Weekly State of the Market: Taper Tantrum Afoot?

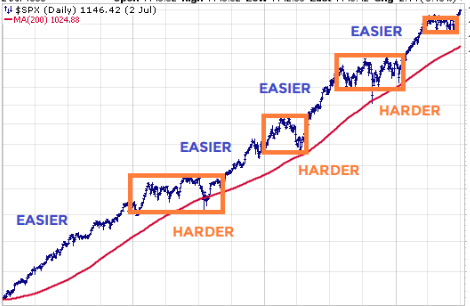

They say the trading hierarchy is 10% Technical analysis, 30% Risk Management and 60% Patience & Emotion management. If you lack patience, and can’t control and recognize your emotions, then you’ll likely find little to any progress with your investing/trading regiments. Technical/Fundamental analysis is the strategy/process and plan to employ. The hardest part is the…...