After 20 years in the retail and consumer goods sector, I became a research analyst and market strategist for Capital Ladder Advisory Group. Since 2011, I have published some 400+ articles surrounding mainstream retailers like Bed Bath & Beyond, Target, Costco and more. I've covered consumer goods corporations such as Apple, Keurig Green Mountain, SodaStream, Skullcandy, Fitbit and more. To date, I've garnered over a hundred media references to my analytics including Forbes. Presently, I am a contracted consultant to many retail and consumer goods companies in North America and manufacturing entities in China and Korea.

Cross-asset Strategy: Stocks and bonds continued to sell off last week on central bank hawkishness. The hawkish Fed outcome with significant upward revision to the dots leads us to now expect a terminal rate of 4.5% by early 2023. While the market has now settled into a view that Fed will continue with outsized hikes,…...

Research Report Excerpt #1 “Assuming, assuming one could be that best market timer in the world, the difference between that amount of work and simply buying the index ETF and holding it through ups and downs is a meager 1 percent. That’s it, that’s all one achieves above the Buy and Hold strategy. In other…

In roughly the last 10 trading sessions, the S&P 500 (SPX) and Nasdaq (COMPQ) have lost 10% of their value. That is how quickly the market is derating. The decline has happened ahead of, through, and after the latest FOMC rate announcement. This past week, and after the benchmark index declined nearly -3.5% in the…...

The worse a situation becomes, the less it takes to turn it around, and the greater the upside. ~George Soros You don’t have to know the future. What you want to know is how to play a PROBABILITY DRIVEN GAME with incomplete information and asymmetric opportunity sets. ~Alex Barrow If you would like to view…...

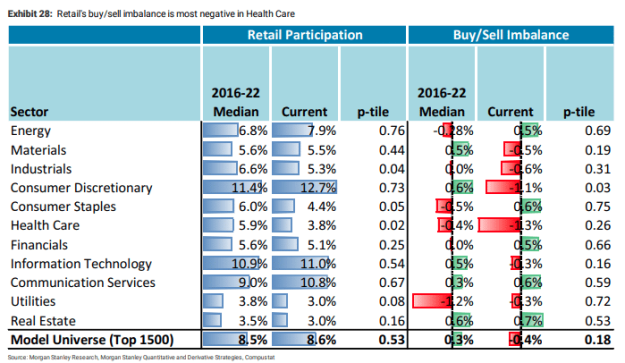

As the evidence builds around our more bearish earnings outlook, the stock market has traded lower again. While we think there is still a long way to go before reality is fairly priced, investors may face a volatile path in the absence of an “event” to clear the decks. The evidence is building…Since our earnings…...

Research Report Excerpt #1 COMPOUNDING is a difficult concept for traders! We dont understand geometric growth as easily as linear growth, because its not intuitive. The chart above helps to depict why, when stocks go up its a win, and when they go down its a longer-term win due to compounding. If you can’t rationalize, that should prices…

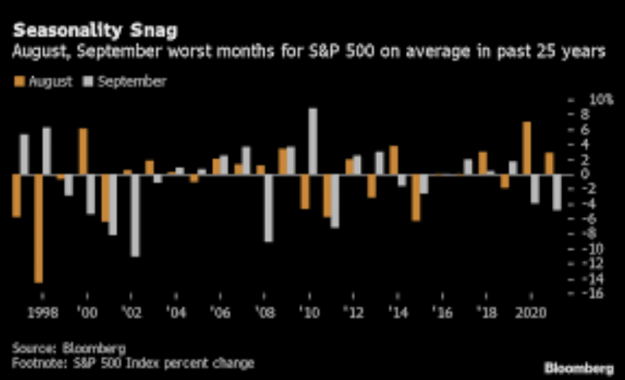

Markets are firmly in the thrawls of another September swoon, which is all-too familiar and painful for many investors. The strength and above average returns in the prior week were supplanted by an engulfing bearish candle and greater losses this past week. I reckon that nobody is having fun, and most investors are unambiguously hoping…...

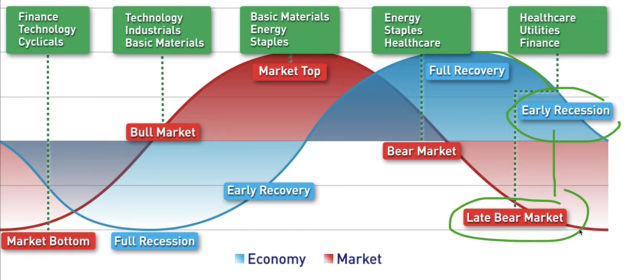

Bear markets are about buying value! Bull markets are about realized profits for value seekers! In other words: “INVESTORS MAKE ALL THEIR MONEY IN BEAR MARKETS , THEY JUST DON’T KNOW IT AT THE TIME” ~Seth Golden “S&P500 is below both 50 & 200-DMA. More importantly, 50-DMA is below 200-DMA. For the S&P 500 all…...

Research Report Excerpt #1 After a 3rd straight weekly decline in the major averages, the AAII investor sentiment fell back to one of the lowest Bullish readings in history, only trumped by the lows seen this past June. Headlines reinforced the fear that investors have felt throughout 2022, and the price action has mirrored the…

Welcome back Finom Group traders and investors. As most are aware, the rollercoaster ride that is the 2022 investing landscape is a difficult one to traverse. We believe that the best approach to investing in 2022 is doing just that, investing. The risk/reward for trading is not optimal for most, as the whipsawing price action…...