It was a mixed trading day for the major indices yesterday as the Dow outperformed its peers in the S&P 500 and Nasdaq. The Dow finished higher by 95 points to 25,241 with the S&P 500 down by less than 2 points to 2,770. The tech-heavy Nasdaq was the laggard with the index falling by 54 points or .70% on the day. The selling pressure doesn’t look as if it will let up on Friday ahead of the all-important G-7 meeting. U.S. equity futures are following global equity markets lower in the 5:00 a.m. hour. Some back and forth tweeting between French President Macron and U.S. President Trump has brought back some of the fears surrounding trade tariffs to the equity markets. But before we discuss the upcoming G-7 meeting let’s briefly take a look at the month of June.

Since the beginning of this bull market in 2009, the S&P 500 Index recorded a June gain five times, and a loss four times. On average, the S&P 500 has fallen 0.55% in June.

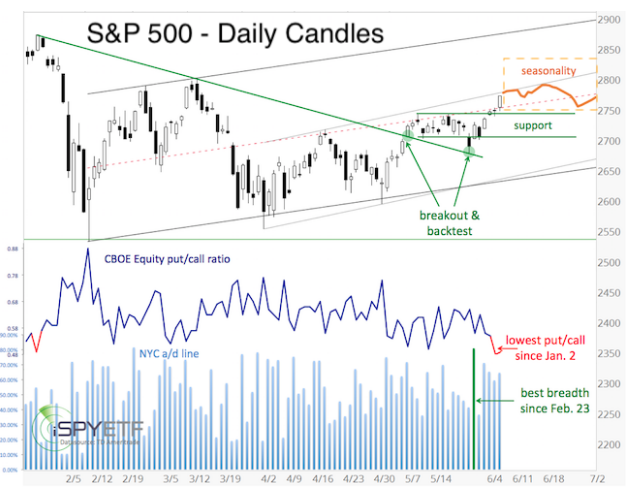

The S&P 500 broke above its 2,710-2,742 trading range in May and early June. This range is now support. The CBOE equity put/call ratio is at the lowest level since Jan. 2. The low CBOE equity put/call ratio usually suggests a pullback of sorts. Based on the structure of the advance, the upcoming pullback could be very shallow.

Based on those limited variables, as there are a host one could use for which to forecast how the market would perform in June, the month is unlikely to be a breakout month or a breakdown month. In other words, absent any headlines of significance, the market will likely churn and trade sideways. Of course, what we’ve come to understand about the markets of 2018 is that headlines are bountiful.

Speaking of headlines, the G-7 Summit and upcoming U.S./N. Korea Summit will bring with them a good many headlines. Neither poses any significant economic risk to the U.S. near term, but the market is forward looking. As such, trade disputes arising between the U.S., the EU, China and NAFTA partners could find investors with a more risk-off sentiment through portions of June. Investors have had to contend with a plethora of trade-related headlines through much of 2018, which has also helped contain the S&P 500 from achieving new highs.

There have been fits and starts for the equity markets for much of the year. The sell-offs have quickly stabilized and the rallies have been quickly capped. It’s for the aforementioned reasons that Blackstone’s Byron Wien says investors enjoying a recent rally in the stock market shouldn’t get too comfortable.

“There will be 10% corrections along the way” he told CNBC but said “generally, we are in a period of low volatility because there isn’t a recession in sight. My view is the earliest we’re gonna have a recession is 2021.”

Unfortunately, this week has been a light week for economic data, but yesterday we did get another peek into the strength of the consumer market via the Fed’s consumer credit report. The Federal Reserve said consumer credit in April slowed to a seasonally adjusted annual rate of 2.9%, or $9.3 billion, down from 3.8% in March. Economists polled by Econoday expected a gain of $14 billion. This was the third straight monthly slowdown in credit growth. Non-revolving credit grew 3% in April, down from a 5.7% rate in March. It is the slowest pace since September.

Revolving credit, namely credit cards, rose 2.6% in April after declining in March. This is well below last year’s monthly average gain of 5.9 percent. Economists believe the consumer is in good shape in 2018. Earlier Thursday, the Fed reported that, due to rising home prices, the net worth of households and nonprofits rose to $100.77 trillion from $99.74 trillion in the first quarter. This is a record high for household net worth.

Ok, so let’s get to the G-7 and the already acrimonious comments made by world leaders ahead of the meeting, which is causing global equities to curtail further gains. With President Trump standing firm on potentially implementing tariffs on allies, early comments coming from Ottawa, Canada take aim at the U.S. President’s stance on trade.

“You say the U.S. president doesn’t care at all. Maybe, but nobody is forever,” French President Emmanuel Macron told a news conference flanked by Canadian Prime Minister Justin Trudeau in Ottawa on Thursday. “The six countries of the G-7 without the United States are a bigger market taken together than the American market. There will be no world hegemony if we know how to organize ourselves. And we don’t want there to be one. The 6 countries represent values and an economic system which has a historical weight and is now the true international force.”

Of course, no seeming attack on the U.S. President goes without response. The following tweet responses come from President Trump, aimed at the French President:

This trade dispute that doesn’t seem to forecast a positive outcome from the G-7 Summit is found with equity markets tumbling on Friday. Finom Group suggests utilizing cash or raising cash to acquire fundamentally strong companies as share prices depreciate temporarily. Cooler heads will likely prevail over trade, even if forcibly through the recognition that a trade war cannot be won, by anybody. Absent the geopolitical headlines, the U.S. economy remains on strong footing with strong corporate earnings growth.

With that being said, investors should expect further bouts of volatility in the markets near term. The VIX has seemingly stalled out, after dropping some 70% from its February highs. Finom Group’s chief market strategist Seth Golden recently publicly announced a large volatility exposure reduction as part of the Golden Capital Portfolio on Twitter. The following tweet expresses this exaction:

The plan was to take some profits from short exposure to VXX shares that have declined from $55 in February to $32s recently. The opportunity remains to recapture or trade short volatility going forward and should there be the added benefit of rising volatility. Rising volatility is generally followed by the inevitable decline in volatility. Shorting shares of specific VIX-Exchange Traded Products with the added benefit of contango affords traders the opportunity to benefit from VIX-ETP price decay that is a structural inevitability.

Tags: SPX VIX SPY DJIA IWM QQQ