State of the Market: Where S&P 500 Rally Meets Displacement of Risk

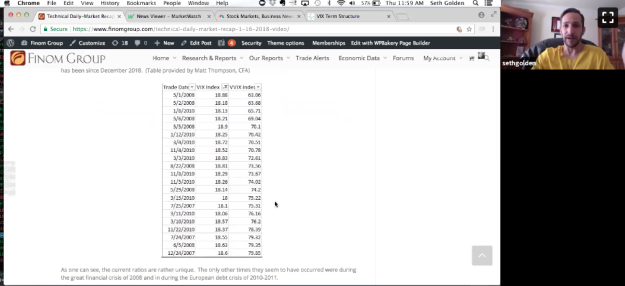

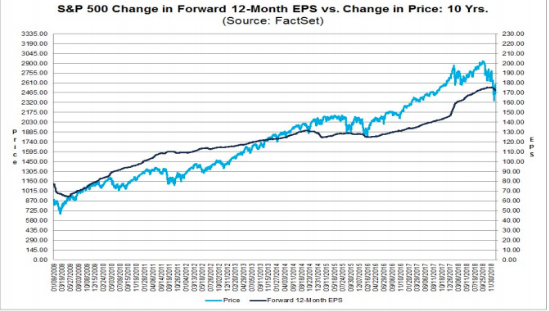

Welcome to the State of the Market video presentation with Wayne and Seth. Please click on the link to review the video. The video discussion on the markets and market volatility is 65 minutes. Outline: Market volatility, VIX Futures expiration, shorting volatility, backwardation (opening dialogue) 5% contango rule (5 minutes in) Realized market volatility vs.…