After 20 years in the retail and consumer goods sector, I became a research analyst and market strategist for Capital Ladder Advisory Group. Since 2011, I have published some 400+ articles surrounding mainstream retailers like Bed Bath & Beyond, Target, Costco and more. I've covered consumer goods corporations such as Apple, Keurig Green Mountain, SodaStream, Skullcandy, Fitbit and more. To date, I've garnered over a hundred media references to my analytics including Forbes. Presently, I am a contracted consultant to many retail and consumer goods companies in North America and manufacturing entities in China and Korea.

Don’t be late. Life often throws us curve balls and when it does,all we can do is adjust our swing. In this regard,2020 may go down as the year of the curve ball. The world didn’t knock everything out of the park, but it did show great resilience and human spirit. Sometimes preparation is the…...

OVERVIEW Following on our series that was produced this year called “The Book of Great,” which discussed 10 separate dynamics that developed in 2020, we believe 2021 represents a year of multiple transitions—“The Gateway to the New Frontier.” First and foremost, we believe this transition develops away from peak uncertainty to a more certain, albeit…...

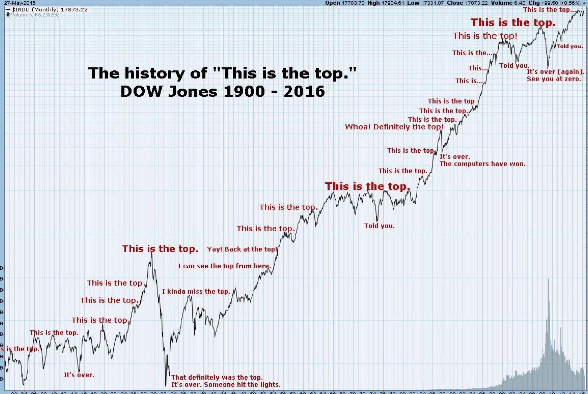

In this week’s video special report we discuss the environment surrounding the February-March 2020 bear market; the fastest bear market in history (17 days). Please click the following video link which discusses all the materials below. While many, if not most, are speculating in perpetuity over market tops, they miss the opportunity to formulate a…...

Once vaccinations start, how quickly can they lower daily new COVID-19 cases: Although the market understands that vaccination will lower daily new cases, the trajectory of the decline remains one of the top incoming questions we receive. We leveraged our previous epidemiological model and,after updating it for the recent uptick in daily cases (mean (sd)…

12 month price momentum is a powerful driver of flows and performance. Over time, price momentum strategies aren’t mean reverting, one reason they are so popular. Over the past decade more strategies have adopted momentum as a key input to their processes so momentum begets momentum. Components of price momentum leaders/laggards change periodically. As recessions…...

Welcome to another trading week!! In appreciation of all of our Basic Membership level participants and daily readers of finomgroup.com content, we offer the following excerpts from our Weekly Research Report. Our weekly Report is extremely detailed and has proven to help guide investors and traders during all types of market conditions with thoughtful insights and analysis, graphs,…

As we wrap-up our third year of operations at Finom Group, we extend our gratitude to each and every member/participant. 2020 has been one of the more difficult years for our country, let alone investors who chose to battle the peak-trough-peak in the markets. Finom Group sincerely hopes that our weekly Research Reports, State of…...

Equities are facing one of the best backdrops for sustained gains next year. After a prolonged period of elevated risks (global trade war, COVID-19 pandemic, US election uncertainty, etc.), the outlook is clearing with the business cycle expanding and risks diminishing. We expect a “market nirvana” scenario for equities with the melt-up continuing into 1H21,…...

Market and VolatilityCommentary Equity Macro and Quantitative Outlook for 2021 Our outlook for 2021 is positive for equities and more broadly for risky assets (see Global Asset Allocation). We expect markets to be driven by recovery from the COVID-19 crisis at the back of highly effective vaccines and continued extraordinary monetary and fiscal support. Given…...

Please click the following link to review our commentary on Sentiment, Leverage, Is it Early 2018 Again or…? What would you say is the most interesting finding in the historical data noted below? The table identifies years in which the S&P 500 captures a 30% or greater return. The most interesting concept concerning the chart…...