Welcome to another trading week!! In appreciation of all of our Basic Membership level participants and daily readers of finomgroup.com content, we offer the following excerpts from our Weekly Research Report. Our weekly Report is extremely detailed and has proven to help guide investors and traders during all types of market conditions with thoughtful insights and analysis, graphs, studies, and historical data/analogues. We encourage our readers to upgrade to our Contributor Membership level ($7.99 monthly, cancel any time) to receive our Weekly Research Report and State of the Market Videos and take advantage of this ongoing promotional event today! Have a great trading week, be in touch, and take a look at some of the materials in this weekend’s published Research Report!

Research Report Excerpts #1

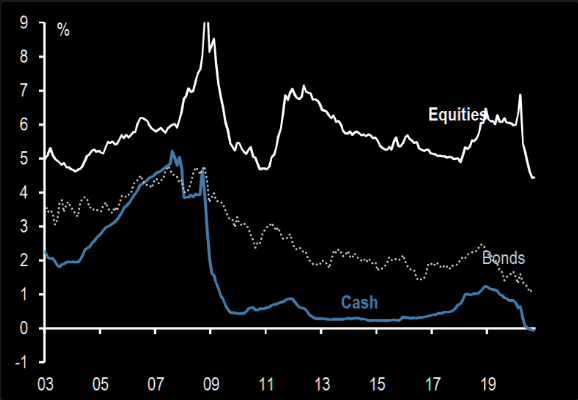

J.P. Morgan’s quant team offers the following analysis of where investors are able to find the greatest yield/returns for their investment dollars as follows:

- Equity yields vs. bond and cash yields would suggest there is only one game in town….

- Method: “We proxy the yield on bonds by the yield of our GABI (JPM Global Aggregate Bond Index); the cash yield by the 3-month yield of our JPM GBI Cash Index for US, Euro area, Japan & UK using their weights in the JPM GBI Global index, and the yield on equities by the dividend plus buyback yield of Datastream’s global equity index, to which we add 5-year rolling CPI inflation”

The trend has been clear since the market began its rebound and resumed the secular bull market back in April, the onset of a new cyclical bull market. Investors were best aligned to buy the dip and maintain long equity market exposure since and as the trend became more cemented with each passing month. If you broke from that trend, as financial media headlines produced a great deal of uncertainty, pessimism and noise, you likely fell behind the markets’ rate of return.

Research Report Excerpts #2

The only question from acknowledging the 2009 analogue performance gap that remained open-ended was, “What catalyst could realign 2020 with 2009 again?” Based on the 2009 analogue and what took place in the S&P 500 this past week, it would appear that the analogue only deviated in price momentarily, as the path remained the same, but along a different plane of time. We can see this in the chart of the S&P 500 (2009 red line) above that depicts a relatively strong month of September up until the end of the month and into the first week of October. For a clearer picture, we extrapolate the 2009 chart of the S&P 500 path below:

The 2009 plane proved the opposite of 2020 whereby the S&P 500 began its consolidation/decline at the onset of September and its uptrend at the end of the month, into October. At this point, however, the S&P 500 in 2020 is trailing the 2009 analogue by just 2 percentage points. The trend has not changed! The analogue has remained quite affective to this point, but has also identified the different macro-sentiment factors at play in 2020 (going into election, renewed QE infinity) when compared to 2009 (coming out of an election year, new QE policy), which has served to set 2020 on a different plane than 2009 even if on the same longer-term path/trend.

Research Report Excerpts #3

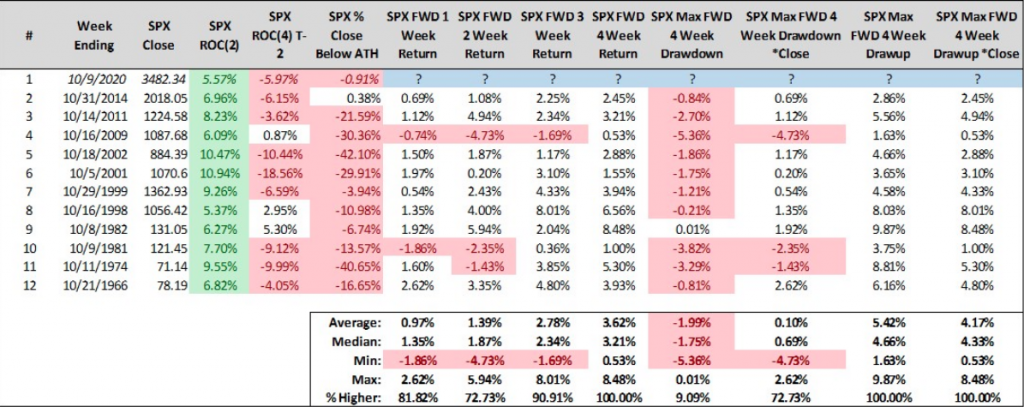

Historically speaking, 10-day breadth thrusts in October are a really good sign of even higher prices in November. Here are all instances of the S&P 500 gaining 5% or more over a 2-week stretch (which just happened) for all weeks ending in October. Spoiler alert; undefeated 1 month later. (Study from Steve Deppe)

- No election years within the study.

- 8 of 11 instances didn’t close a calendar week lower at any point over the forward 1-month.

- Average draw-ups are ~5%.

- 4 weeks from now is 11/6. Few believe it’s possible to close at ~3,656 on 11/6.

Research Report Excerpts #4

If you think the strength from Transports is a sight to behold, check this out!

It’s rare to see equal-weight consumer Discretionary sector ETF (RCD) this strong on a relative basis. The EW Consumer Discretionary ETF is leading the Consumer Discretionary SPDR (XLY) on the price chart with a move above the September highs. Still short of a new high, but taking the lead with strength in housing and retail. The retail sector ETF also recently hit a new high.

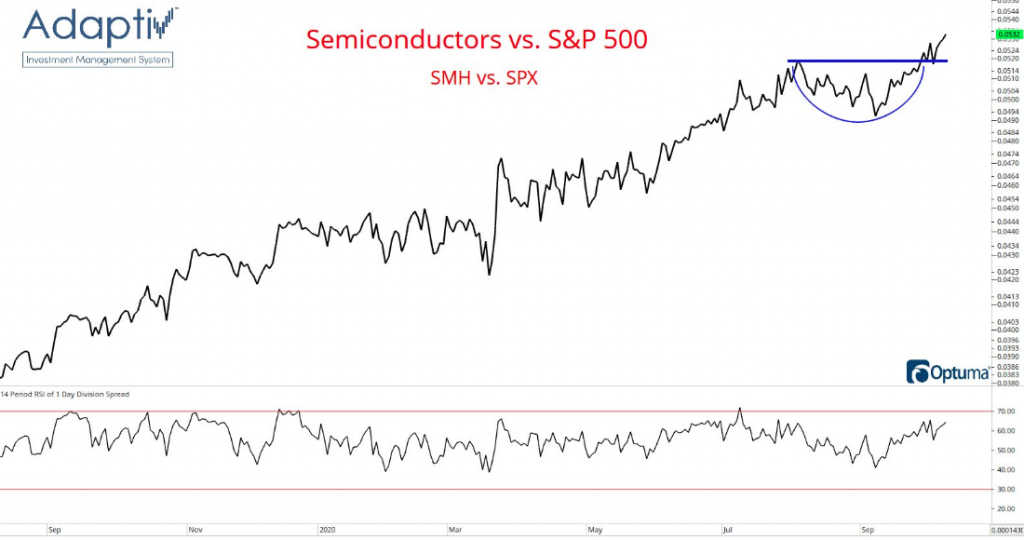

Semiconductors have also proven a safe haven, growth sector of the market that recently underwent the same breakout-retest-bigger breakout pattern that the Dow Jones Transports went through.

Research Report Excerpts #5

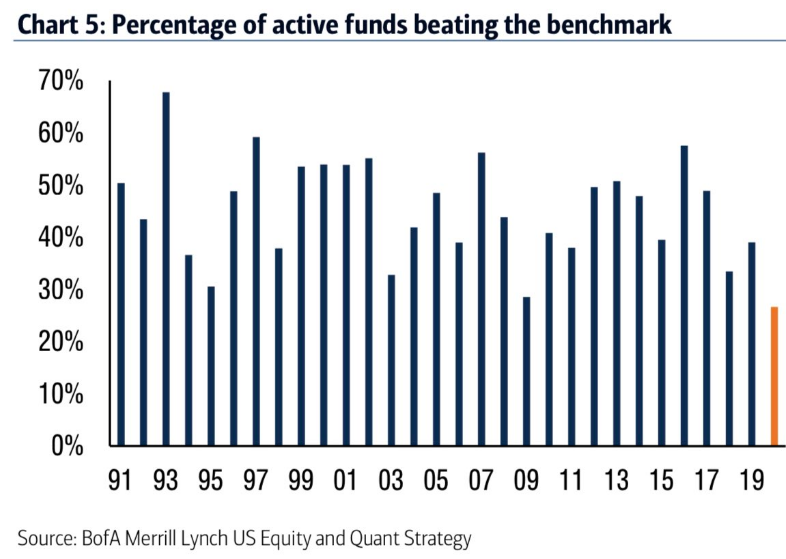

Money managers’ first priority is often to limit risk, which means limit market exposure. This is largely why most fund managers underperform the market, which moves higher over time.

The glass half-full approach is still the better approach and path taken by investors long-term, despite what the financial media puts in front of us on a weekly basis.

Research Report Excerpts #6

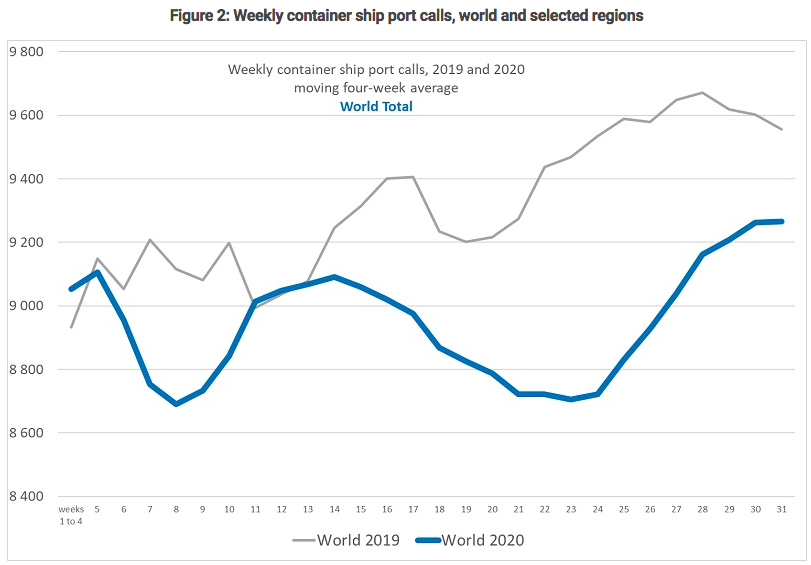

Leading indicators continue to suggest a positive growth dynamic ahead. The U.S. Institute for Supply Management (ISM) manufacturing index new-orders component remained strong in September despite some moderation from a 16-year high in August, and the global IHS Markit survey manufacturing index reached a two-year high, strongly suggesting continued manufacturing sector growth ahead. Given the close link between global manufacturing and trade cycles in today’s globally integrated economy, it is not surprising that international trade has already recovered much of its precipitous 18% year-over-year May drop, with a swing to positive growth of +3% to +4% likely by early 2021, in our view, which would be the strongest in three years.

Moreover, according to new UNCTAD data, (chart above) the number of ships pulling into ports to unload & load containers rebounded in many parts of the world in the 3rd quarter of 2020, which offers a hopeful sign of recovery from COVID-19 for global trade.

Research Report Excerpts #7

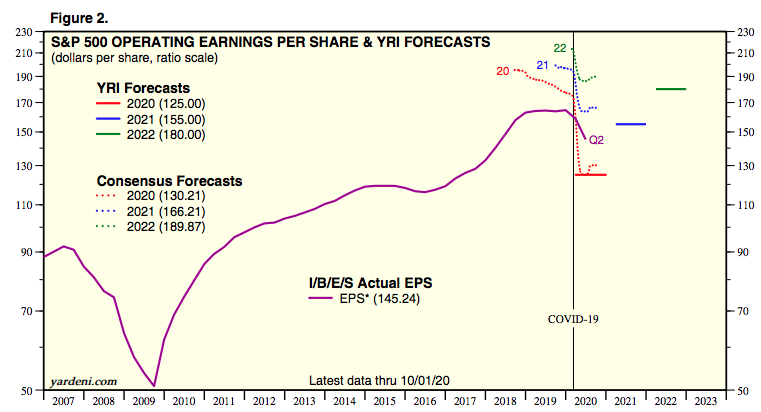

While Finom Group anticipates continued upside revisions to Q3 and FY2020 EPS models, we are of the opinion that Q3 EPS will still come in at roughly -15% YoY when it is all said and done.

Over the past five years on average, actual earnings reported by S&P 500 companies have exceeded estimated earnings by 5.6 percent. During this same period, 73% of companies in the S&P 500 have reported actual EPS above the mean EPS estimate on average. As a result, from the end of the quarter through the end of the earnings season, the earnings growth rate has typically increased by 3.4 percentage points on average (over the past 5 years) due to the number and magnitude of positive earnings surprises.

Research Report Excerpts #8

Race-by-race analysis and polling data favor Democrats to retain the majority in the House of Representatives. Democrats built a sizable majority in the 2018 midterm elections, and current political trends support a continuation of the dynamics that boosted Democrats in the midterms. Democrats are currently favored by a notable margin in the “generic ballot” test, traditionally the best indicator for the overall House result. An approximate seven point lead in the generic ballot produced a 40 seat Democratic gain in 2018, and Democrats are favored by a similar margin in this cycle. In order for Republicans to win back the majority, they would have to win all 28 toss-up seats and gain three upset victories in Democrat-favored seats.

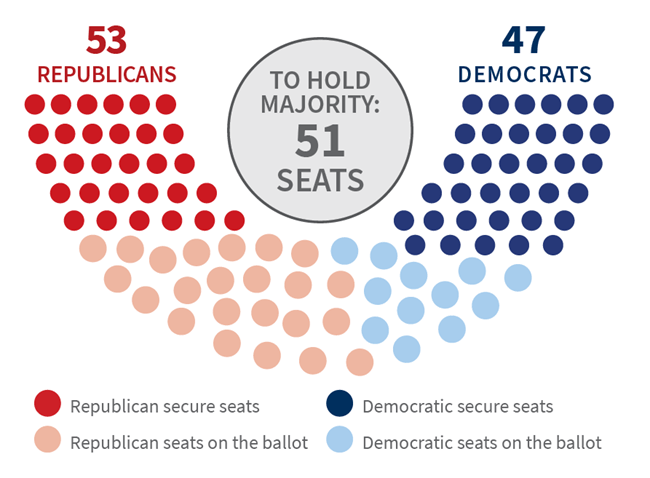

The battle for the Senate

Policy in the next presidential term will run through the Senate. As such, markets will be closely watching the outcome of key Senate races for their potential to swing party control of the Senate to Democrats for the first time since 2014.

We know, without any doubt that we are going to see some crazy market swings ahead and before year’s end, centered on the election cycle.

“I’ve been involved in presidential politics going back to the 1980s, and I have to say this is the most unusual election of my lifetime — and probably anyone’s lifetime who is alive today,” says John Emerson, Vice Chairman of Capital Group International, Inc. and a former U.S. Ambassador to Germany.

Thank you for joining us for another trading week and reviewing our weekly “Must Knows”! To receive and review our weekly, full-scale Research Report each Sunday and our State of the Markets weekly video analysis every Thursday, subscribe to our Contributor Membership level at just $7.99 monthly (Cancel any time)! With these two weekly deliveries, you’ll have all the unbiased and fact-driven market and economic data analysis at your fingertips. Don’t make capital allocation decisions based on headlines that brush the surface of what is and isn’t affecting markets. Let our deep-dive analytics supply you with bottom-up and top-down analytics. You won’t be disappointed. Upgrade today!!