After 20 years in the retail and consumer goods sector, I became a research analyst and market strategist for Capital Ladder Advisory Group. Since 2011, I have published some 400+ articles surrounding mainstream retailers like Bed Bath & Beyond, Target, Costco and more. I've covered consumer goods corporations such as Apple, Keurig Green Mountain, SodaStream, Skullcandy, Fitbit and more. To date, I've garnered over a hundred media references to my analytics including Forbes. Presently, I am a contracted consultant to many retail and consumer goods companies in North America and manufacturing entities in China and Korea.

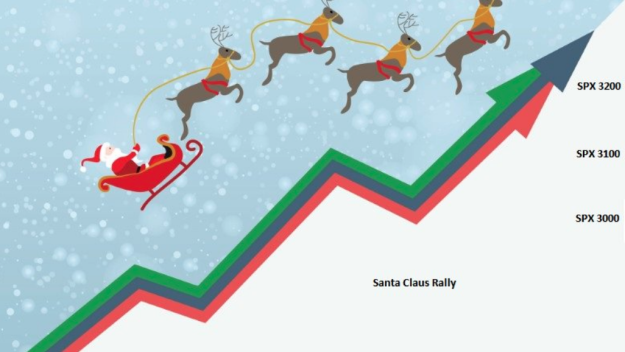

What happens when the threat from the ongoing trade war abates? Naturally, the melt-up ensues. This is not to discount the the surge in the S&P 500 since October, but rather to highlight the seasonal trends that suggest the last couple of weeks in December are usually found with the major averages advancing. The Dow…

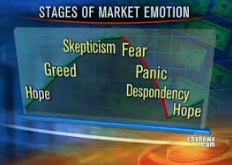

The trading week that was ended in a manner that many may have not anticipated. As we read this week’s Research Report, we can’t help but to recall the setup for the trading week that was found with some anxiety surrounding the December 15 tariffs. Investors had a choice to make at the beginning of…

The trading week that was ended in a manner that many may have not anticipated. As we read this week’s Research Report, we can’t help but to recall the setup for the trading week that was found with some anxiety surrounding the December 15 tariffs. Investors had a choice to make at the beginning of…...

Welcome to this week’s State of the Markets with Wayne Nelson and Seth Golden. Please click the following link to review the SOTM video. This week we discuss the culmination and conclusion of the anticipation surrounding the December 15 tariff deadline and announced U.S./China, phase-1 trade deal. The removal of this market headwind sets the stage for a potential melt-up into…...

MACROECONOMIC OUTLOOK: Our view is that the market turmoil and economic slowdown over the past 18 months is not marking the end of the business cycle, but rather represents a reset similar to crises that occurred every 3 years after 2008 (2011/2012, 2015/2016, and 2018/2019). In 2020, the global economy is expected to grow at…...

U.S. options skew on the S&P 500 has been rising recently, and a recent close of 136.6 is actually higher than at any point during last December’s stock meltdown. A refresher on what skew measures: Imagine a $100 stock that has put and call options that expire in 1 year with strike prices of $50 (for…

Markets got off to a rough start in the pre-market trading hours on Tuesday and after a down day Monday. But then headlines surfaced that pointed to delaying the December 15th tariffs. U.S. and Chinese trade negotiators were said to be laying the groundwork for a delay of tariffs set to kick in on Dec.…

U.S. equity markets are in distribution and/or de-risk mode ahead of the December 15th tariff deadline. While the financial news media outlets march out various opinions and forward-looking analysis for the markets and economy given this critical trade issue, investors have taken to de-risking their respective portfolios… just in case. On Monday, investors began adding…

The S&P 500 (SPX) has been on a wild ride this past trading week and it remains a guesstimate as to how investors will anticipate a trading week that ends ahead of a potential binary market driver. As we discuss the potential market and economic driving forces in this week’s Research Report, we encourage investors/traders…...

Welcome to this week’s State of the Markets with Wayne Nelson and Seth Golden. Please click the following link to review the SOTM video. This week we discuss the upcoming risks to the coming trading week, which will complete ahead of the December 15th tariff deadline/announcement. Employment data surprised strongly and with upward revisions to previous months, setting off a market…