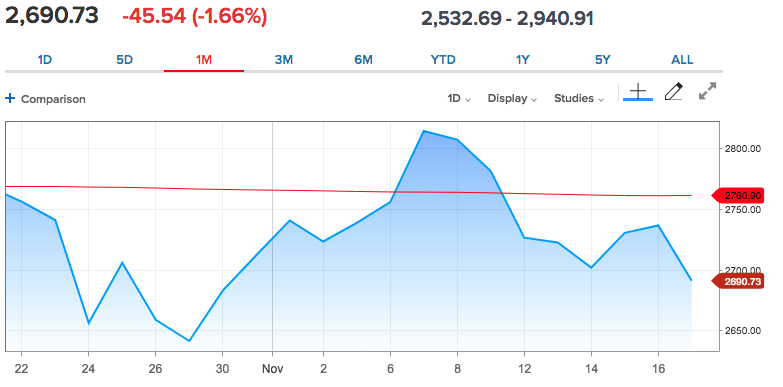

The market is definitively testing the resolve of long-term investors and has been since October you might say. Earnings are rising over 20% for 2018, sales are growing nearly double-digits and profit margins are at all time highs. But…the major averages are on the verge of turning negative for the year and with the Nasdaq (NDX) already resolving its October lows with a newer low as of Monday. As for the S&P 500 (SPX) many investors remain of the opinion that until it retests the October lows, the selling pressure may not subside. If that is indeed what necessitates a rebound for the benchmark index through year’s end, the good news is the SPX only has a couple more percent of downside pressure until it reaches the October lows.

As we noted in our weekend research report, the market had several headwinds yet to be resolved. With those headwinds, the market seemingly demanded resolution before basing and finding greater alignment with the corporate earnings picture. The biggest hurdles for the market are likely well known, but for simple reiteration and reference we encourage readers to refer to our in-depth research reporting. Otherwise…

- U.S./China trade relations and tariffs

- Federal Reserve rate hike path and neutral rate

- Strong USD and/or Crude Oil

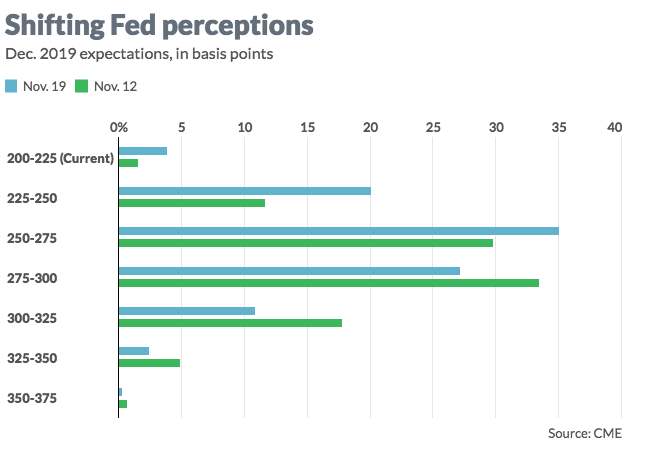

In this weekend’s research report we discussed all 3 of the headwinds bulleted above, as they represent a great obstacle for investors. Last Friday, Fed Vice Chairman Clarida, basically gave investors a great deal of hope that the Fed was much closer to the neutral rate than previously outlined in October by Fed Chairman Jerome Powell.

“As you move in the range of policy that by some estimates is close to neutral, then with the economy doing well it’s appropriate to sort of shift the emphasis toward being more data dependent,” Clarida said during a “Squawk Box” interview, his first public comments since being confirmed in September.”

The market had been demanding that the Fed become more data dependent and less automatic with its rate hikes. Between Powell’s Q&A session in Dallas on Thursday of last week and Clarida’s interview on CNBC Friday, the Fed all but stated they will hike in December and pause thereafter. This is a net positive sentiment for the market, even if not yet represented in the marketplace. The bottom line is that many investors and analysts alike believe the Fed has finally “blinked”.

Put another way, the weighted average of interest rate forecasts for the end of 2019 has dropped by about 10 basis points.

“The markets have decided that Chairman Powell defiantly blinked,” said Steven Ricchiuto, U.S. chief economist for Mizuho Securities USA.

The second key issue for the markets to resolve surrounds U.S./China trade relations and also on Friday, President Trump offered investors a more positive sentiment on the subject.

“China wants to make a deal,” Trump said, adding that China had recently sent a list of trade items the nation is open to compromise on.

“Large list,” Trump noted.”

Trump’s comments sent the Dow to its high of the day, briefly trading more than 200 points higher at session highs. But White House officials immediately after Trump’s remarks told CNBC that people should not read too much into those claims, because there is no sign of a deal coming soon. Trump continues to keep the world on the edge of its seat as the trade war escalated through the summer months and the prospects for increased tariffs weigh heavily on corporate profits and investors’ outlook for equity returns in 2019. Most analysts are still of the opinion a deal will get done or further tariff implementations will be placed on hold and in favor of ongoing talks/negotiations.

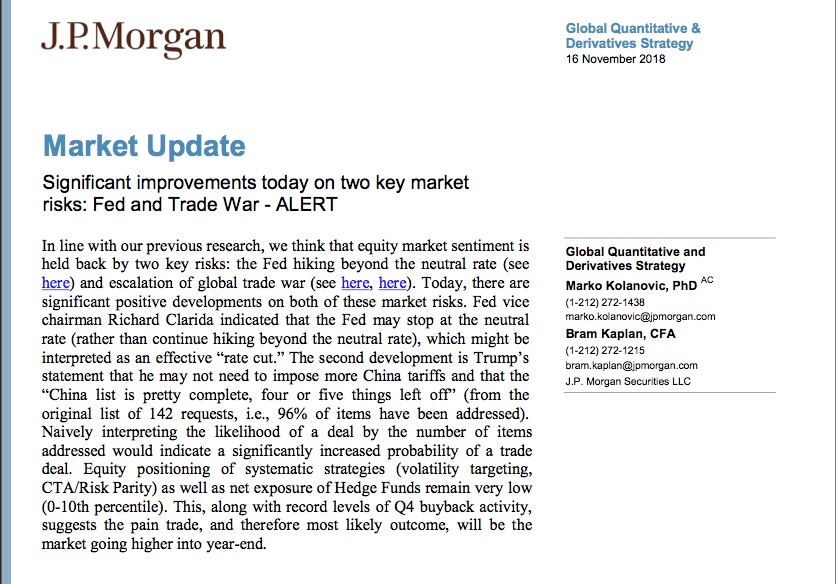

Shortly after Friday’s headlines on rate hikes and trade relations, J.P. Morgan’s quant-analytics team, led by Marco Kolanovic offered the following notes to clients.

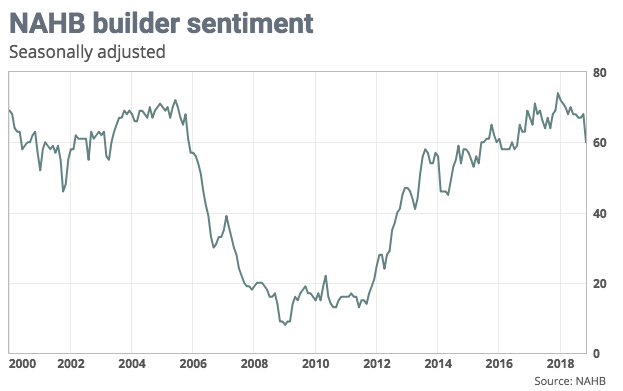

As one can see from the notes, Kolanovic believes as Finom Group and other analysts believe; Friday’s developments on the Fed and trade are net positives as they directly address major headwinds for the market. The Fed is being guided by certain of the global economic data and the latest downturn in the U.S. housing sector, which has been hit by rising rates, low inventory levels and higher median average home prices. The latest data out of the housing sector on Monday served to underscore the prevailing sentiment in the housing sector.

The National Association of Home Builders’ monthly confidence index plunged eight points to 60 in November. Labor is still expensive, lots are still scarce, lumber is at the mercy of tariff politics, and now, mortgage rates are rising and customers are holding back.

NAHB, the building industry’s Washington lobby, noted in a press release that the reading of 60 is still “positive,” but that “customers are taking a pause.” The eight-point plunge is only reminiscent of the nine-point drop just after the 9/11 attacks and one other instance, a 10-point drop, in early 2014. The overall reading is the lowest since mid-2016. November’s results badly missed the Econoday consensus of a flat reading.

“Housing is performing at a moderately high level, but it also appears to be settling into a plateau,” Jefferies economists wrote after the NAHB release. “Moderation in housing activity is a blessing that delays what has previously been an inevitable development of excesses. While the pace of housing market activity has decelerated, there are no signs of threatening excesses such as inventory overhangs and a surge in delinquencies.”

The Jefferies economics team also noted that November’s NAHB survey had far fewer respondents than October’s: 315 versus 360. “Some of the volatility in this data can be traced to the month-to-month changes in the sample,” they observed.

As far as the housing data is concerned, more will be delivered on Tuesday and with equity futures already pointing to a sharply lower open on Wall Street. Housing starts and Building Permits data will be delivered ahead of the opening bell at 8:30 a.m. EST and alongside several key earnings reports. Housing starts are actually expected to have rebounded in October with expectations of around 1.23mm Housing starts. Earnings are set to be delivered by several retailers including Target (TGT) and Lowe’s (LOW) prior to the market open.

As far as the U.S. Dollar (DXY) is concerned and the headwind it provides to international corporate sales, that too has had some positive developments as of late.

Since peaking only a week ago and above $97.50, it has tumbled to right around $96 as depicted in the chart above.

It’s quite easy to lose track of the long-term picture for the market given the present stage of the market’s correction. FANG stocks have been tossed out the window and Consumer Staple stocks are rising. The search for value and discarding of growth tends to deliver negative market reactions and sentiment. While earnings growth has remained strong and beating down the calls for peak earnings in each successive reporting season, it hasn’t offset the bearish market participation. Additionally, it has become increasingly difficult to have a positive outlook on the market when 2 corrections develop in a single calendar year and as growth expectations come down for 2019. It’s a lot of negative sentiment to overcome. But with that said, there are a lot of positives that could potentially resolve the market’s bearish declines both directionally and in terms of sentiment.

Holding the October lows would be the most critical objective near term for the bulls. Holding the lows could represent the “W” shaped recovery that investors look for when defining a technical “double-bottom”. Outside of the Housing sector, the U.S. economic data is indeed robust, with the unemployment rate at multi-decade lows, GDP growing above 3% annualized, consumer spending at 3%, consumer sentiment hovering near all-time record high levels and small business sentiment marching in pace with the consumer. Despite fears of inflation, even this aspect of the bear market narrative has failed to materialize in a manner that impacts U.S. consumption trends.

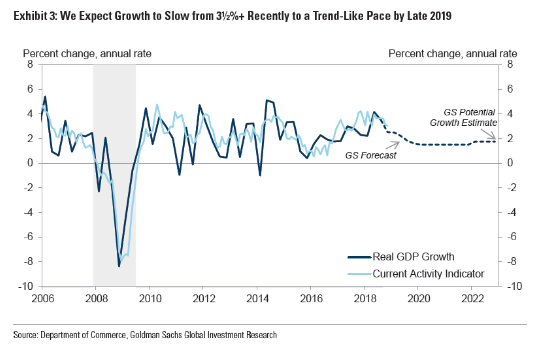

Markets tend to be psychologically driven and prevailing sentiment proves to drive markets in the short term, not the long-term. Fears of a global slowdown, tightening credit, U.S./China trade relations, rising USD impact on corporate sales and the Fed tightening have all culminated in a fashion to compress the market’s multiple in 2018. The narrative of the day is that the corporate earnings picture is simply “as good as it gets”. Having said that, even if the aforementioned components driving fear into the market don’t resolve favorably by year’s end, the outlook for 2019 is still one that sees GDP growth and corporate earnings growth. In other words, the negative outlook for 2019 is still a growth outlook. Take a look at the recently revised outlook from Goldman Sachs, as they consider the turn of the calendar year ahead.

Goldman Sachs believes the U.S. economy will slow significantly in the second half of next year as the Federal Reserve continues to raise interest rates and the effects of the tax cut fade. As we read this forecast, remember, the Fed may not stay the course with regards to rate hikes and we may find some semblance of a deal on trade. Additionally, the effects of the tax cuts hasn’t proven to fade even as such calls for the temporary “sugar high” have prevailed throughout 2018. Such fading may prove to be offset by the unemployment rate as more citizens working deliver greater consumer spending.

“Growth is likely to slow significantly next year, from a recent pace of 3.5 percent-plus to roughly our 1.75 percent estimate of potential by end-2019,” wrote Jan Hatzius, chief economist for the investment bank, in a note to clients on Sunday. “We expect tighter financial conditions and a fading fiscal stimulus to be the key drivers of the deceleration.”

The commentary from Goldman Sach’s chief economist above is not one that calls for a recession in 2019, but rather a curtailment of growth. We believe growth will definitively slow in 2019 as the laws of large numbers make it an inevitability. Simply put, it’s incredibly difficult to sustain growth above 3% or better.

Goldman Sachs sees the economy expanding at 2.5% in the fourth quarter of this year, down from 3.5% last quarter. Real GDP growth will come in at 2.5% again in the first quarter of 2019, but then will slow to 2.2%, 1.8% and 1.6% in the next three quarters, respectively. Additionally, Goldman sees the Fed raising rates this December and then 4 more times in 2019. The firm believes it will do so because inflation will reach 2.25% by the end of next year because of tariffs and increasing wages, the bank predicted, noting there was also a chance of an “inflation overshoot.” Wages are likely to increase and would be a healthy variable in the expansion cycle. Obviously additional global tariffs would serve to offset wage increases in a negative manner.

Goldman Sachs sees the economy expanding at 2.5% in the fourth quarter of this year, down from 3.5% last quarter. Real GDP growth will come in at 2.5% again in the first quarter of 2019, but then will slow to 2.2%, 1.8% and 1.6% in the next three quarters, respectively. Additionally, Goldman sees the Fed raising rates this December and then 4 more times in 2019. The firm believes it will do so because inflation will reach 2.25% by the end of next year because of tariffs and increasing wages, the bank predicted, noting there was also a chance of an “inflation overshoot.” Wages are likely to increase and would be a healthy variable in the expansion cycle. Obviously additional global tariffs would serve to offset wage increases in a negative manner.

“For now, neither overheating risks nor financial imbalances — the classic causes of US recessions — look worrisome,” Hatzius wrote. “As a result, the expansion is on course to become the longest in US history next year, and even in subsequent years recession is not our base case.”

It’s always a difficult situation for investors to navigate through negative market sentiment. As the market searches for a bottom, it seems as though it will either never find the bottom or never rise again. With that in mind, Tony Dwyer of Canaccord Genuity offers the following sentiment and guidance for investors in his playbook.