After 20 years in the retail and consumer goods sector, I became a research analyst and market strategist for Capital Ladder Advisory Group. Since 2011, I have published some 400+ articles surrounding mainstream retailers like Bed Bath & Beyond, Target, Costco and more. I've covered consumer goods corporations such as Apple, Keurig Green Mountain, SodaStream, Skullcandy, Fitbit and more. To date, I've garnered over a hundred media references to my analytics including Forbes. Presently, I am a contracted consultant to many retail and consumer goods companies in North America and manufacturing entities in China and Korea.

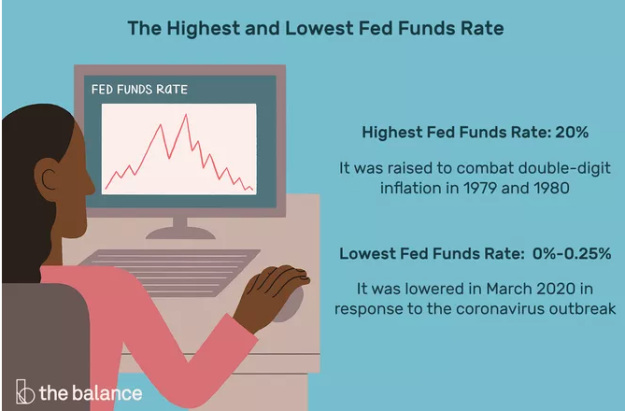

Fed Funds Rate History The charts below show the targeted fed funds rate changes since 1971. The Federal Open Market Committee (FOMC) didn’t announce its target interest rate after meetings until October 1979. The Fed adjusted the rate through its open market operations. Banks were forced to guess what the rates would be as a result. The Fed…

Macro Strategy—Expansion and Profits Growth to Continue in 2022: Current Federal Reserve (Fed) projections and the leads and lags involved between changes in monetary policy and changes in economic conditions suggest policy will not become a meaningful restraint to growth in 2022, so real growth is likely to remain above trend and inflation high, in…...

“Anyone can get lucky for a short period of time. But consistent outperformance over long periods is probably evidence of skill.” ~Bill Miller **Unfortunately, due to scheduling issues, we will not be delivering a weekly Research Report this Sunday. We will start up our typical 3-on 1-off regiment in the following week however. To watch…...

With all the attention on rate moves so far this year, investors may soon shift that focus to growth. Our focus will be on PMIs and earnings revisions to determine the eventual magnitude of this correction. We continue to recommend a barbell of defensives and small cap value. With rates having adjusted, our focus now…...

Research Report Excerpt #1 It’s important to respect seasonal patterns/data, but the seasonal data is often best utilized when pared with other quantitative studies/data. When it comes to the January Barometer, this may be especially true. The catch is the January Barometer has been broken lately. In fact, a lower January for the S&P 500 has been bullish…

After 3 consecutive years of double-digit returns for investors who stayed the course, through the ups and downs, downs and ups; 2022 is not starting off on the proverbial “good foot”. Then again, there is a significant portion of the investing population who missed a significant portion of the bull market rally since the March…...

“If you can’t pull the trigger on stocks here it may be because you’re focused on the next 3% when the better approach is to focus on the next 30%.” To watch the State of the Market video, please click the link provided. Choppy markets in early 2022, with a long, and almost certainly, winding…...

A new year brings new investment opportunities even if the narrative isn’t changing. We still recommend a large cap defensive bias given tightening financial conditions and decelerating growth. Round it out with a barbell of small/mid cap value until valuations fully reset this Spring. A new year but same narrative, for now. Tightening monetary policy…...

The way Technicians feel about Fundamentals is the way Quants feel about Technicians!! Know which discipline aligns mostly with your aptitude, but grow your knowledge for all investing disciplines!! The best investors I know are able to utilize all 3 disciplines!! If you would like to watch the State of the Market video analysis hosted…...

7 GENERAL PRINCIPLES: What is evidence-based research 1. Nothing new under the sun: Importance of looking at cycles 2. Equities junior in capital structure: Bonds lead stocks 3. Don’t shout at the market: Market doesn’t care about my opinion 4. Stop carrying a “Lehman hammer”: Avoid cognitive bias 5. Confidence drives markets: Confidence changes faster…...