After 20 years in the retail and consumer goods sector, I became a research analyst and market strategist for Capital Ladder Advisory Group. Since 2011, I have published some 400+ articles surrounding mainstream retailers like Bed Bath & Beyond, Target, Costco and more. I've covered consumer goods corporations such as Apple, Keurig Green Mountain, SodaStream, Skullcandy, Fitbit and more. To date, I've garnered over a hundred media references to my analytics including Forbes. Presently, I am a contracted consultant to many retail and consumer goods companies in North America and manufacturing entities in China and Korea.

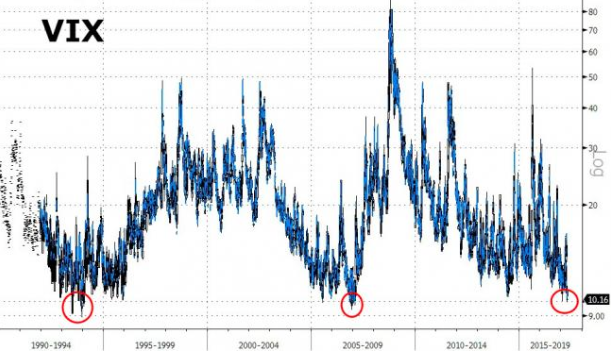

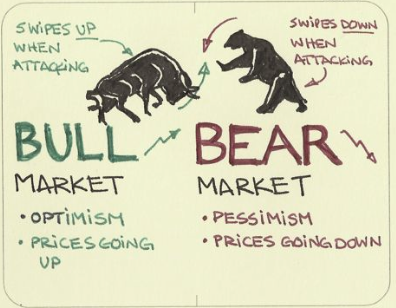

BofA Merrill Lynch 2019 Market Outlook: From Peak to Trough, the Market Unfriends Stocks and Bonds, Likes Volatility, and Swipes Right on Cash CATEGORIES Global Markets Merrill Lynch Print to PDFRSS Feed Showing its age, the long bull market cycle of excess stock and bond returns is expected to finally wind down next year, but…...

So we had a pretty strong rally in the major indices on Monday. By now, everyone is aware that a “trade truce” between China and the U.S. has resulted in the latest market uptick. The media has taken to task the trade truce, describing it as lacking substance and less likely to prove an actual…

https://www.youtube.com/watch?v=ZdmQ1HKs2fE...

After a really poor performance in October, the S&P 500 (SPX) rebounded in November. It may not have seemed like it rebounded given the mid-November retest of the October lows, but ultimately the benchmark index finished higher than where it began on November 1st. The S&P 500 closed November up 1.79% from the previous month…...

After some alarming headlines on the political front forced U.S. equity markets sharply lower for much of the trading day on Thursday, a late afternoon rally found the major averages slightly lower on the day. Ahead of the G-20 Summit, President Trump discussed with reporters the possibility of easing trade tensions with China. Trump had…

Markets rallied hard on Wednesday and in unison with Federal Reserve Chairman Jerome Powell indicating that the FOMC was just below the “neutral rate”. In addition to this statement of great consequence, Powell also indicated that the Fed was looking more closely and willing to align with the economic data. Both of these statements and/or…

I had a conversation with a client in the late evenings recently. Yes, in the late evening and as the selling pressure in the markets persisted last week. The conversation centered on the client’s e-mini Futures positions and the general sentiment for the market going forward. He was a bit confused as to the correlations…

https://www.youtube.com/watch?v=T0pCRO_ATRY...

Everything bounced on Monday on… well there really wasn’t any significant news for which the market could reactively bounce. Sure the UK and EU agreeing on a Brexit format/plan was a positive, but it’s highly unlikely that would cause a greater than 1.5% move higher in the S&P 500 (SPX). No, we simply found some…

In the week that was, we had a rare 2018 example of market inefficiency. For much of the year and at one point for 26 consecutive weeks, the S&P 500 (SPX) managed to close within its weekly expected move. For the trading week that ended November 23rd, the SPX weekly expected move was $47. Keep…...