as Apple, Keurig Green Mountain, SodaStream, Skullcandy, Fitbit and more. To date, I've garnered over a hundred media references to my analytics including Forbes. Presently, I am a contracted consultant to many retail and consumer goods companies in North America and manufacturing entities in China and Korea.

Fear and uncertainty building short-term but so many resolved near term In the first two months of 2022, a number of developments understandably rattled investor convictions and confidence around financial assets. One of the biggest lessons I learned at JPMorgan is the view “credit markets run on confidence, and they are good until they are…...

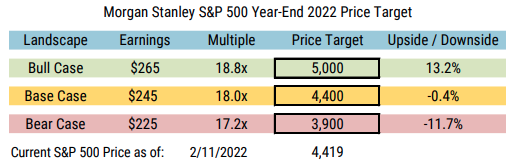

Research Report Excerpt #1 Heading into 2022, we understood that the historic potential S&P 500 returns surrounding midterm cycles and Year 2 of Presidential cycles usually deliver higher volatility and lesser returns. There were no guarantees that history would repeat, but the seasonal cycles suggested that a strongly profitable 2021 should reinforce year-end rebalancing ahead…

This past trading week was met with more disappointment for the bulls, as a usually strong February monthly Options Expiration (OP/EX) week failed to achieve its trend since 1990 by delivering a favorable return. NOPE, the bears took the week once again, which has been the trend of 2022 thus far. While the bears may…...

Part of successful investing is the ability to be able to forsake instant gratification and embrace delayed gratification! Not every trade will deliver an immediate profit, but every trade should be taken under the premise of an eventual profit! If you would like to watch the Weekly State of the Market video, please click the…...

With the focus on inflation and the Fed now an obsession, it’s time to pivot to growth and how much it will decelerate. We remain more concerned about growth than most and Friday’s consumer confidence number should not be overlooked in that regard. Correction remains incomplete. The CPI is old news. While last week’s inflation…...

Merrill Lynch: Macro Risk Macro Strategy—Risky Business (Cycle): We believe the probability of a recession this year is low and remain overweight Equities for now, but business cycle risk is rising for a number of reasons. Inflation is one of the biggest risks, as it could drive the Federal Reserve (Fed) to induce a recession.…...

“The S&P 500 has not bottomed in the months of January – May when it has finished the year in the RED on a total return basis since 1958. The S&P 500 has bottomed in the back half of the year all but 1 time when the index has ended the year in the RED…...

We continue to be more focused on what growth is going to do rather than rates and believe investors are still too optimistic, particularly as it relates to consumption. Exacerbating that risk is the fact that inventories are now rising rapidly. Maintain a Defensive Posture. Signs of weakness go beyond Omicron. 4Q earnings beat rates…...

Research Report Excerpt #1 As detailed since late last year, this is the S&P 500’s fourth longest run without a 10% pullback (~22 months vs. ~1 per year). Since 1980, the S&P 500 has averaged a 14% drawdown annually. As of Friday’s close, the S&P 500 has traveled 460 trading days without a 10% correction…

While certain individual stocks demonstrated massive downside moves this past week, the indices managed a consecutive weekly gain. In 2021, investors are witnessing the turbulence of markets that hasn’t really been a focus topic since the pandemic lows in March of 2020. The absence of such market volatility for a protracted period of time, finally…...