After Monday’s bounce back in the major averages, Tuesday served to turn up the heat on the bears as investors sought to recoup that which had been lost and then some. At it’s peak on Tuesday, the Dow had been up more than 500 points, and when combined with the gains from Monday, surpassed the 600 point loss from the previous Friday. Not to be discounted, at it’s peak on Tuesday, the S&P 500 rose back above 3,305 before finishing the day up more than 1.5 percent and more than 18 points above the 20-DMA which had served as resistance.

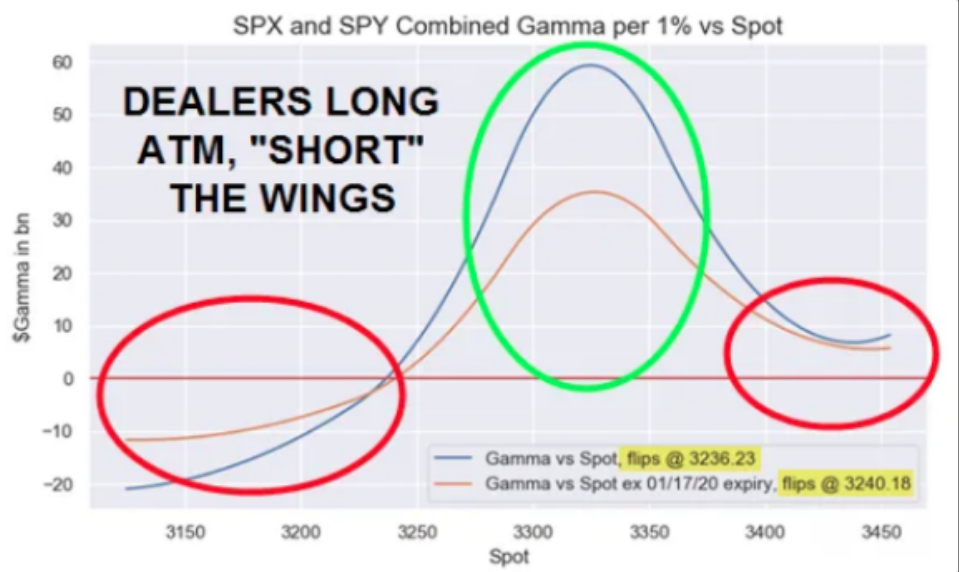

While it may have seemed an unlikely 2-day rally on Wall Street, in and of itself, the rally served as another reminder why gamma zones are an irrelevant guide to capital allocation and forecasting for market outcomes.

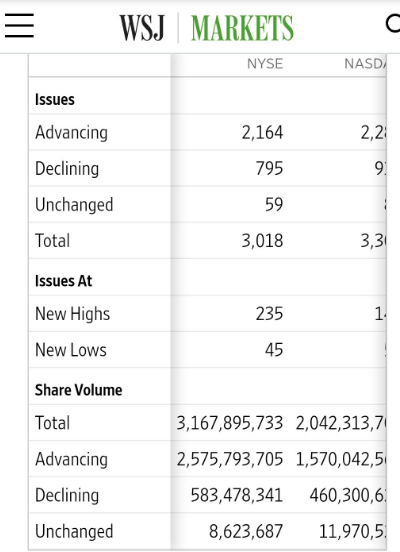

Where one would have expected dealer hedging programs to accelerate after the 3,250 gamma zone flip, supplying even greater pressure on the S&P 500, that may have proven the added fuel for the 2-day rally. Tuesday’s market rally was even stronger and indiscriminate as it pertains to breadth. When reviewing advancers to decliners, it was clear to see that much of the rally had to come from short covering activity.

Some 85% of volume came from advancing stocks, suggesting the rally was a “buy it all” rally, typically found with exogenous short covering. CNBC’s Jim Cramer weighed in on the subject of a short covering rally after the market’s close Tuesday with the following commentary:

“So much of today’s rally took place on the backs of hedge funds who were poorly positioned going into the sell-off on Friday. So they overcompensated by shorting anything related to the coronavirus right into the teeth of the downturn.

Instead we only really had sellers of the S&P [500] futures and they stopped once we got a sense that the Chinese have gotten the situation … under control. It looks like China will be back to work next week, and that’s huge.

When the longs, the current shareholders, saw the news, they didn’t freak out like the short sellers needed,” he said. “Many of those owners … are index funds, and they never sell anyway. Others probably think the worst is over.”

Either way, it’s extraordinary that something bad happened to these Macao gambling names and there was a shortage of major sellers

The shorts will keep getting squeezed until some natural sellers finally surface, but so far, that has not happened.

Short sellers have certainly taken it on the chin the last couple of trading days, but if they’re looking for anybody to blame, they would likely be able to find it everywhere. Here’s a question to ask oneself at this very point in time: “Do you even remember that the U.S. and Iran had a flare-up that resulted in a tit-for-tat exchange about a month ago, something that led to the killing of THE TOP military general of Iran?” If the answer to that question is NO, it’s likely due to the media’s never-ending quest for the next fear-driven narrative. That next narrative came in the form of the latest coronavirus, which served to brush the U.S.-Iran conflict off the front page of the news, fading into the background. Once the coronavirus broke onto the scene, media headlines acted in order to hyperbolize the viral outbreak, which simultaneously gave frothy markets an excuse to retreat and work off overbought conditions and trim extreme sentiment.

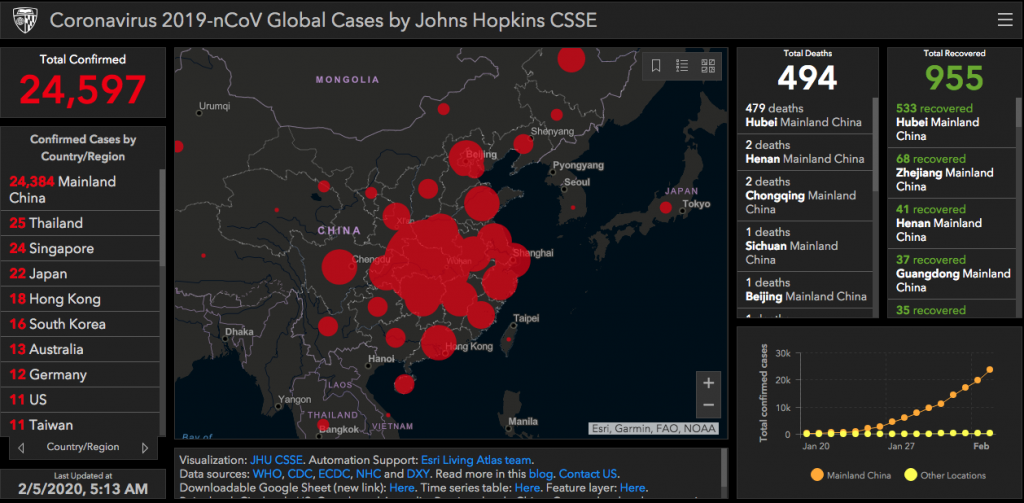

For those short-sellers whom pressed their bets against the market, they’ve been forced to succumb to the likelihood that the virus will eventually be found for containment, and even a treatment. As the virus continues to spread at a greater rate than its predecessors, the mortality rate continues to decline while the recovery rate continues to rise. The virus has proven more communicable, but less lethal than that of SARS from the 2002-2004 period.

And all of that brings us to the latest headlines that, indeed, suggests a treatment for the virus has been established.

“The research team of Li Lanjuan, one of China’s leading scientists in the fight against the novel coronavirus, announced a major breakthrough on Tuesday, China’s Changjiang daily reported.

Preliminary tests showed that two drugs – Abidol and Darunavir – can effectively inhibit the virus in vitro cell experiments, according to Li, who is also a professor at Zhejiang University.

She has brought medical personnel from east China’s Zhejiang Province to central China’s Hubei Province, hoping to enhance the emergency treatment of newly-infected patients.”

With the headlines pointing to a potential treatment breaking Wednesday morning, U.S. equity futures are in rally mode once again. The S&P 500 looks to open about 10 points below its all-time high of 3,337.77 on Wednesday and ahead of the January ADP private sector payroll report. The former 3%, peak-to-trough, pullback in the S&P 500 seems like a world away given what appears to be a severe walk back up in just 3 short trading sessions. Having said that, Wednesday has a lot of trading time left in the day!

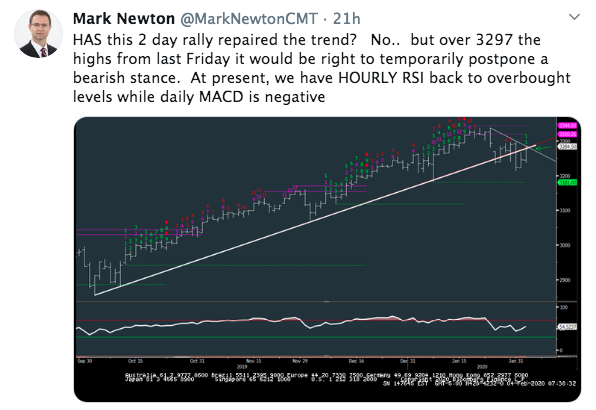

Given the snapback rally that is seemingly continuing into Wednesday and post the Iowa Primary debacle that has also been pushed off the front page of media headlines, it’s safe to say that we are quickly getting into overbought territory once again. Mark Newton of Newton Advisors recognized such conditions that would also be pared with increasing bullish sentiment.

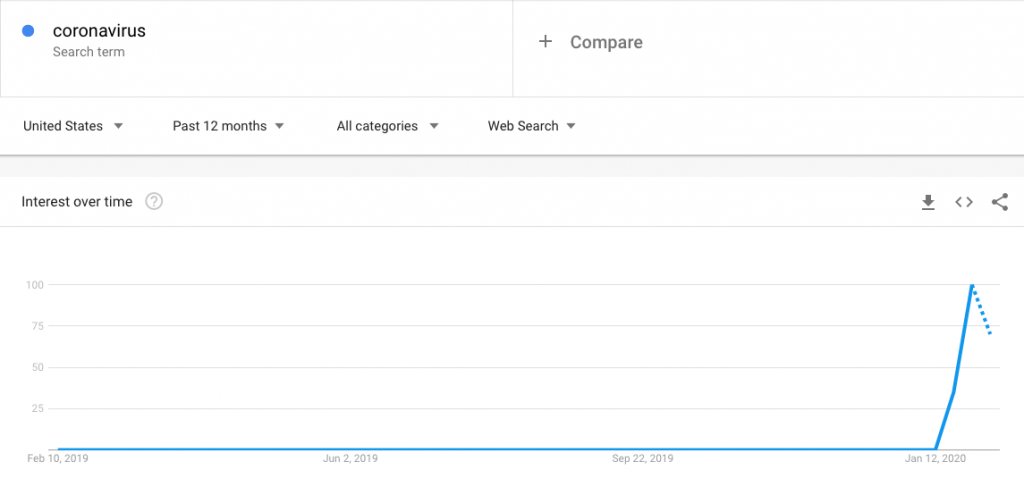

In the Finom Group Trading Room Tuesday, we stated that should the S&P 500 close above the 20-DMA, the bulls would likely be back in charge of markets. It would appear as though that is the case once again with the latest coronavirus headlines pointing to a treatment and risk appetite steadily improving. With a treatment in the works, the question investors might be asking themselves now is whether or not we’ve seen the peak in the coronavirus fears. (Google trends search for key word coronavirus below)

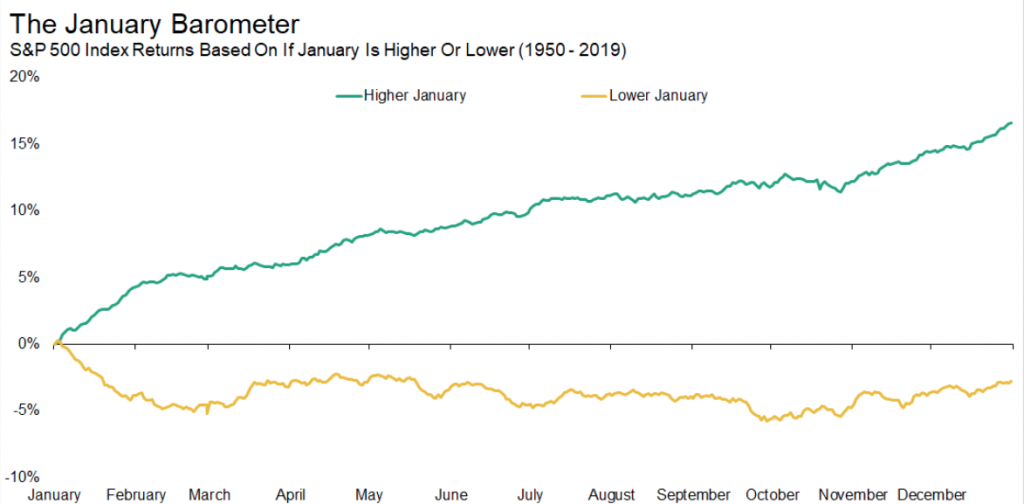

Again, it seems as though investors are easily able to disregard that while the S&P 500 rose throughout most of January, the pullback in the final week actually found the index in the red for the month. So here’s what happens during the year when the S&P 500 is higher in January versus lower in January. 2020 didn’t fall in January by much, but it was negative.

That’s a whole lot of nothing, unfortunately, but history doesn’t always repeat itself and it certainly didn’t in 2018 which had a very strong January market return despite ending the year lower. An election year carries with it greater optimism than the failed January barometer of 2018 as well.

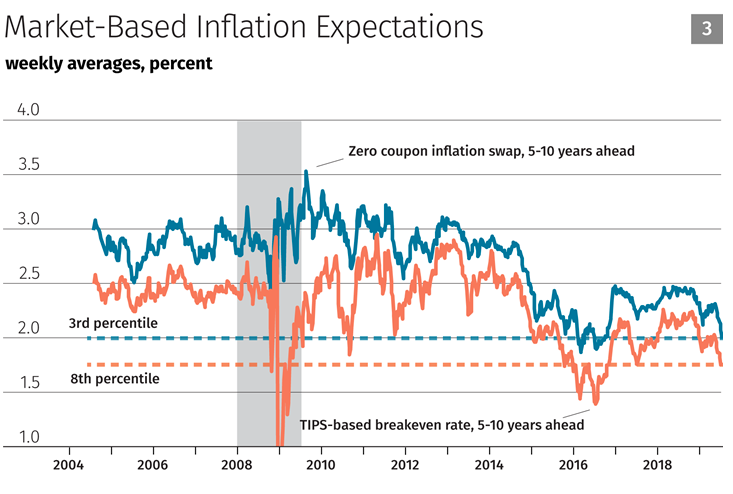

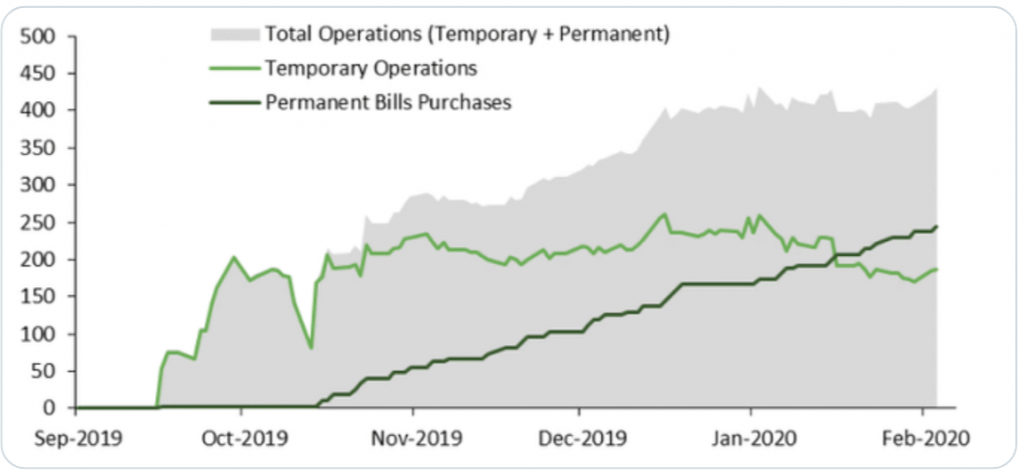

While we can rationally deduce the latest headlines as proving supportive of the snapback rally, we’ll likely hear permabears continue to rant and rave about Fed-induced liquidity boosting risk assets. I think we would have to admit that the previous 2-day rally was a bit irrational absent the latest coronavirus headline that pointed to a treatment. Nonetheless, the reality is that the last couple of days, Fed repo operations have picked up. But overall, total cash injections have been roughly flat for a while. Fed liquidity has stopped incrementally supporting equities the past month and a half, as shown in the chart below:

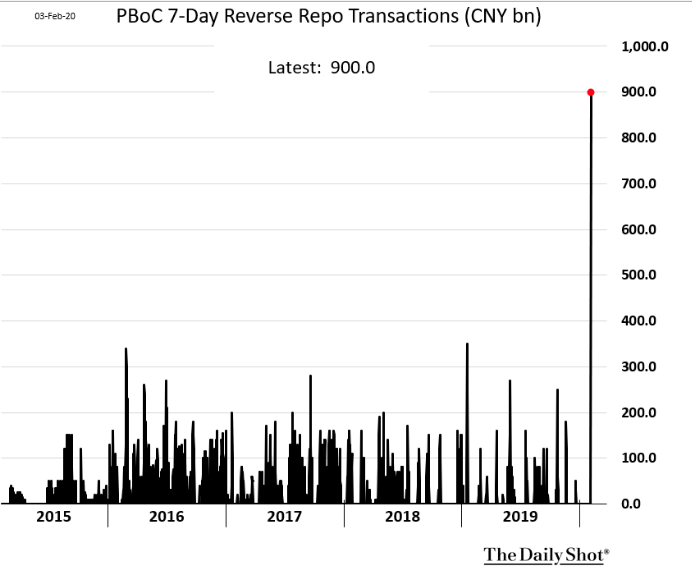

It’s painfully clear that the permanent bill purchases have been rising steadily since late October 2019, but in 2020, temporary operations (REPO activity) have meaningfully slowed and even fell through January. Facts are facts folks! But there are more facts… Just because the FOMC has tapered their purchases, doesn’t mean the PBOC has. Since the reopening of Chinese markets, the PBOC has engaged it’s markets with massive liquidity as shown in the following chart. Liquidity measures beget improved risk appetite.

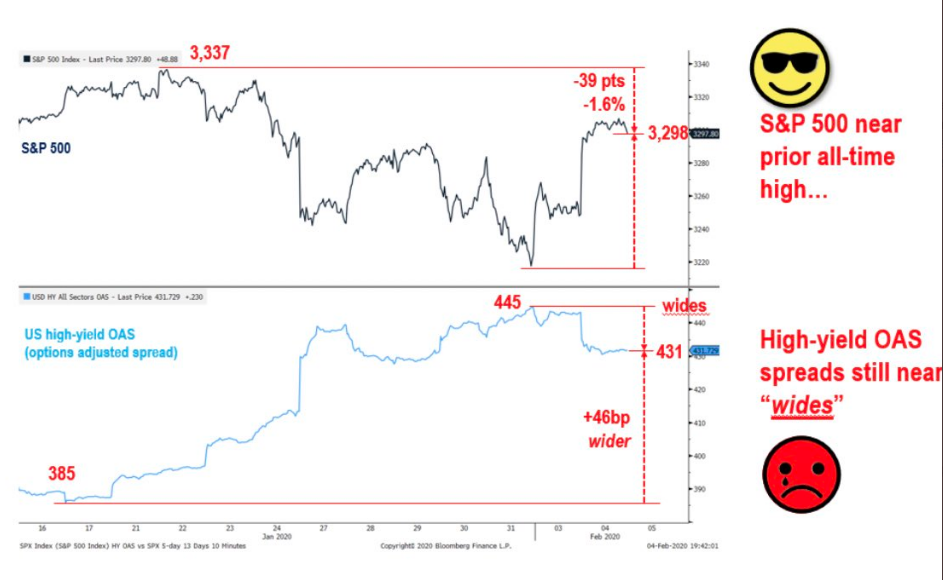

While we had previously been of the opinion that the market would continue to fall and, at least, touch the 50-DMA before bouncing, the headlines have proven most who desired a pullback wrong. We’re happily finding markets proving out long-term breadth and equity exposure positioning beneficial in terms of historic data/statistics. And it is with the rapid move back toward all-time highs on the S&P 500, other analysts and strategists that have been heralding a pullback are found reassessing their views on such a pullback.

FUNDSTRAT: “Given the equity rebound, “our conviction about a deeper correction has narrowed by a meaningful margin –> ala, let’s say we saw a >60% chance of 3,150, we are now still >50% chance of 3,150” — thanks, in part, to stubborn high-yield spreads.”

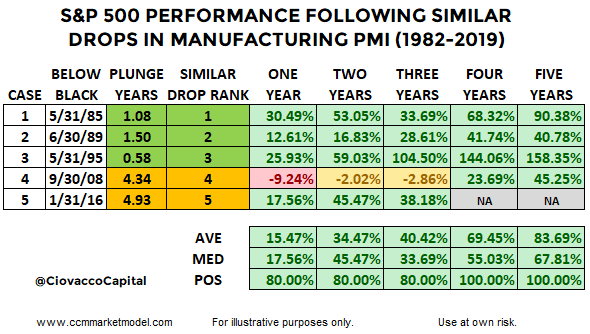

Here is some of that really strong historical data mentioned previously. The ISM data suggests we can disregard the January barometer, although history doesn’t guarantee it. Given the ISM Manufacturing Index was strong in August 2018 and plunged to the October 1, 2019 level, it might be helpful to know how many similar drops from above the blue line to below the black line have occurred since 1982 and how did the stock market perform over the next five years? The answer to the first question is five previous times (see chart below from Chris Ciovacco).

So how did the stock market perform over the next five years? In the first two years, 80% of the cases posted positive returns. All historical cases (1982-2019) posted gains after four and five years.

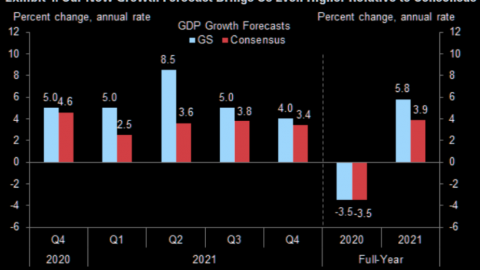

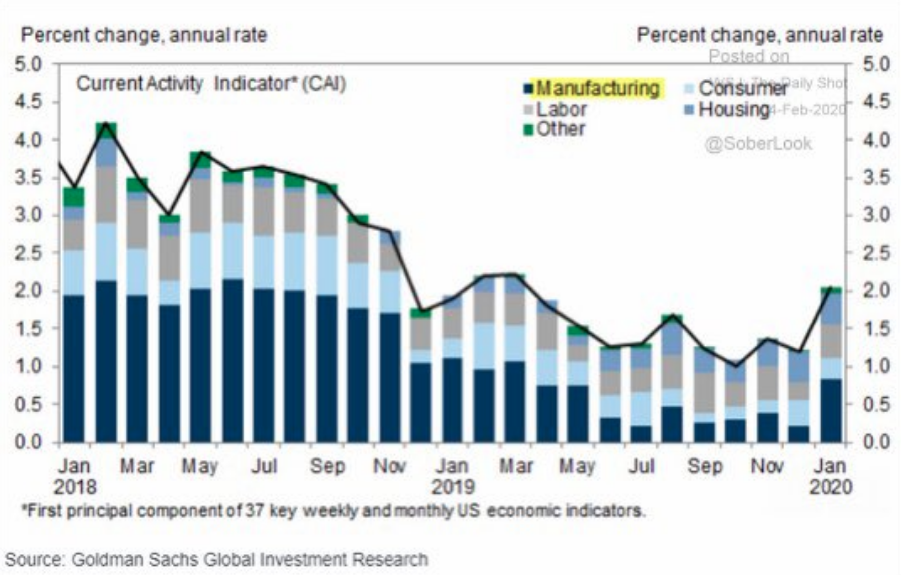

The historic data suggests we should keep an open mind about future returns and/or market performance given the strength OR weakness of the economy. Manufacturing has remained week since late-2019, but the most recent ISM manufacturing index reading (50.9) gave investors reason to believe the worst of the manufacturing recession may be in the rear view mirror. Having said that, the economic impact from the coronavirus carries with it an unknown impact to-date. Nonetheless, outside of manufacturing we’ve seen a steady uptick in global growth as indicated in the Current Activity Indicator from Goldman Sachs”

GOLDMAN: “Coronavirus “doesn’t change our baseline view that underlying global growth has bottomed and the next leg is likely to be higher.”

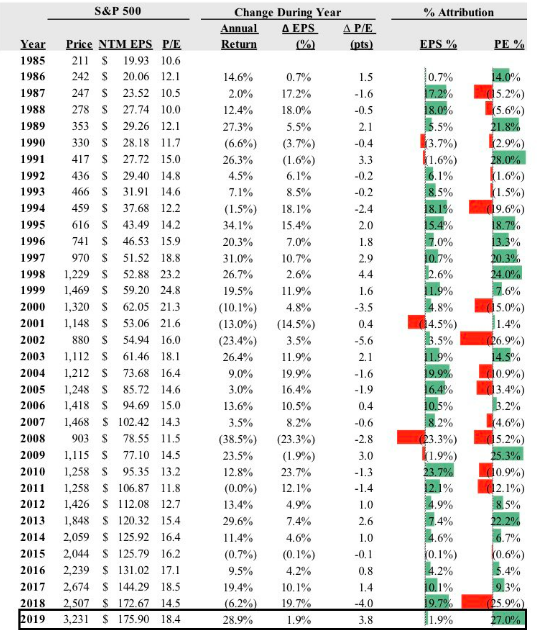

Given the recent rally in stocks, accelerating into Wednesday’s trading session, do we simply dismiss valuations which have become stretched once again? We think the best way to answer this question is to recognize that valuation doesn’t always drive markets, look at shares of Tesla (TSLA). Nonetheless history does suggest that the higher the valuation, the more muted returns become. Here’s a chart of 35 years of SPY price returns broken down by earnings and P/Es . Of course, seeing how 2019 will be found with flat earnings, it will likely prove a year whereby the majority of S&P 500 gains came from multiple expansion. (table from Michael Kantrowitz)

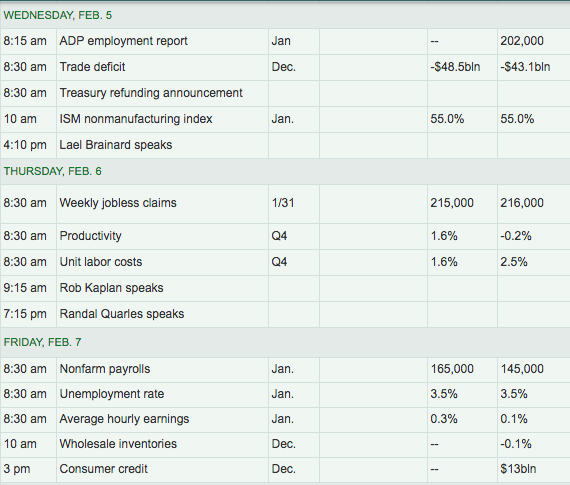

In closing out our daily market dispatch article for Wednesday, we look forward to the ADP private sector payroll report and the latest service sector data out of the ISM. Of course, later this week investors will get to see the BLS Nonfarm Payroll report. Current estimates from economists suggests that 165,000 jobs were created in the month of January. That forecast will likely be revised after the release of the ADP payroll report Wednesday.

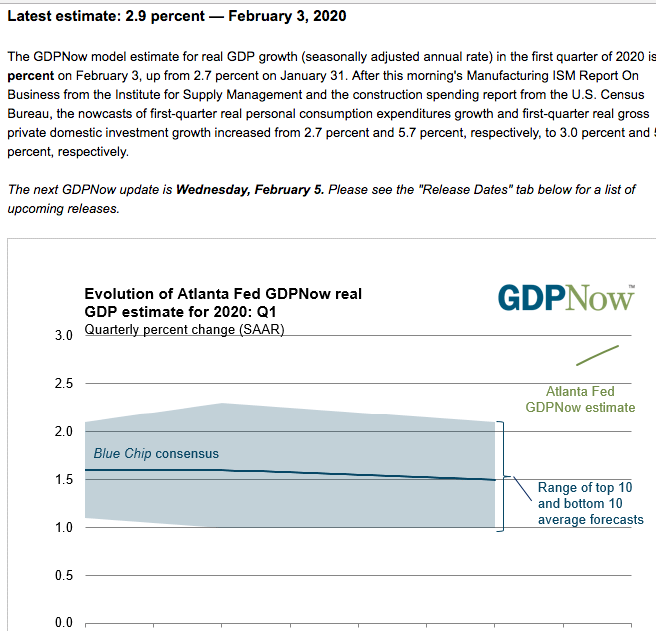

Accompanying today’s economic data will be an update from the Atlanta Fed GDPNow forecast/tracker. With a better than expected result from the January ISM manufacturing index, the Atlanta Fed’s GDPNow forecast for Q1 2020 came in at 2.9 percent.

Markets are bouncing higher on positive headlines surrounding a treatment for the latest coronavirus ahead of China’s business and transportation sectors scheduled to reopen at midnight February 9th. Finom Group had been discussing the likely announcement of a treatment in the near-term and now it has arrived. There’s still work to be done on this front, but we may have moved beyond the climactic point in the coronavirus saga. If the market buy signal occurs when the growth in the number of cases of coronavirus peaks, then there will be a lot of eyeballs & algorithms glued to headlines. We’re already seeing a stampede of buy programs for risk assets & sales of bonds given the headlines. New record highs for the S&P 500 may be just a matter of time and as earnings come in better than expected for the Q4 2019 period.