After 20 years in the retail and consumer goods sector, I became a research analyst and market strategist for Capital Ladder Advisory Group. Since 2011, I have published some 400+ articles surrounding mainstream retailers like Bed Bath & Beyond, Target, Costco and more. I've covered consumer goods corporations such as Apple, Keurig Green Mountain, SodaStream, Skullcandy, Fitbit and more. To date, I've garnered over a hundred media references to my analytics including Forbes. Presently, I am a contracted consultant to many retail and consumer goods companies in North America and manufacturing entities in China and Korea.

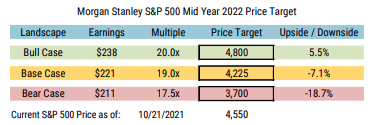

The US equity market continues to ride the wave of liquidity and seasonal FOMO. As we approach our bull case of 4800, the risk/reward deteriorates, particularly with leverage high. The consumer looks ready for a strong and early holiday shopping season—supporting the near-term positive trend. Riding the wave. Equity markets continue to ride the wave…...

With just 2 months remaining in the 2021 trading year, investors are gearing up for the typical seasonal tailwinds, but also recognizing that markets are trading at all-time highs heading into a “tapering… storm?” That’s a question I’ll leave open-ended for investors and traders alike, as each will be approaching the end of the year…...

“The speculator fights his own good sense, struggles against his own will … and is at odds with his own decisions … There are many occasions in which every speculator seems to have two bodies so that astonished observers see a human being fighting himself.” ~Joseph de la Vega Please click on the provided link…...

Growth is slowing for both the economy and earnings and is unlikely to bottom until 1H2022. Meanwhile, earnings revisions breadth has deteriorated sharply over the past month, a leading indicator for NTM EPS. Most of this deterioration has been due to costs and supply but demand looks vulnerable. Odds are increasing that growth will continue…...

Research Report Excerpt #1 Putting some more context to this past Friday’s price action, with a minor loss in the S&P 500, this was the more probable and even predicted price action based on the overbought and/or overheated conditions Seth had been analyzing during the course of the trading week. On Thursday, the S&P 500…

Welcome back traders and investors. New highs, new highs and not quite new highs. What am I referring to? Well, the Dow Jones Industrial Average (DJIA) and S&P 500 (SPX) both made new all-time highs this week while the Nasdaq (COMPQ) failed to achieve this feat of strength. Close, but close is not going to…...

“One-half of life is luck; the other half is discipline — and that’s the important half, for without discipline you wouldn’t know what to do with luck.” — Carl Zuckmayer If you would like to review the weekly State of the Market video, please click the included link. Have a great trading week! (video…...

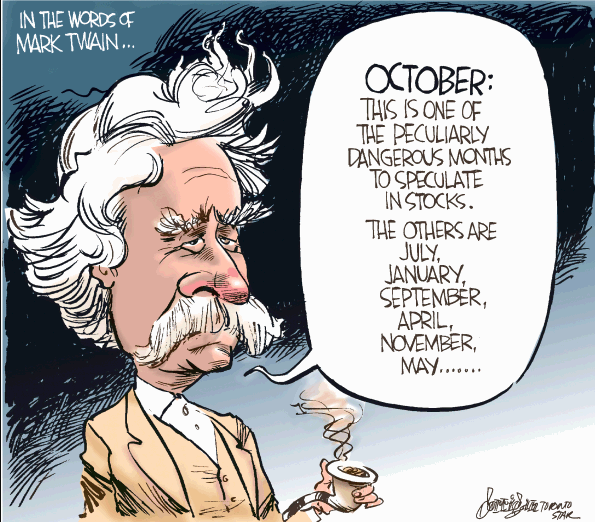

Research Report Excerpt #1 Over the last twenty-one years, the full month of October has been a solid month for the market. DJIA, S&P 500, NASDAQ, Russell 1000 and Russell 2000 have all recorded gains ranging from 0.6% by Russell 2000 to 1.9% by NASDAQ. But these gains have come with volatile trading, most notably…

Markets rallied again this past week, but finished on a high note unlike the previous week’s rally. The S&P 500 (SPX) was up 3 days in a row to end the week, but it hasn’t been up a 4th day in a row since Aug 25, 2021. Given the 2-week win streak, it may also…...