After 20 years in the retail and consumer goods sector, I became a research analyst and market strategist for Capital Ladder Advisory Group. Since 2011, I have published some 400+ articles surrounding mainstream retailers like Bed Bath & Beyond, Target, Costco and more. I've covered consumer goods corporations such as Apple, Keurig Green Mountain, SodaStream, Skullcandy, Fitbit and more. To date, I've garnered over a hundred media references to my analytics including Forbes. Presently, I am a contracted consultant to many retail and consumer goods companies in North America and manufacturing entities in China and Korea.

Within this past week’s State of the Market video, our focus suggested that the market has stepped through the open window and into a relatively protracted period of opportunity for investors. It is during the November – April period of the following year that, within a Midterm Election cycle and 4-Year Presidential Cycle, the greatest…

Investing isn’t about beating others at their game. It’s about controlling yourself at your own game! ~Ben Graham If you would like to watch our weekly State of the Market, please click the provided link (to be provided shortly). Have a great trading week and be on the lookout for this weekend’s macro-market Research Report!…...

Research Report Excerpt #1 THE FED IS DRIVING THE MARKET, and it demands the market to stay put until further notice. With the aforementioned sentiment, which is hard to argue against, as it was further demonstrated most recently during the Fed chairman’s press conference this past week, it is ideal for investors to accept this…

With each passing week in 2022, we analyze, scrutinize, and rationalize a litany of macro-fundamental, technical, and quantitative data. This week, however, we won’t be doing the same ole’ same ole’, as the saying goes. For many Finom Group members you likely have read our works throughout the year or heard our chief equity strategist…...

“Time in the market” is only a benefit if the market is heading in a positive direction. Otherwise, idleness is a curse not a blessing. ~Willie Delwiche If you would like to watch this week’s State of the Market video, please click the provided link. Be on the look out for this weekend’s macro-market Research…...

Since at least Jackson Hole, the narrative has been that inflation is a big problem, and the Federal Reserve was up for the fight—certifying it would raise interest rates quickly, substantially, and for a long time. Powell gave his “tough-love” speech on August 26th when the S&P 500 was at 4,200 and the Treasury yield…...

Research Report Excerpt #1 The chart of the S&P 500 above is the exact price action from a double-bottom, bottoming process in 1962, whereby the index took off through the end of October and into 1963. Indeed, just as it was in 1962, the markets found the June rally sputter and falter through September, into…

What a week, month I mean. The first three quarters of 2022 have been disasterous for investors of all types. Recall that year-to-date through Q3 had been the worst start for a 60/40 portfolio since 1974, which was also an inflation and Fed hiking regime. However, as detailed in the Ned Davis Research chart below, following…...

“Do you know what investing for the long run, but listening to market news everyday is like? It’s like a man walking up a big hill with a yo-yo and keeping his eyes fixed on the yo-yo instead of the hill.” ~Alan Abelson If you would like to watch this week’s State of the Market,…...

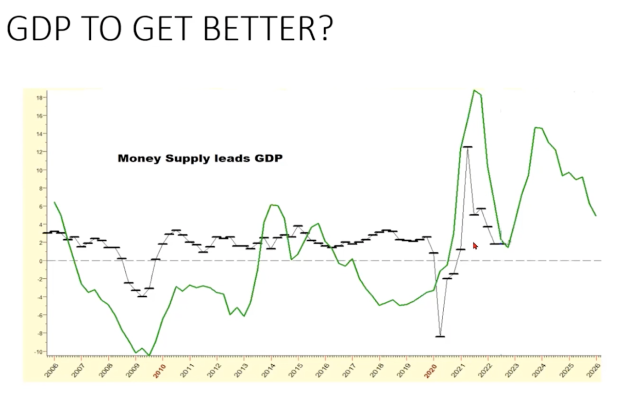

Last week’s tactical bullish call was met with doubt from clients, which means there is still upside as we transition from Fire to Ice—falling inflation expectations can lead to lower rates and higher stock prices in the absence of capitulation from companies on 2023 EPS guidance. A good start as we transition from Fire to…...