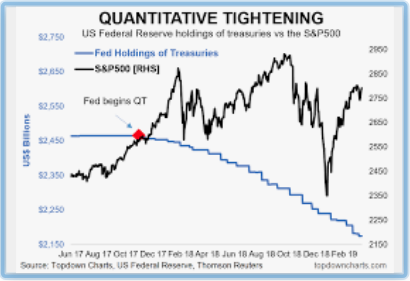

Fed Directed Price Action Drives Bearish Sentiment

In roughly the last 10 trading sessions, the S&P 500 (SPX) and Nasdaq (COMPQ) have lost 10% of their value. That is how quickly the market is derating. The decline has happened ahead of, through, and after the latest FOMC rate announcement. This past week, and after the benchmark index declined nearly -3.5% in the…...