After 20 years in the retail and consumer goods sector, I became a research analyst and market strategist for Capital Ladder Advisory Group. Since 2011, I have published some 400+ articles surrounding mainstream retailers like Bed Bath & Beyond, Target, Costco and more. I've covered consumer goods corporations such as Apple, Keurig Green Mountain, SodaStream, Skullcandy, Fitbit and more. To date, I've garnered over a hundred media references to my analytics including Forbes. Presently, I am a contracted consultant to many retail and consumer goods companies in North America and manufacturing entities in China and Korea.

Weekly Warm-up: More on The Mid Cycle Transition to Quality; Staples over Discretionary Last week we argued for a faster transition to mid cycle dynamics which means it’s time to upgrade the quality in one’s portfolio. One sector shift that makes sense is Discretionary to Staples which received a lot of pushback. Today, we defend…...

Research Report Excerpt #1 The typical April return has been good, but not great. Over the past 10 years, April has been only the eighth-strongest month of the year, with a 0.9% median SPX return. Since 1991, though, the median April return has been 1.3%—the fifth-best month of the year:1 Research Report Excerpt #2…

The S&P 500 (SPX) bottomed in March of 2009 at 666, the Devil’s Bottom as it has become known. As of this past week’s record closing high, the S&P 500 stands close to 4,020. That’s a gain of more than 500%, and if we include dividends, it’s now up more than 660% from the March…...

Welcome to this week’s State of the Markets. This week’s episode will hope to find a video recording, but presently I am without my voice. That may please some of you ;-). I am hoping to have my voice back soon as it has improved today. With that being said and our apologies, when the…...

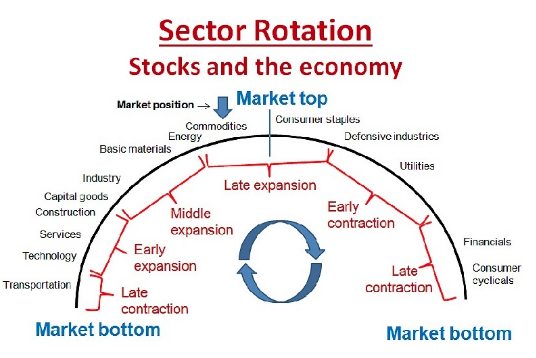

A hotter but shorter economic cycle has implications for asset allocation as well as equity portfolio construction. In the near term, it means we are likely to move out of the early cycle leadership toward mid-cycle which comes with a move up the quality curve, too. Running with the Bulls. At this point, the bullish…...

2021 started out like a continuation of 2020 with tech ripping higher and everything else lagging in the US Equity markets, but as I’m sure you are well aware, the last month (plus) has been anything but. Below are the year to date returns for Russell, S&P500, Dow and Nasdaq. YTD Returns respectively $IWM 12.52%…...

Research Report Insight #1 Good stuff Edward and I urge our readers to review what Edward offered about TIME/DURATION and pair it with the following data: We’ve been chatting up the Facebook (FB) chart with Finom Group members in the Trading Room over the past couple of weeks. I’ve posted several charts recently on Twitter,…

Everyday I read The Chart Report. It’s a mixture of charts and thoughtful quotes for what I find to be “useful information”. And believe it or not, sometimes it’s not just relatable to markets, but to our every day lives. Here is a quote published in The Chart Report that I tend to think delivers…...

No month-end equity selling but likely buying, what if ship breaks, Oil and CTAs Over the past few days, the equity market was fairly weak despite no real change in the macro fundamental outlook. The Fed has remained dovish, the US stimulus was released as planned, and the pandemic and vaccination in the US are…...

It’s never easy, is it? As an active portfolio manager, trader or investor, it seems as though once we move beyond one obstacle, one fearful market narrative there is another one right around the corner if not immediately following the last fearful narrative. What could tip the scales from a bullish trend to a bearish…