The 2022 Market Challenge

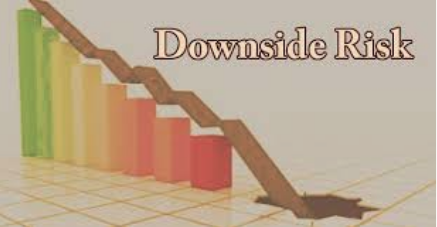

While certain individual stocks demonstrated massive downside moves this past week, the indices managed a consecutive weekly gain. In 2021, investors are witnessing the turbulence of markets that hasn’t really been a focus topic since the pandemic lows in March of 2020. The absence of such market volatility for a protracted period of time, finally…...