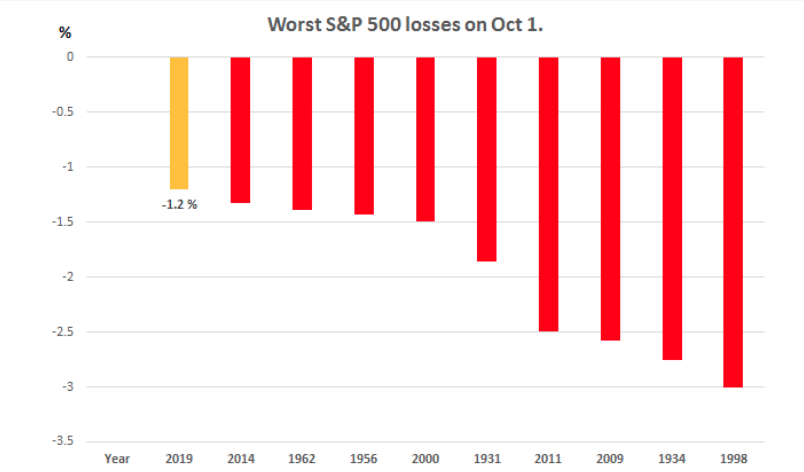

Can we extrapolate any positives from a sharp decline in the S&P 500 (SPX) and peer indices on Tuesday? I ask that question given how far ranging and polarizing market participant views have become. With the question put forth, my answer and subjective perspective suggests there was at least one positive takeaway from the daily loss of some 1.2% Tuesday, which essentially wiped out all of the gains from the 3rd quarter. Additionally, the 1.2% decline was the 10th worst start to October in market history.

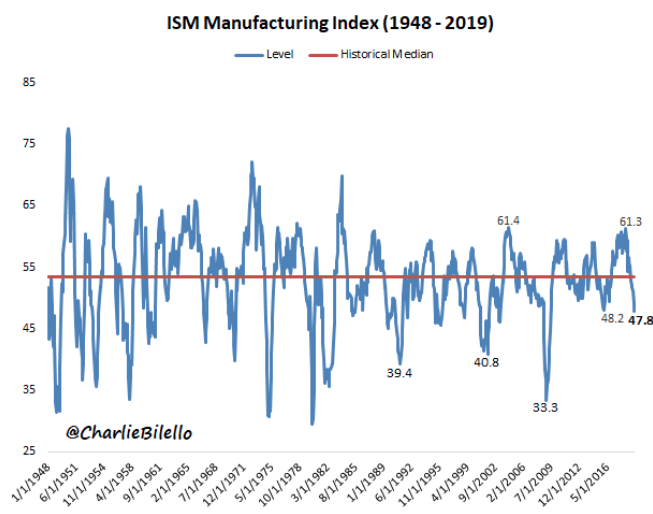

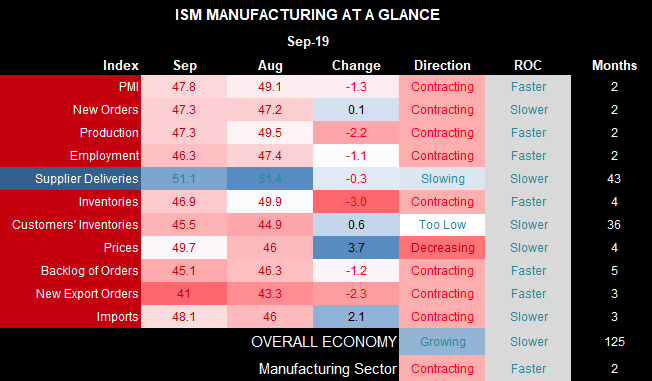

The markets tumbled on Tuesday shortly after the ISM Manufacturing Index revealed a more substantial decline for the month of September. The Institute for Supply Management said its manufacturing index fell to 47.8% last month from 49.1%, marking the lowest level since June 2009.

Only three of the 18 U.S. manufacturing industries tracked by ISM reported growth, down from nine in the prior month. The data from ISM has been weakening ever since August 2018, a month after the first tranche of tariffs were imposed on China. The index went from the best ISM numbers in 16 years to the worst in 10 years as of September 2019.

In earnest, most economists and myself had anticipated an increase in the ISM Manufacturing Index. Regional PMIs were improving around the globe and domestically, but it appears that tariffs remain front and center in the survey. Yes survey! Keep in mind the ISM Manufacturing Index is just that, a survey, soft data. Moreover, the ISM Manufacturing Index survey doesn’t propose questions about the YoY manufacturing picture, but the MoM picture. Nonetheless, the base usage of the survey hasn’t changed since inception.

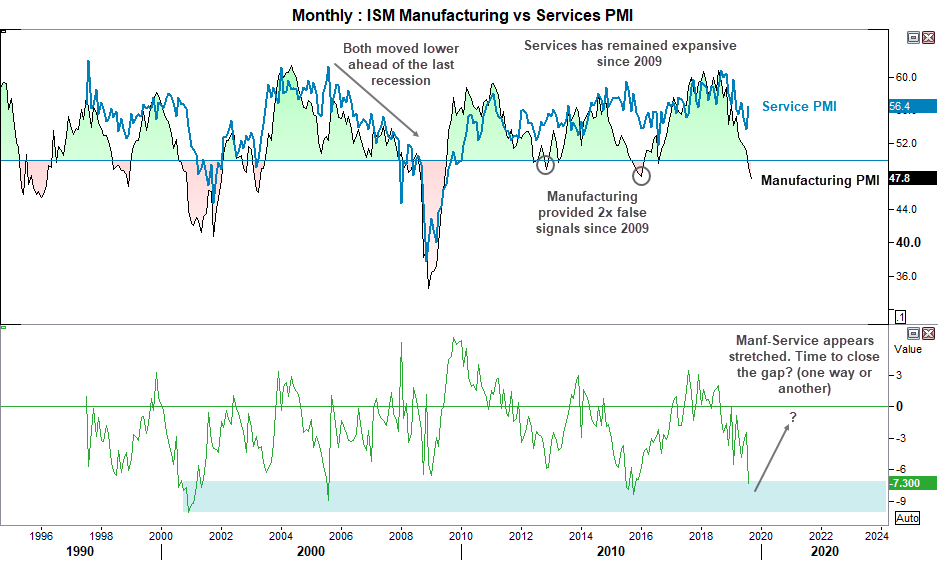

Not only have the headline PMI, new orders and production contracted at their fastest pace since the great recession, employment is its lowest since 2007 and exports fell off a cliff. While the spotlight is likely to remain on the plunge in export orders and the headline ISM index number, manufacturing as a percentage of GDP continues to be less and less significant with each passing year. Data from the world bank suggests that as of 2017, the U.S. Services sector accounted for over 77% of GDP. With that being said, we can better understand the divergence between the ISM Manufacturing Index and ISM Non-Manufacturing Index/Services

A wide gap has emerged between the two index readings recently, with Non-manufacturing proving to bounce recently. If most gaps are to be filled eventually, it remains to be seen just how this particular economic data gap will be filled. Will it come from the ISM Manufacturing Index catching up to its peer index, or will the peer index fall down to meet the ISM Manufacturing Index? Oddly enough and while we contemplate this forward-looking issue, another manufacturing reading pointed in a more favorable direction.

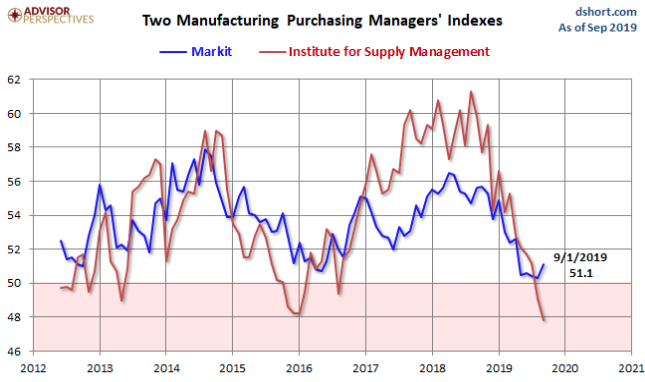

The seasonally adjusted IHS Markit final U.S. Manufacturing Purchasing Managers’ Index hit 51.1 in September, the highest level in five months, rebounding from 50.3 in August. (Chart both Markit and ISM)

“News of the PMI hitting a five-month high brings a sigh of relief, but manufacturing is not out of the woods yet,” Chris Williamson, chief business economist at IHS Markit said in a statement. “The September improvement fails to prevent US goods producers from having endured their worst quarter for a decade. Given these PMI numbers, the manufacturing recession appears to have extended into its third quarter.”

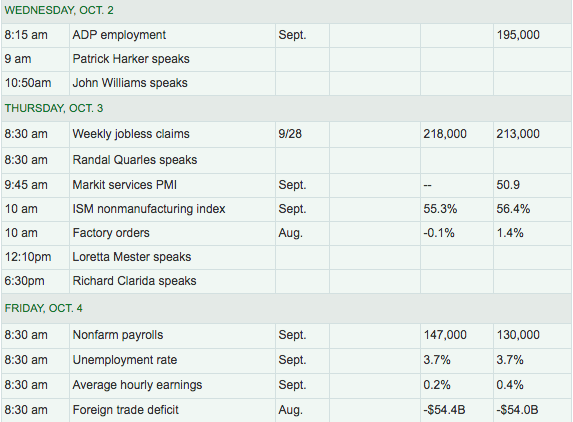

To reiterate, the Markit PMI improved to 51.1 in September (best since April) while the ISM fell to 47.8 (worst since recession). Notice that ISM ran much stronger in 2017-18 than Markit, overstating growth. The ISM might be understating it now. It’s important to understand, also, that the ISM is an equal weighted composite of its five components (new orders, production, deliveries, inventories and employment). Markit has about twice the sample size and overweights production and new orders, assigning a smaller weight to inventories and deliveries. As such, this may suggest that the Markit PMI gives greater insight into the manufacturing economy than does the ISM. Regardless, manufacturing as a whole is undoubtedly in a recession, but serves to emphasize that much greater importance will be placed on future economic data to be released this week, including the ISM Non-manufacturing index on Thursday.

Besides the emphasis to be placed on the next ISM Non-manufacturing data release, investors are also now forced to more greatly consider the ADP private sector payroll data Wednesday and the Nonfarm Payroll report on Friday. Recall from the ISM Manufacturing sub-index on employment, which fell to 46.3 in September, the lowest level since January 2016. Declining employment in the manufacturing sector could foreshadow weakness in the September jobs report. With this in mind, investors are likely to remain cautious ahead of the to be released employment data.

This isn’t the first time the market has seen weak economic data, but it comes ahead of some key macro issues that have binary outcomes, which remain to be determined. The U.S./China trade talks scheduled for October 10-11 will either serve to drive optimism or pessimism through the markets. Every economists, strategist and analysts has a perspective to offer on how the talks will go and what the probable outcome will be for the global economy and markets. With the date of these trade talks moving closer and markets reeling from weakening economic data, BlackStone’s CEO Steve Schwarzman suggests that investors have 5 key issues to consider.

- Global manufacturing weakness

- Federal Reserve might be headed down a similar monetary path as Japan and Europe.

- Low interest rates specifically that are responsible for weak economic growth. “If you push down [interest rates] too much, you create the problem you are trying to solve.”

- Global economy has shifted from synchronized growth as late as 2018 to a one in which expansion is receding as if there was no end in sight.

- Recent travails of some tech companies in public markets — including Peleton Interactive Inc. disappointing launch Friday, WeWork parent The We Co.’s decision to scrap its IPO indefinitely, amid the steady slide of stocks of ride-sharing firms Uber Technologies Inc. and Lyft Inc. — are “signs of excess” that are typically associated with the late stages of an economic expansion cycle.

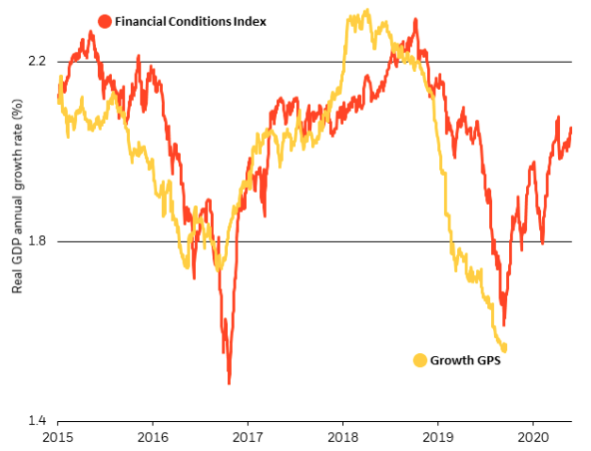

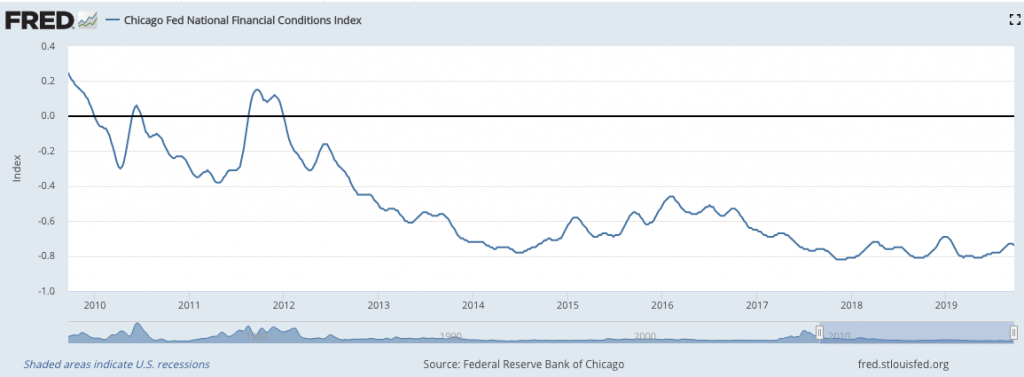

While Blackstone’s CEO is worried about these issues, it’s important to inject a rational observation of what central bank easing can and has produced in the past. Historically, when central banks serve to ease financial conditions, as they are doing presently, the action serves to provide a boost to economic conditions. This was recently opined by BlackRock. In a new commentary, BlackRock’s Investment Institute points out that financial conditions have eased as central banks, including the Federal Reserve and European Central Bank, have cut interest rates.

BlackRock says it’s already starting to see signs of its impact, as the U.S. housing market appears to have turned a corner, auto sales have held up and machinery investment has rebounded in Europe. BlackRock says it expects a pickup in global economic growth in the next six to 12 months.

Speaking of auto sales. September auto sales haven’t been fully recognized as of yet, but the early headlines are quite ominous.

A more complete picture will emerge Wednesday when General Motors and Ford are due to report. A closely watched measure that aims to smooth out month-to-month sales swings, the seasonal adjusted annualized rate, or SAAR, suggests the pessimism reflected in how auto shares traded Tuesday may be overblown. The rate was 17.2 million in September, according to Ward’s Automotive Group, up from 17 million in August, which benefited from more selling days this year, including the Labor Day holiday weekend.

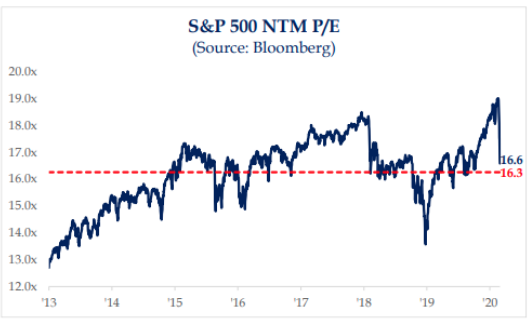

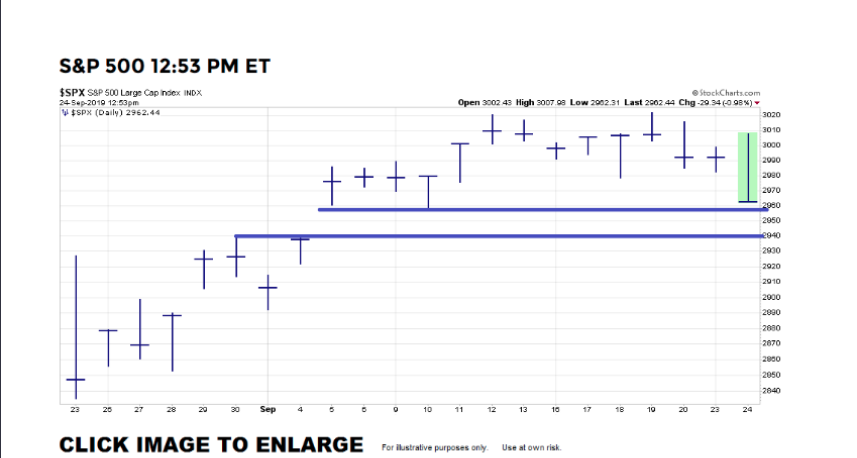

With all the macro issues coming to the forefront on Tuesday, the S&P 500 got off to a rather poor start to the Q4 period. In fact, it was the worst start to a Q4 period since 2014. Referring to the initial question posed within this article, did anything positive happen on October 1st? In previous reports Finom Group had denoted an open gap in the S&P 500 from 2,957 down to 2,938.

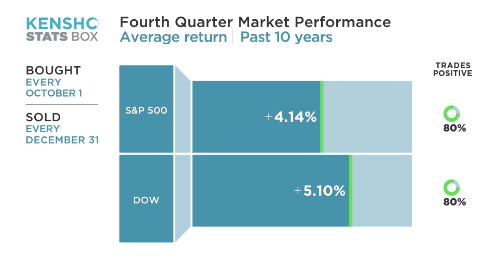

A truism of the financial markets is that most gaps get filled over time. With this technical gap in the benchmark index falling to selling pressure on Tuesday, this gap has now been filled. Additionally, while the first trading day of the 4th quarter proved a dismal day for investors and the markets, Kensho statistics suggests investors should remain bullish. The market analysis platform says that the S&P 500 Index has averaged a 4% gain in the final three months of the year over the past decade. The S&P 500 had traded positively 80% of the time during this period.

While the future for the market portends well, the interim market performance can certainly prove bumpy or more volatile. The VIX rose sharply on Tuesday and is higher by another 6%+ ahead of Wednesday’s economic data releases and potential headlines on either trade or the impeachment inquiry. Investors should be found expecting volatility near-term and look for buying opportunities. We would also be considering how the macro data reflects on technical market levels or moving averages. The S&P 500 finished the trading day Tuesday right below the 50-DMA. If the macro data proves disappointing on Wednesday, the 100-DMA is not far off, at 2,924.

Finom Group, regardless of the weakness in the ISM data, does not believe a recession is imminent, especially with free flowing credit that is serving to support a resurgence in the housing sector. While financial conditions and rates remain loose and relatively low, it is difficult to construct a recession thesis in a service/consumer driven economy.

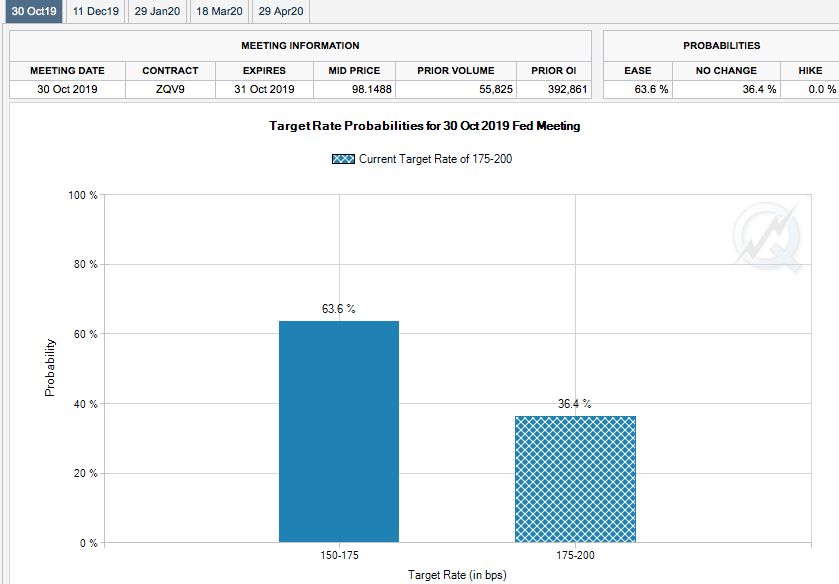

With the latest disappointing economic data (ISM Manufacturing Index), investors are now pulling forward the next rate cut probability for October. Expectations for a rate cut by the end of October jumped to 60% after the ISM report from 40% a day ago, based on trading in the fed fund futures market. Economists said that the pace of Fed action could ultimately depend on the U.S. September employment report, set for release on Friday. Economists surveyed by MarketWatch expect the economy created 147,000 jobs in the month.

With the backdrop of supportive central banks and free flowing credit markets, Canaccord Genuity’s Tony Dwyer believes investors should look through manufacturing weakness and be on the offense when it comes to equity exposure.

“There’s a global manufacturing slowdown that’s pretty sharp based on the trade war. Meanwhile, other surveys on manufacturing issued by Markit showed the U.S. sector in expansion while reflecting improvement in China and Europe. I know investors are scared because they reacted to the weaker data and completely ignored” the Markit figures.

Dwyer sees the current soft spot as a repeat of the “mini-recessions” in 2011-2012, triggered by the European debt crisis, and that of 2015-2016, instigated by a collapse in oil prices.

“Market pundits keep trying to identify the next recession while we are just beginning to emerge from the third mini recession of this cycle,” Dwyer said in a Tuesday note to clients. Low interest rates, he argued, “have already done the work of stimulating future growth, and Fed Chair Jerome Powell’s comment that the Fed will be more aggressive if data weakness continues to support an offensive position.”

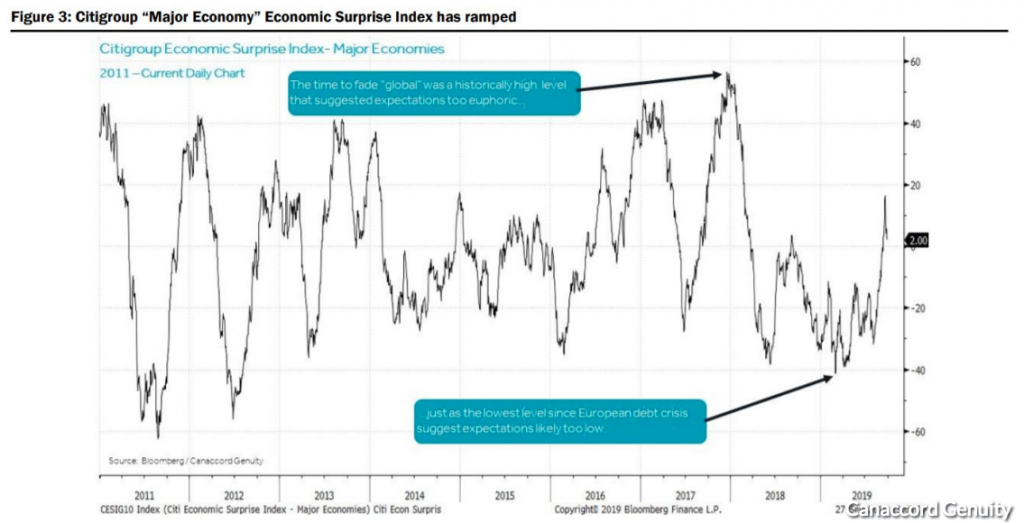

Dwyer said that he believes the Fed will move to cut interest rates for the third time this year in October. He also said that the global growth picture has begun to bottom, pointing to the OECD composite leading index, which shows that growth is deteriorating less quickly today than in recent months, and a recent jump in the Citigroup Economic Surprise index, which shows global economic data has begun to surpass expectations.

Dwyer represents that markets may find an increase in volatility in October, but recommends investors overweight their portfolios in cyclical sectors, including industrials and financials. Where Dwyer sets down the mic, CNBC’s Jim Cramer picks it up and builds on Dwyer’s bullish sentiment.

“If you’ve been selling stock for weeks to raise cash, as I’ve been advising you to, this is a good time to start looking for stocks to buy into weakness … ,” he said. “But if you’re living in fear of a recession or the prospect of an Elizabeth Warren presidency, I think you’re going to miss out on some terrific opportunities.”

Look folks, the market had a bad day spurred by sanguine economic data. And there’s nothing to suggest Wednesday can’t or won’t mirror Tuesday’s trading action that proved a fallout from the manufacturing data. Remember, nearly 77% of the U.S. economy is service oriented and driven by consumption. This is also something pointed out by UPS’ CEO recently.

“It’s still consumer driven, and we are seeing that it’s still holding up,”Abney said on “Squawk Alley.” “It may not be as strong an increase as last year, but we still feel pretty good about what we are seeing.

Of course we’d like to see industrial production and manufacturing increase, but consumer is holding on right now. Consumer activity accounts of about two-thirds of the U.S. economy.“

Nonetheless, we urge investors to maintain a long-term outlook and consider that while economic policy has created a global economic slowdown and policy uncertainty, central banks are providing a buffer for the global economy. Additionally, if policy proves too unfavorable for markets, too restrictive for growth, the markets will step in and do as they always do; dictate policy! When the market speaks, and we know how dialed into the market’s performance the White House has become, governing bodies are forced to listen and course correct.