That was much to do about nothing now wasn’t it. Well, the major averages did finish lower, which is a bit of a new occurrence in the New Year. And after a bump in volatility at the opening of the trading day, the VIX managed to finish below 10 once again in 2018. The S&P 500 index lost 3.06 points, or 0.1%, to 2,748.23, after scoring its highest number of records in a new year since 1964. The Nasdaq Composite Index fell10.01 points, or 0.1%, to 7,153.57 and the Dow Jones Industrial Average lost 16.67 points to 25,369.13. Much of the morning “buzz” surrounded the 10-year yield breaching 2.50% and touching 2.59 percent. Much of the fear mongering surrounding bond yields did indeed come from fund managers and a Bloomberg News report that China is considering halting or cutting its purchases of U.S. government paper. But even with most European equity markets finishing lower on the day and the 10-year above 2.50%, U.S. equities turned a Dow 130+ point loss into a mere 16 point loss. So there…!

One day does not make it a trend anymore than creeping treasury yields make for panic in the markets. Investors are best aligned with the premise that it’s not a matter of bond yields rising, but how quickly they rise. But if bond yields didn’t make for a long day, the specter of the U.S. pulling out of NAFTA added another layer of worry for equity investors.

“If the U.S. pulls out of Nafta, I do think that represents a definite risk to markets,” said Liz Ann Sonders, chief investment strategist at Charles Schwab.

Sonders distinguished between Trump wanting to withdraw and the U.S. actually doing it, noting that such a fundamental shift in policy would likely need congressional approval, which could be difficult to obtain given how controversial such an initiative would likely be. “There could be an announcement that we’re pulling out, and then there’s what actually has to happen for it to occur. Either way there will be shock waves” in the market, she said.

I don’t know how many notions, headwinds, scenarios or circumstances it takes to halt this bull market, but it certainly seems like the longer in the tooth the bull market gets, the more it is hunted for with hatred of the bull market. For now and until something more egregious finds markets in turmoil the course is straight and narrow.

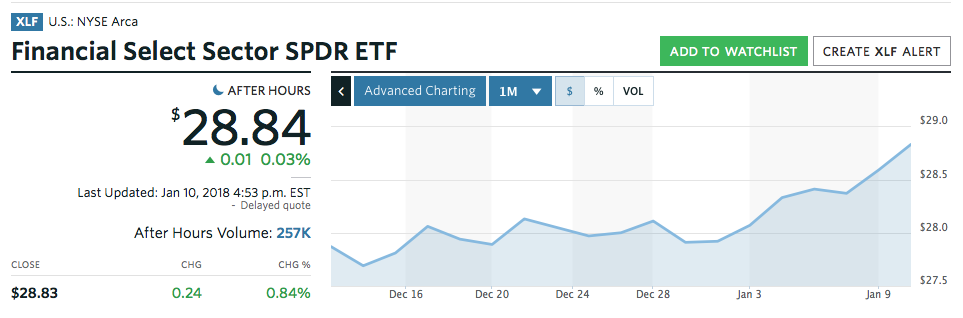

Tomorrow begins a 2-day cycle of more relevant economic data. The Producer Price Index will be reported tomorrow at 8:30 a.m. EST followed by Friday’s release of Consumer Price Index and December Retail Sales. Also Friday, we’ll get into the Q4 2017 Earnings reporting with Wells Fargo, J. P. Morgan Chase, PNC Financial and Blackrock all reporting quarterly results. And if you don’t think investors are already out in front of the financials reporting cycle, take a look a chart of the 30-day Financials Select Sector SPDR ETF below:

Sold UVXY weekly calls at the SPY LOD today. That’s pure luck, but I won’t turn down a gift from the market gods!

Seth curious to hear your thinking on inflation. Last few weeks it seems banks are up, yields are up, and bonds/utilities/REITs are down (all normal correlations per Market Theory 101). What does not agree with this is oil, which appears stronger than it has in months/years depending on who you ask, as well as gold which is suddenly out of the grave and looking very lively. That coupled with most of the market being overbought would lead me to believe that we will soon see some volatility and a decent size pullback, but then I recall long stretches at beginning of 2017 where commodities (especially gold) rose strongly with the broader market, only to fizzle and suck wind for rest of the year. What craps out first in 2018? You still shorting vol here?

For the last 15 years or so I’ve offered my take on inflation which is defined by the very simplistic statement, “there’s no such thing”. Inflation exists as necessary opposition or antonym to the word deflation. Regardless of the regional economy, whether here or abroad, inflation is transitory. It can only be transitory and fleeting or an economy can not sustain its constructs. I often invite people to pull up the 10yr-yield historical chart. It is a validation of my ideology of inflation. Fleeting/Transitory i.e. the 1980s or for other short periods of time. The Arab Spring: This occurrence in the middle east came to be because of inflation that abruptly disrupted not just the economies in the region but the social constructs. So yes, inflation is a devastating force, but it is also an equalizer, a mean reverting, transitory occurrence.

So when our Federal Reserve pegged their monetary policies to the notion of 2% inflation, it’s not that they are perplexed as to why over the last decade inflationary levels have not come to be, it’s that they were counting on them not to be. If you read my work on the Shadow Banking system and transmission mechanisms, you’ll likely walk away pretty pissed off, feeling duped by our FOMC as the mathematical possibilities didn’t exist for the Fed to witness its inflation targets achieved.

Having said probably more than you bargained for, 😉 Anything and sometimes even nothing can cause a volatility spike, excessive hedging of long portfolios in unison to the 10yr hovering around 2.60% and then some. I think we are all witnessing a “different market” and a different “financial system” of sorts that will end badly at some point. When that point comes to pass is anybodies guess, but like the Fed’s inflation targets, the math doesn’t add up favorably for our financial system and at some point…

I think I follow you over the longer term but I am thinking more along the lines of “will commodities/commodity stocks ever catch a break?” I mean here we are 2 years from the 2016 lows for oil and WTI has more than doubled. Yet XLE is up barely 50%? What gives? Then look at ags-DBA looks like the VIX… It can’t go to 0. Is it really going to keep marching down absent a crisis? Commodities used to have orderly rises, so the free money Fed has really changed that dynamic in your opinion?

Another baby vol spike to short. It is so sad they are so short lived. Shorted a batch of VXX at 26.50 through Canadian Questrade (opened specifically for long term shorts) . Margin 50%. As opposed to IB 150% and up to 350.

UVXY and TVIX shares as expected were not available. Need better spikes like I 2016 or 2017. Where they are all gone? I guess algos getting smarter…