After 20 years in the retail and consumer goods sector, I became a research analyst and market strategist for Capital Ladder Advisory Group. Since 2011, I have published some 400+ articles surrounding mainstream retailers like Bed Bath & Beyond, Target, Costco and more. I've covered consumer goods corporations such as Apple, Keurig Green Mountain, SodaStream, Skullcandy, Fitbit and more. To date, I've garnered over a hundred media references to my analytics including Forbes. Presently, I am a contracted consultant to many retail and consumer goods companies in North America and manufacturing entities in China and Korea.

By Alexander Osipovich March 5, 2020 6:00 am ET Trading conditions have sharply deteriorated in a popular vehicle for betting on swings in the S&P 500, exacerbating the volatility in the stock market in the past two weeks. E-mini S&P 500 futures play a huge, if little understood, role in financial markets, with hundreds of…

Welcome to this week’s State of the Markets with Wayne Nelson and Seth Golden. Please click the following link to review the SOTM video. The coronavirus, has taken equity and bond markets by storm and while both rose in previous weeks, only bonds are rising since last week and now found with yields at record low levels and wildly volatile equity…...

After investor optimism that supported the largest 1-Day rise in the Dow Jones Industrial Average (DJIA) on Monday and with all major averages rallying sharply, “turn around Tuesday” took on a new form. While the major averages didn’t lose everything they recaptured on Monday, they were all lower by nearly 3% in the trading session.…

It’s never advisable to short the market when it’s known that central banks are likely to respond to perceived exogenous economic shocks. Friday’s S&P 500 lows are a perfect example of such inadvisable action, with the low of the trading session and seemingly trough in recent correction at 2,855 and a close roughly 100 points…

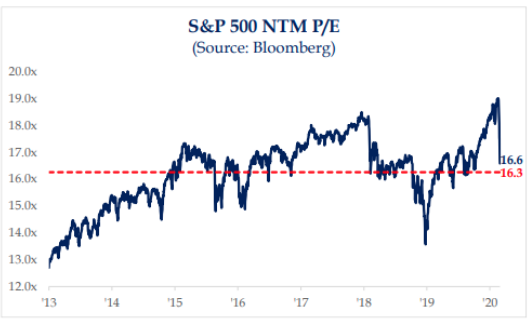

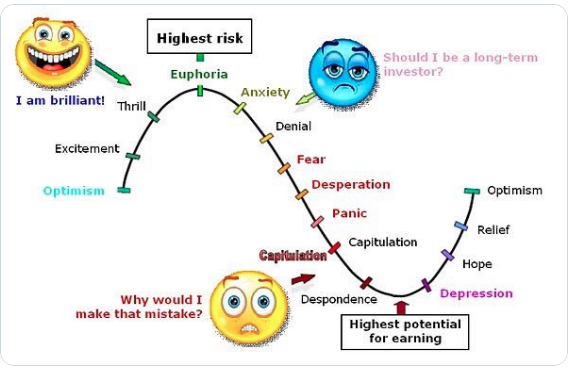

The S&P 500 (SPX) closed a volatile, ugly week with a major correction and it’s largest since Q4 2018. The index is down 11.5% from last Friday, and down 8.56% year-to-date. It was a record setting decline/correction that unfolded and found many traders/investors abandoning equity exposure in favor of cash as the correction deepened. This…...

This article first appeared in the Wall Street Journal Updated Feb. 28, 2020 5:11 pm ET The coronavirus has sent markets tumbling, as its ramifications to a swath of businesses and industries becomes more apparent. Companies that make and sell products are struggling to secure supply lines as business disruptions ricochet far beyond China. They are…

Welcome to this week’s State of the Markets with Wayne Nelson and Seth Golden. Please click the following link to review the SOTM video. The bulls are being tested and with the fastest 10% pullback in history. All 3 major moving averages have been breached and found with great volumes in the S&P 500 over the course of the week. The…...

Falls in equity prices and bond yields so far this week reflect fears that coronavirus cases outside China will mark the start of a wider outbreak that deals a blow to the world economy. For now, we envisage a moderate hit to global GDP growth of 0.5ppts this year, due almost entirely to the impact…

Twas another rough day on Wall Street as U.S. indices fell by another 3%+ and as coronavirus fears spread. In the early morning hours, futures were pointed to a higher open for the day and Finom Group urged traders not to trust the early indications, as we’ve seen this movie play out many times before…

Monday was one of those days that test the resolve of many traders/investors. The major averages fell by roughly 3.5% or worse, with the S&P 500 (SPX) tumbling some 3.35% on the day and accelerating losses into the closing bell. Many narratives and headlines produced during the trading day highlighted market losses due to the…