After 20 years in the retail and consumer goods sector, I became a research analyst and market strategist for Capital Ladder Advisory Group. Since 2011, I have published some 400+ articles surrounding mainstream retailers like Bed Bath & Beyond, Target, Costco and more. I've covered consumer goods corporations such as Apple, Keurig Green Mountain, SodaStream, Skullcandy, Fitbit and more. To date, I've garnered over a hundred media references to my analytics including Forbes. Presently, I am a contracted consultant to many retail and consumer goods companies in North America and manufacturing entities in China and Korea.

The following works come directly from the St. Louis Federal Reserve website of Research Reports and authored by Board of Governors and the St. Louis Federal Reserve members. For the original works and corresponding Glossary, please utilize the positioned link. If you have ever wondered how the Fed’s monetary policies work, this Report will aid…

Welcome to another trading week!! In appreciation of all of our Basic Membership level participants and daily readers of finomgroup.com content, we offer the following excerpts from our Weekly Research Report. Our weekly Report is extremely detailed and has proven to help guide investors and traders during all types of market conditions with thoughtful insights and analysis, graphs,…

We’ve made it through another topsy-turvy week in the equity markets relatively unscathed. There was a good deal of sideways action this past week, but all major averages still managed to add gains to their YTD performance. The S&P 500 (SPX) gained .64% for the week, while touching just above the former closing high back…...

Welcome to this week’s State of the Markets with Wayne Nelson and Seth Golden. Please click the following link to review the SOTM video. In this week’s episode, we discuss the path traveled by the markets and since the March bottoms. It has always proven a useful and helpful exercise to review the past for optimizing one’s trading and investing strategies. We can’t…...

After another green day on Monday, with S&P 500 (SPX) finishing the day that much closer to a record closing high and the Russell 2000 (RUT – small caps) leading markets higher, stocks were poised to achieve record levels on Tuesday. All but the Nasdaq (COMPQ) had been rallying heading into Tuesday’s trading session and…

IN THIS ISSUE • Macro Strategy—Housing activity and prices are currently picking up, supported by a convergence of cyclical, structural and behavioral forces. This is a positive backdrop for housing-related stocks and will support the recovery in the overall business cycle.• Global Market View—Equities have remained resilient in the face of rising virus cases with…...

Welcome to another trading week!! In appreciation of all of our Basic Membership level participants and daily readers of finomgroup.com content, we offer the following excerpts from our Weekly Research Report. Our weekly Report is extremely detailed and has proven to help guide investors and traders during all types of market conditions with thoughtful insights and analysis, graphs,…

If the S&P 500 (SPX) chose to chide the permabears and even poke those in hibernation, it might do so by taking a line from the Spaceballs movie when Lord Helmet offers, “fooled you“, during his comedic battle with Lonestar. The S&P 500 is now up 3.75% for the year and sits 1% from the…...

Welcome to this week’s State of the Markets with Wayne Nelson and Seth Golden. Please click the following link to review the SOTM video. In this week’s episode, we discuss the continuation of the new, bull market with various overbought conditions and with key economic data ahead. Additionally, we recognize historic studies that still suggest new highs are ahead for the S&P 500,…...

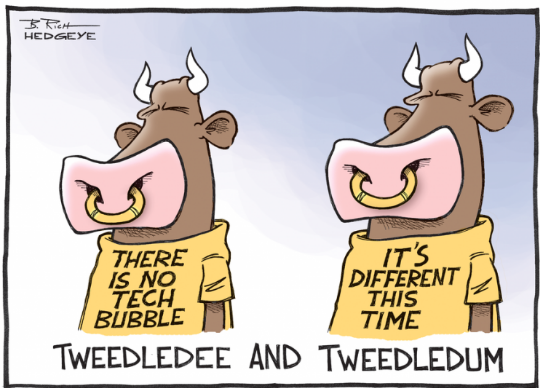

Another day on Wall Street meant another day of equity market gains, while Bonds also continue to rally and with yields moving ever-lower. It seems a paradox and concerning to many, but as Quantitative Easing manipulates the otherwise normal correlation between stocks and bonds, a new normal may be developing. I hesitate to herald such…