Welcome to this weeks rendition of State of the Markets with Wayne and Seth. Please click the link to review the video, which is one hour in duration.

Outline

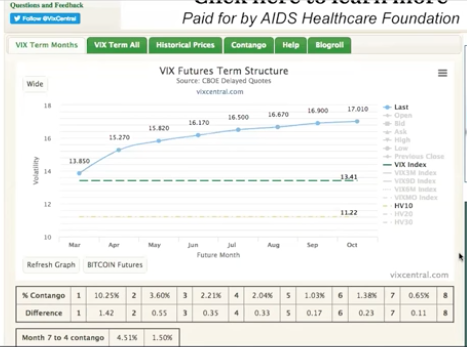

- Introduction to SOTM with conversation on market volatility. Front month contango of 10%+. Greater focus should be on back month/m2 given VIX Futures expiration and roll occurring next week. (0-5 minutes in)

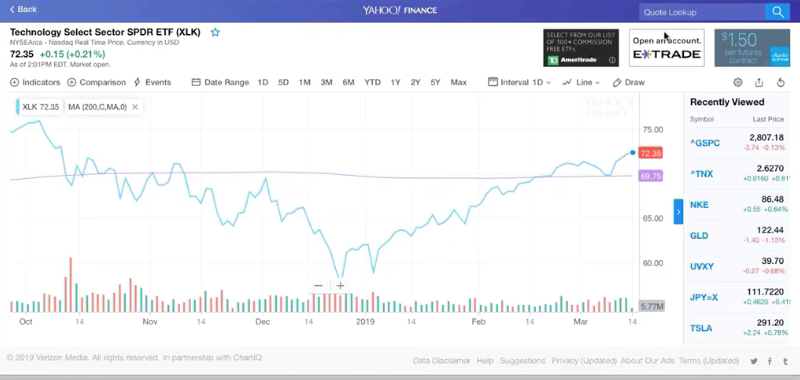

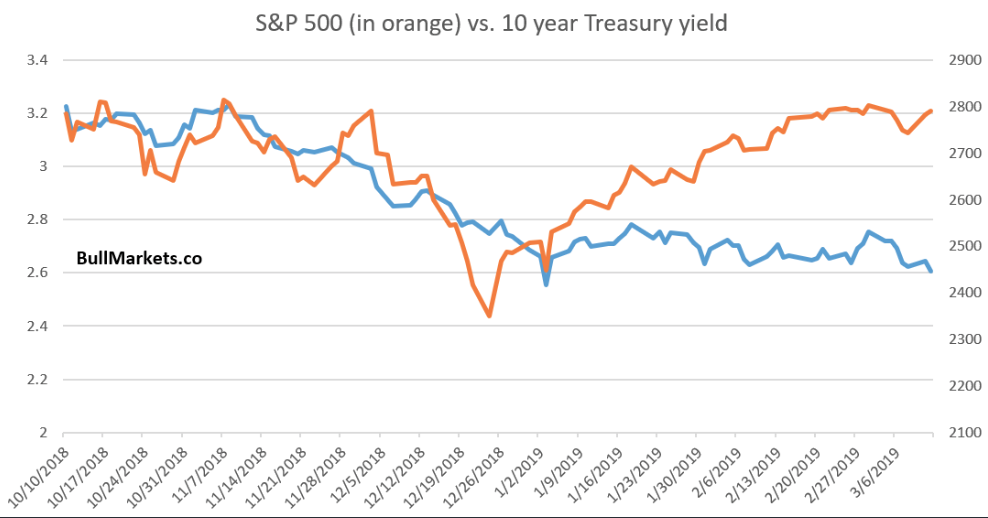

- Major averages have been trending higher throughout the trading week. BTD never ends, it just hibernates. Last week market had a 2sigma move against the weekly expected move. This week’s expected move is $41 and has already moved beyond the weekly expected move with no checkback as of yet. Momentum has been strong, but not without its concerns. Fund flows negative, defensive sectors have rallied along with bonds. Yields have not recovered although S&P 500 has.

- Bond market did not lead equities down in late 2018, myth. Yields haven’t ticked higher because Fed is on the sidelines, economy lacks inflation. Equity market repriced in late 2018 for what it forecasted as a earnings recession in 2019. S&P 500 overshot to the downside as EPS is projected to grow 3-6% in 2019. S&P 500 currently trading 16.3X forward 12-month EPS. The equity to bond correlation may resolve itself in favor of equities over time. (5-17 minutes in)

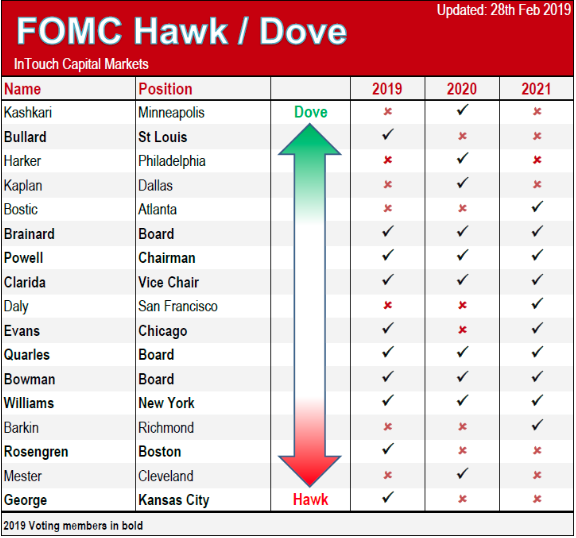

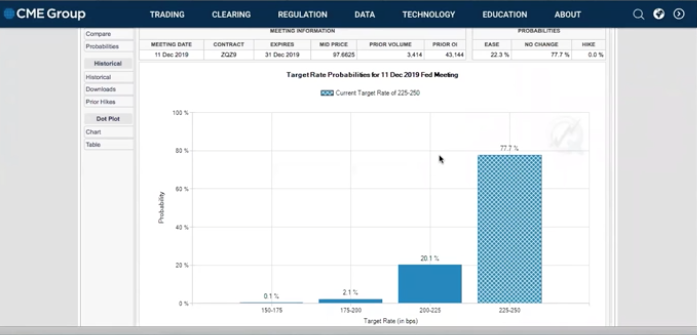

- Fed is on the sidelines. Fed 2-day meeting is next week. Trade war has presently resolved outside of the current headline risk of escalation and in favor of near-term resolution. ( Meeting between Trump/Xi delayed at least until April) A good deal of the economic data since the end of the government shutdown has proven mixed and with great skepticism over the data’s accuracy.

Expectations are for PMI data to start moving higher given low inventories. Fed will likely not pivot from its dovish stance any time soon. The market has gone from possibly one rate hike in 2019 to the probability of a rate cut by the end of the year. Current probability is 20%. According to the FOMC, what are business leaders saying about wages, labor force, demand, tariffs etc. (17-30 minutes in)

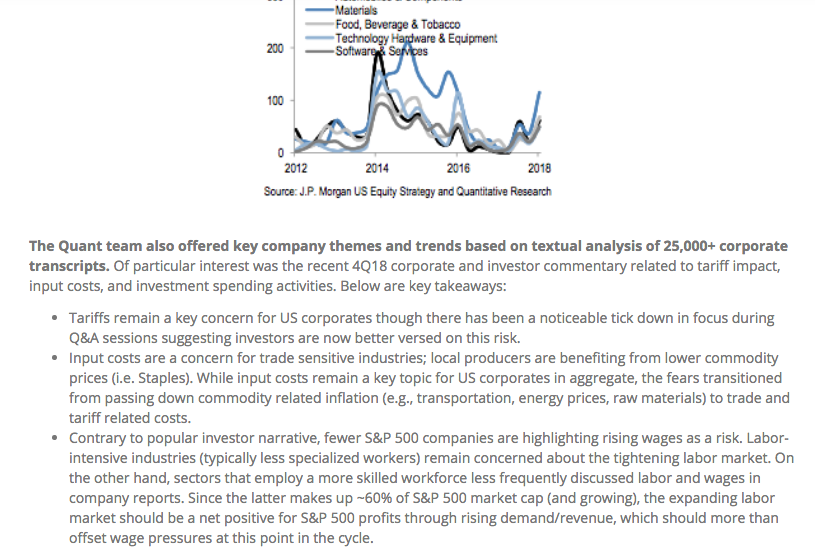

There’s good measures of economic inflation within the “wage” component, but lacking in CPI and/or PPI. Wages rose 3.4% in 2018. See J. P. Morgan notes:

- Michael Wilson of Morgan Stanley is of the opinion the market will finish the year at 2,750 and as wage inflation will result in negative to flat S&P 500 EPS on a YOY basis. Wilson doesn’t discuss or outline where wages are rising and their feedback look as positive, but rather a net negative. S&P 500 revenues are expected to grow 4-5% in 2019. Geffrey Gundlach commentary (30-37 minutes in).

- Unfortunate conversation concerning the reality of our National debt that is not only unsustainable, but without the ability of repayment in whole. Being bullish market participation does not exonerate or eliminate one’s understanding of the macro-economic situation. Fear mongering is less informative than trader/market educating. (30-44 minutes in)

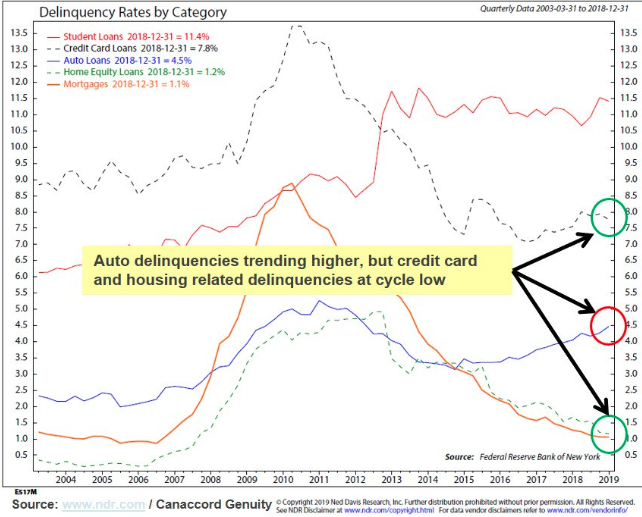

- The media and permabears take headlines and hope those which are bullish on the market don’t dig into the details. Discussion on student loan debt, auto loan delinquencies, mortgage and credit card debt. None of which are in bad shape. (44-47 minutes in)

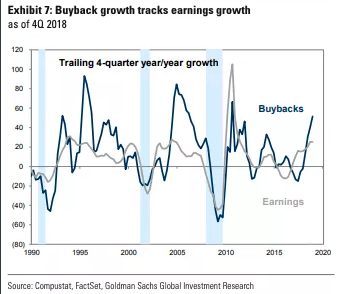

- Discussion on buybacks and EPS trends. Unlike previous periods, corporations are flush with cash from repatriation, high net profits in 2018 etc. Every time is different but people hate hearing that phrase. The only thing that doesn’t change is what tends to bring about a recession and that is the inversion of the yield curve. Right now the yield curve is flattening, but has not inverted. (47-55 minutes in)