After 20 years in the retail and consumer goods sector, I became a research analyst and market strategist for Capital Ladder Advisory Group. Since 2011, I have published some 400+ articles surrounding mainstream retailers like Bed Bath & Beyond, Target, Costco and more. I've covered consumer goods corporations such as Apple, Keurig Green Mountain, SodaStream, Skullcandy, Fitbit and more. To date, I've garnered over a hundred media references to my analytics including Forbes. Presently, I am a contracted consultant to many retail and consumer goods companies in North America and manufacturing entities in China and Korea.

With the S&P 500 up more than 20% YTD, alpha has been harder to generate this year. Having the right narrative has helped. We see the mid cycle transition ending with a 10%+ correction either by fire or ice which will determine the right leadership. Own Defensives, Financials & Consumer Services. Strong index and big…...

Research Report Excerpt #1 In the above chart, daily data since July 1, 1979 through August 20, 2021 for the Russell 2000 index of smaller companies are divided by the Russell 1000 index of largest companies, and then compressed into a single year to show an idealized yearly pattern. When the graph is descending, large-cap…

Welcome back investors! One week every quarter, Finom Group offers its weekly Research Report freely to the public. This is that week, and hopefully newcomers will discover a wealth of analysis, insights and information that they can utilize to improve upon their journey through the markets. So let’s kick-off this week’s reporting with a quote…

“It’s easier to know what’s going to happen than when it’s going to happen” ~ Dan Rasmussen “Stop focusing on the when, focus on what you know, and plan for the inevitable” ~ Seth Marcus Golden To review the weekly State of the Market video, please click the following link. The risks identified to the…...

Disappointing retail sales and consumer sentiment suggest the US consumer is fading. Most blame Delta but we think this is more about a payback in demand. We reiterate our defensive tilt and remain underweight discretionary and most cyclical sectors. Inventories not as low as consensus believes. Is the US consumer fading? Never bet against the…...

Research Report Excerpt #1 In a down week for all major indices, it’s clear that what worked was defensive in nature and what didn’t work for investors was cyclical in nature. This weekly performance comes on the heels of the latest University of Michigan consumer sentiment report (released Friday August 13), which was rather abysmal,…

That was some wild monthly Options Expiration week; was it not? While the S&P 500 (SPX) fell .60% on the week, it threatened a great deal more than that by mid-week. The trend has not proven friendly for monthly Options Expiration week, but the long-term trend for the benchmark index proved its strength once again…...

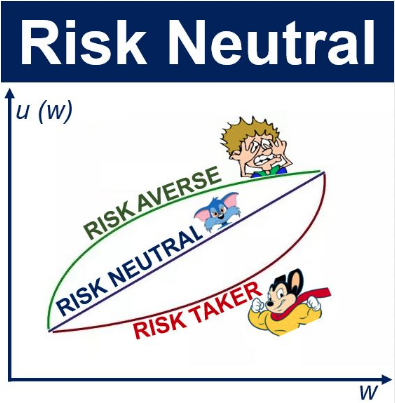

They say the trading hierarchy is 10% Technical analysis, 30% Risk Management and 60% Patience & Emotion management. If you lack patience, and can’t control and recognize your emotions, then you’ll likely find little to any progress with your investing/trading regiments. Technical/Fundamental analysis is the strategy/process and plan to employ. The hardest part is the…...

Following very strong 1H earnings, we raise our forecasts that leave us above consensus on 2021 but below on 2022 due to lower margins and higher taxes. With our view for further derating, our S&P targets remain largely unchanged. We also take a deep dive on what companies are currently saying. Marking to market on…...

Research Report Excerpt #1 Seriously, investing/trading is hard. Nothing worth doing well is easy, and if it’s something we really enjoy or desire to master/perfect we tend to make it more difficult, given the passion we employ for the activity. So just know these factoids of life apply for investors just the same. All good…