Another quick snapback for markets after breaking a 5-week win streak for the S&P 500 (SPX) and 8-week win streak for the Nasdaq Composite (COMPQ). If you’ve doubted the validity of the “buy-the-dip” market regime of 2023, we would think investors are increasingly adopting the reality of the markets’ performance year-to-date. At Finom Group, we…...

A Pause/Consolidation That Refreshes The Bull ?

If Risk Management is priority #1… Is that Opportunity Risk or is that Downside Risk? The threat from the former is historically greater than the latter. ~Seth Golden If you would like to watch this week’s State of the Market video, please click the provided link. Be on the lookout for this weekend’s Research Report.…...

Be Contrary On Discretionary

The Fed’s June announcement of a pause with further rate hikes to come has extended the uncertainty of whether an inverted curve and persistent policy tightening will ultimately lead to a recession. The business cycle is a critical investment issue because the relative returns of many assets depend on the state of the macro economy.…...

Market spotlight: Bull market? 5 signs things could be getting better

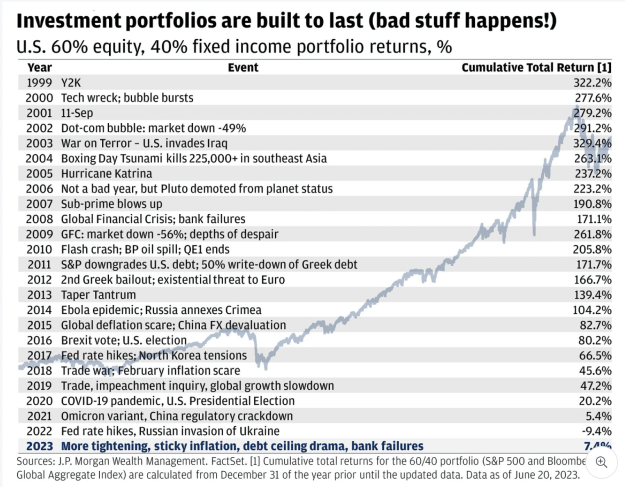

By J.P. Morgan Wealth Management There’s no shortage of worries batting around: the Fed is holding resolute on its call for two more rate hikes, U.S. regional banks still face challenges like the possibility of higher capital requirements, the Bank of England and Norges Bank delivered their own heftier-than-expected 50 basis point hikes this week…...

Merrill Lynch Capital Markets Report For June

Macro Strategy—Equity Market Climbs A “Wall Of Worry” Yet Again: Moderating domestic demand growth, big energy price declines, loosening labor market conditions, and softening wage growth have boosted confidence in a “soft landing” scenario for the U.S. economy, in which the Federal Reserve (Fed) manages to bring both growth and inflation back to moderate, sustainable…...

Weekly State of the Market: Consolidation Arrives

Markets are fundamentally volatile. No way around it. Your problem is not in the math. There is no math to get you out of having to experience uncertainty. ~Ed Seykota If you would like to watch the weekly State of the Market video, please click the provided link. I will be in travels from Friday through…...

The Leuthold Group: Market Odds For The Second Half

With the halfway point of 2023 two weeks away, the S&P 500 has broken out to a 12-month high. The index has accomplished that feat 32 times during the month of June—or exactly one-third of all cases measured back to 1928. Since stock prices are not only anticipatory, but also causal in nature, does the achievement of…...

How much could AI boost US stocks?

As investors debate the merits of generative artificial intelligence, a key question is what it could mean for the stock market. Take Nvidia for example: last month the semiconductor firm said it expects $11 billion of sales in the current quarter — fully 53% above the $7 billion consensus estimate amid AI-inspired demand for its…...

A Good Overbought Posture In Markets

Welcome back investors! In this weekend’s macro-market Research Report, we intend to catch-up on the markets’ year-to-date performance and advance the probabilities for markets going forward. The S&P 500 finished Thursday (6/15) with its highest close in almost 14 months, leading to its fifth consecutive weekly gain, despite Friday’s loss. The index is currently up…...