After 20 years in the retail and consumer goods sector, I became a research analyst and market strategist for Capital Ladder Advisory Group. Since 2011, I have published some 400+ articles surrounding mainstream retailers like Bed Bath & Beyond, Target, Costco and more. I've covered consumer goods corporations such as Apple, Keurig Green Mountain, SodaStream, Skullcandy, Fitbit and more. To date, I've garnered over a hundred media references to my analytics including Forbes. Presently, I am a contracted consultant to many retail and consumer goods companies in North America and manufacturing entities in China and Korea.

There are good reasons that new traders are washed out of the markets within their first 2 years of trading. The first is likely due to a lacking of discipline and dedication to the investing craft. The second reason is a lacking of respect for capital investing and the process surrounding capital investing, well. The…

“The greatest enemy of a good plan is the dream of a perfect plan. Stick to the good plan.” ~ Jack Bogle If you would like to watch this week’s State of the Market, please click the provided link . This weekend we will not be publishing a weekend macro-market Research Report, but will pick…...

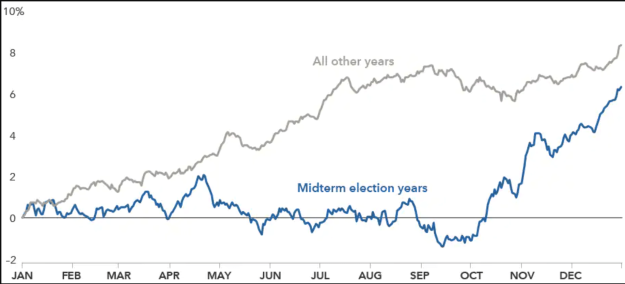

Unfortunately our monthly-cycle, weekend macro-market Research Report will be postponed until Sunday October 30, 2022, due to an unexpected family visit. As we often offer, today’s 3rd party Research is disseminated by Morgan Stanley and the team led by Mike Wilson, chief equity strategist. Last week’s infatuation with CPI/PPI may be a trap for the…...

Research Report Excerpt #1 Year-to-date through Q3 had been the worst start for a 60/40 portfolio since 1974, which was also an inflation and Fed hiking regime. However, as detailed in the Ned Davis Research chart below, following the other 2 drops below -20%, the 60/40 portfolio then evidenced strong gains for the next 2 years. MAXIMUM…

I’ll be flying solo for this weekend’s Research Report, as Edward is off this weekend. So forgive any shortcomings in spelling and grammar, kindly. With that being said, welcome back, even if the markets are not altogether welcoming in 2022. It’s a bear market that is sparing no investor, no portfolio, and approaching levels not…...

Everything you need to know about what separates the big winners from everyone else. “Signals” are sexy, exciting and mysterious. “Learning” is hard work. Same as it ever was. ~Jay Kapeal If you would like to watch the weekly State of the Market video, please click the provided link . Have a great trading week…...

Research Report Excerpt #1 The average duration of a bear market is 446 days (calendar days). The average duration of a bull market is 2,069 days. The average bear market return is -38.4% while the average bull market return is +209 percent. I’m of the belief that the savvy investor should be willing and able to choose in favor of bullish outcomes,…

Welcome back Finom Group members! As we kick-off the monthly reporting cycle, we are recognizing gains for the first week of the 4th quarter of 2022. We are also recognizing that it doesn’t truly feel that way for most investors, given how the trading week ended with a steep sell-off on Friday. Bear market rallies…...

Hardest thing for most traders/investors to do is to pull the trigger and execute the trade. They put risk management ahead of risk taking, even though logic dictates there is no risk to manage absent risk taking. It simply sounds smart to speak of risk management. and diversification, while the greatest returns come from concentrated…...

The investing landscape couldn’t be any better for investors than it has proven to be in 2022. Now, before you stop reading for fear of lunacy of the author, let me explain. One of the foremost principles of investing is to “buy low and sell high”. In other words, value is the friend of the…