Goldman Sachs Tactical Flow-of-Funds: August – On Correction Watch

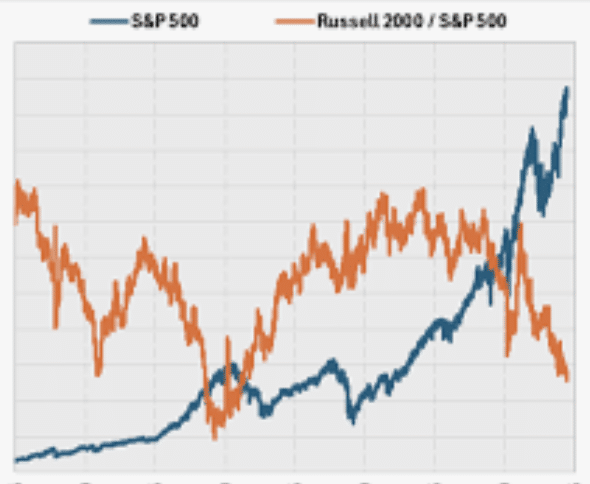

Scott Rubner, Managing Director Goldman Sachs This is the last bullish US Equity email that I will be sending out for now, as the last standing bears have capitulated and everyone is in the pool. I am so bullish after 34 new ATH’s, that I am actually turning tactically bearish. The pain trade has shifted…...