Good evening traders/investors. With the S&P 500 breakout of the recent box pattern and closing above the 50-DMA for the first time since August 1, 2019. The following chart identifies not just the aforementioned occurrence, but the clear and present breakout of the S&P 500.

But that is not what this evening’s Special Report aims to discuss! You’ve heard the phrase “all gaps get filled”, right? While this has historically been true, we don’t quite know when the gaps will get filled. Everyone becomes a professional market technician when the market gaps up or down for some reason. With that being said, many traders and investors decided to do a bit of hedging late in the trading session Thursday. And why…?

Investors saw a good deal of strategists promoting hedging ahead of Friday’s key Nonfarm Payroll report that some feel may be down right crummy! But before we get to some of these strategists/analysts’ notes, there are some indicators that align with the pessimistic outlook for tomorrow’s release of the August Payroll data.

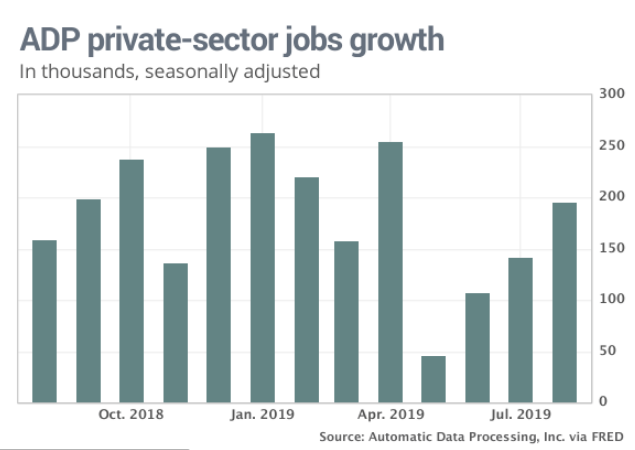

First up in detracting from the fears is the latest ADP private sector data that was delivered this morning and proved rather favorable.

The nation’s businesses created 195,000 private-sector jobs in August, payroll processor ADP said Thursday.

Economists polled by Econoday had forecast a gain of 150,000. Some 142,000 private-sector jobs were added in July, according to figures that were lowered from an earlier seasonally adjusted figure of 156,000.

And of course, there’s President Donald Trump touting the stronger than anticipated jobs creation in the month of August.

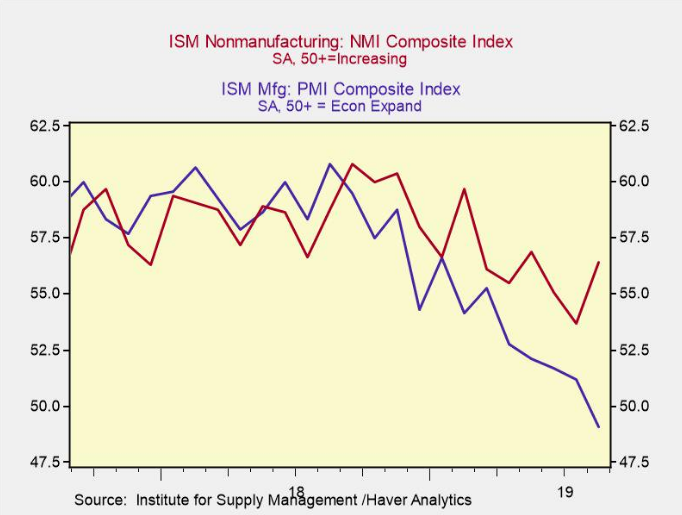

Unfortunately, when we review the internal employment metrics from the ISM Indexes, they prove less favorable when compared to the ADP Payroll report.

By the way, that was a some strong ISM Non-manufacturing data reported today, huh? While the manufacturing sector has been faltering, the service sector has found its legs, and why?

Tale of 2 economies so to speak: The 7.3-point gap between the ISM Services and Manufacturing Indexes is historically large, the 13th biggest out of 266 months according to Steve Leisman of CNBC. In 2000, a large gap presaged a recession. In 2015, only a growth slowdown. It could be the tariffs, which hit manufacturing harder than the service sector this go round. No, it is the tariffs folks. But more importantly is the employment component of the ISM indexes we aim to flush out for the relevance of this Special Report.

- The ISM Manufacturing Survey employment component fell to 47.4, down nearly 4 points from last month’s 51.7 reading.

- The ISM Non-Manufacturing Survey employment component fell to 53.1, down 3 points from last month’s 56.2 reading.

- The 4-week moving average of Initial Jobless Claims edged higher to 216,250, up from last month’s historically-low 211,500 reading.

Combining the ISM data and slight uptick in Initial Jobless Claims, this doesn’t point to a strong Nonfarm Payroll report, but the headline number will be influenced by the addition of some 40,000 jobs due to seasonal Census Bureau hires/additions. With that being said, here is the forecast from Forex.com as follows:

Economists polled by MarketWatch are forecasting 170,000 jobs to have been created in the month of August. According to a Reuters survey of economists, Nonfarm Payrolls probably increased by 158,000 jobs last month after rising by 164,000 in July. Job growth has slowed from an average of 223,000 per month in 2018.

The pace of employment gains remains well above the roughly 100,000 jobs needed per month to keep up with growth in the working-age population. The unemployment rate is expected to have held at 3.7% in August for a third straight month.

Okay, so here is what strategists are suggesting investors do ahead of the tomorrows NFP release. An awful lot of strategists are recommending hedges on U.S. equities right now.

JPMorgan Chase & Co. suggests bearish options on the SPDR S&P 500 ETF Trust, citing concern the market may be underpricing risks that a deterioration in corporate America’s health could hurt jobs. Bank of America Merrill Lynch is touting puts because its model suggests increasing risk for the S&P 500. And Societe Generale SA and Credit Suisse Group AG see some options tied to the index that are too cheap to pass up.

JPMorgan strategists Shawn Quigg and Marko Kolanovic say buying protection may be rewarding amid a likely weakening in the jobs data. Softening unemployment figures could weigh on equities, and options are pricing a move on the SPY ETF of about 1% through Sept. 6, which they deem as cheap.

Trade ideas from the firms include:

- JPMorgan: Buy Sept. 6-expiry SPY $292 put options

- BofAML: Buy one S&P 500 October 2,825 put, selling two 2,700 puts and buying one 2,575 put

- SocGen: Sell one S&P 500 95% put with a December 2020 maturity, while buying 4.5 times the 70% put

- Credit Suisse: Hedge with SPY put strategies

Meanwhile, Morgan Stanley strategists including Phanikiran Naraparaju and Sheena Shah took a globally cautious view. They are strategically bearish and recommend buying puts on a basket of global equity indexes because August’s volatility will persist, they wrote in a Sept. 4 note.

SocGen Financial Engineer Aymen Boukhari notes that short-term S&P 500 volatility skew is very steep, meaning puts are in demand relative to calls. Far out-of-the-money puts are very cheap compared with at-the-money puts, Boukhari said by email.

Credit Suisse’s Mandy Xu also says relative cheapness in puts that are far below current index levels with three-month expiry and shorter, amid little demand for the far out-of-the-money tails versus greater popularity of options closer to index levels.

BofAML’s models of market stress are flashing caution, causing strategists led by Lars Naeckter and Stefano Pascale to advice hedging bullish wagers.

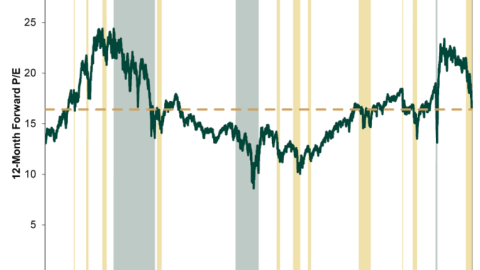

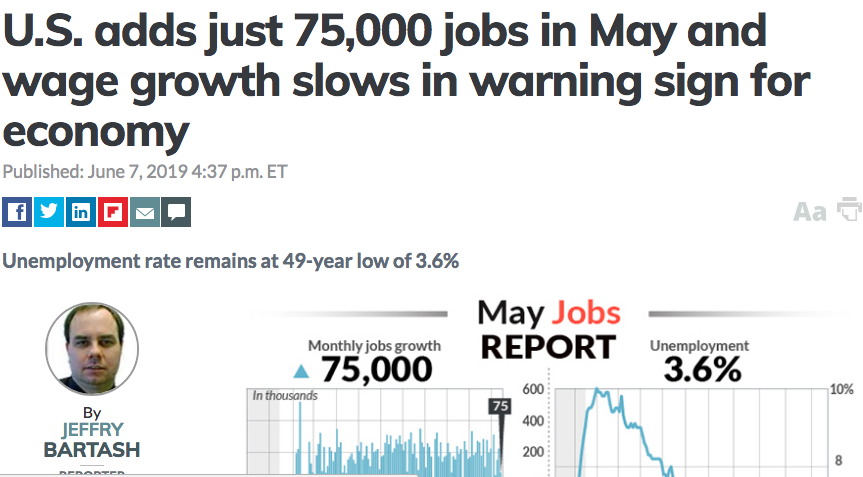

Keep in mind that all of these notes were delivered before the S&P 500 broke out from the August trading range. Moreover, let’s consider the analysts/strategists’ fears are warranted. If we take a trip down memory lane to the release of the May Nonfarm Payroll report and market reaction, does recent history suggest that portfolio protection is the right strategy? Maybe appropriate strategy is a better phrasing.

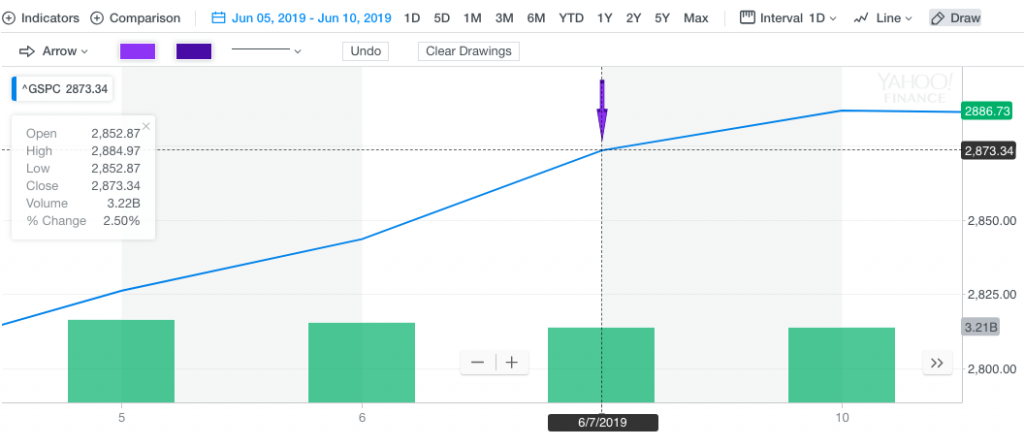

The release of the May jobs data came on June 7th and missed by roughly 100,000 when compared to economists’ estimates. It was a pretty lousy number/report and yet when we look at how the market performed that day…

The market opened that day pretty close to the intraday lows and finished higher. The S&P 500 likely dismissed the report as a one-off and, in part, because of the belief that this would only lend itself favorably to a Fed rate cut in July.

Now I’m not suggesting investors should be complacent going into tomorrow’s report, but rather offering a most recent example of a poor headline jobs number with how the market actually performed. And that’s before we even revisit the notion of gap fills. So here is the calculus we invite investors to consider…

We don’t know what lay in store for investors with regards to the market’s reaction to the NFP report, just don’t know. What we do know is that by hedging there are essentially two outcomes we can expect: 1. Good jobs number and market likely moves higher, hedges prove a tax on your portfolio. 2. Bad jobs number and the market has an initial reaction that might be reversed by the proposed “Fed put”. How quickly and confidently can you time that reversal in order to remove those hedges profitably?

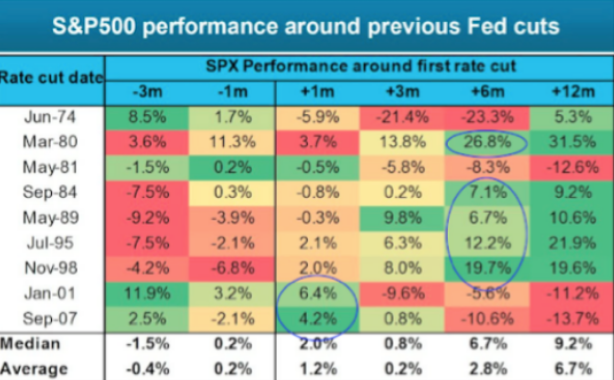

Furthermore, why not just save the worrying altogether and do what has proven to work in past and present easing cycles? Buy the dip; how simple is that? The stats don’t lie folks! We discussed this sentiment in an article back in mid-july and in the linked article.

History doesn’t always repeat, but the probabilities are still favorable for market bulls. Moreover, regardless of what Friday’s trading activity looks like, Finom Group is likely to be delivering trade alerts in the manner we have all year long and most recently, as depicted in the following trade alerts delivered and completed for our Premium Members:

Subscribe to our Contributor or Premium Membership levels today and trade with us at Finom Group in our live Trading Room daily!