After 20 years in the retail and consumer goods sector, I became a research analyst and market strategist for Capital Ladder Advisory Group. Since 2011, I have published some 400+ articles surrounding mainstream retailers like Bed Bath & Beyond, Target, Costco and more. I've covered consumer goods corporations such as Apple, Keurig Green Mountain, SodaStream, Skullcandy, Fitbit and more. To date, I've garnered over a hundred media references to my analytics including Forbes. Presently, I am a contracted consultant to many retail and consumer goods companies in North America and manufacturing entities in China and Korea.

Welcome to this week’s State of the Markets. Please click the following link to review the SOTM video. In this week’s episode we discuss October markets alongside the geopolitical heavyweight optionality that is whipsawing markets. A trade deal of sorts has been outlined by the Chinese and U.S. negotiating parties Friday. Our dialogue this week aims to rationalize the numerous…...

Were you paying attention to the headlines in the after hours trading session on Wednesday? If the answer is no, you’re probably no worse off and as multiple, conflicting trade headlines proliferated across media outlets. Dow Jones equity futures fell some 300 points Wednesday evening as a report via the South China Morning Post revealed that the…

Additions to the Commerce Department’s blacklist, announced visa restrictions on Chinese government and Communist Party officials who are believed to be involved in abuse of Uighurs and other Muslim minority groups in Xinjiang, China, and we simply can only imagine what else might be to come ahead of the Thursday trade talks between the U.S.…

Ahead of the Thursday resumption of U.S./China trade talks, it seems both parties are doing their best to impede progress toward some sort of deescalation in the 15-month trade feud. The U.S. Commerce Dept. announced 28 new additions to its blacklist of Chinese entities, over human rights of its Muslim minority the Uighurs. Not necessarily…

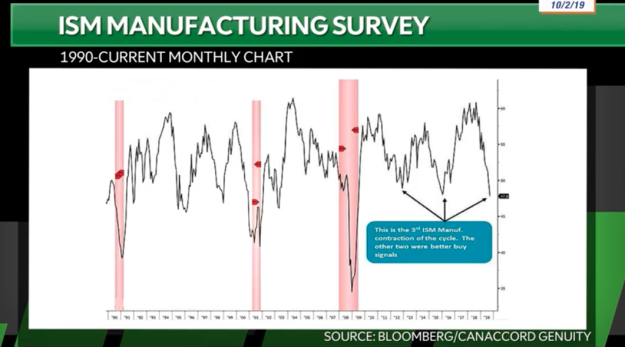

If you enjoy roller coasters then you probably enjoyed the market action this past trading week. From peak to trough the S&P 500 (SPX) fell nearly 3% intra-week, before rebounding Thursday-Friday. The latest ISM data proved to question bullish market and economic trends, but failed to give sustainable rise to bearish market sentiment, at least…...

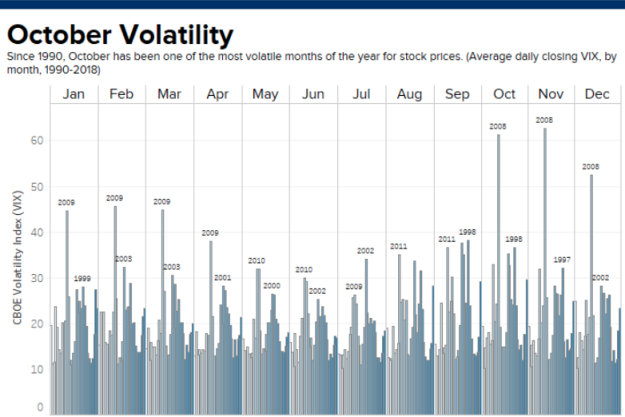

Welcome to this week’s State of the Markets. Please click the following link to review the SOTM video. In this week’s episode we discuss the craziness that comes with October markets. While the economic data is supportive of trend-growth, it has shown signs of weakening in the ISM data series. The 4th quarter has a reasonable setup for the markets…

If you thought Tuesday was a somber day in the markets, Wednesday performed that much worse and with the S&P 500 falling another 1.8 percent. The benchmark index broke down and through the 100-DMA at the onset of the trading day and before bouncing off the 200-EMA. With equity markets retreating, hedging activity has also…

Can we extrapolate any positives from a sharp decline in the S&P 500 (SPX) and peer indices on Tuesday? I ask that question given how far ranging and polarizing market participant views have become. With the question put forth, my answer and subjective perspective suggests there was at least one positive takeaway from the daily…

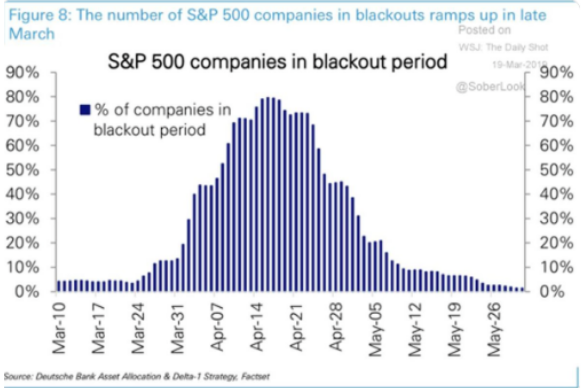

Out with September and in with October. Our recency bias might suggest that September was a rough month, but it was only in the final trading week that the S&P 500 (SPX) faltered a bit. In fact, the seasonality that presides over the indexes performance was quite precise when we look at the Bespoke Investment…

“In order to know where we’re going, you need to know where you’ve been.” This quote by Maya Angelou is no less important to investors as they look forward to another trading week. With this in mind, we are forced to recognize the S&P 500 has faltered for 2 consecutive weeks, losing .5% two weeks…