Bank Of America: Tactical Risks In Early 2024

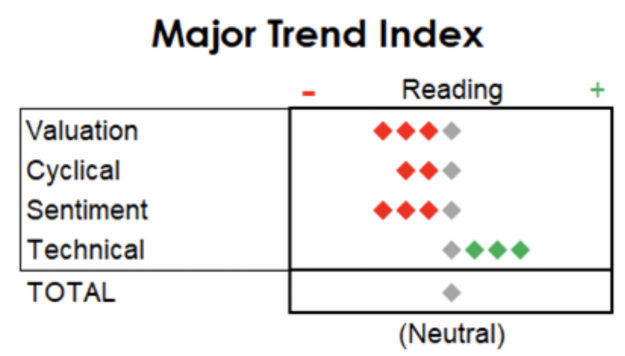

Sentiment: Plenty of believers = tactical risk in early 2024 Sentiment indicators such as Farrell Sentiment, asset manager S&P 500 (SPX) E-mini net futures position and the 25-day put/call have risen, entering 2024 near complacent levels. Although not yet euphoric, individual and institutional investor sentiment suggests that many investors have embraced the 34% rally from…...