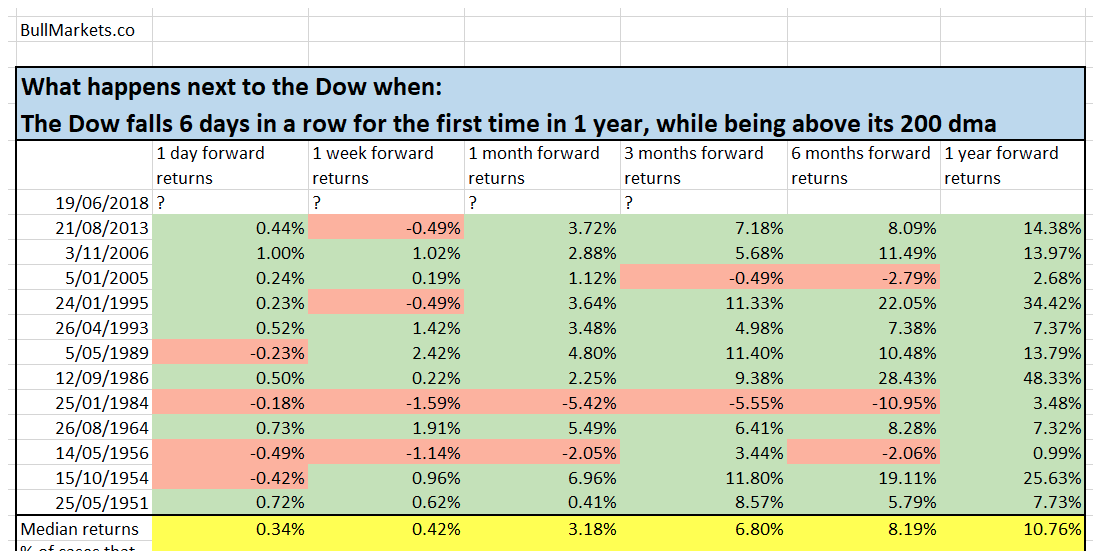

That wasn’t as bad as it could have been or maybe even should have been, now was it? The Dow Jones Industrial Average fell 1.2%, or 287.26 points, to close at 24,700.21. At its intraday low, the Dow was down by as many as 420 points. Tuesday’s decline marked the 6th straight drop for the Dow, representing the longest such losing streak since March 2017. The streak has also erased all of 2018’s gains thus far and puts the index down about 0.1% year to date. But more importantly, the Dow has fallen 6 consecutive days while remaining above its 200-DMA.

As noted in the chart above, even as a 6-day losing streak has erased all of the Dow’s 2018 gains, it may prove to be a good signal over the medium and longer-term horizon. Over the subsequent weeks and months, the vast majority of the time the Dow is higher post a 6-day losing streak that occurs after a minimum of 1 year.

Yesterday also proved a difficult day for the broader indexes. The S&P 500 fell 11.18 points, or 0.4%, to 2,762.57. The S&P briefly brushed up against its 50-DMA before bouncing intraday. The Nasdaq Composite Index shed 21.44 points to 7,725.59, a drop of 0.3 percent.

Yesterday’s markets’ declines came as the trade rhetoric between the United States and China was elevated by the U.S. administration. Trump asked U.S. Trade Representative Robert Lighthizer late Monday to identify $200 billion more in Chinese products that could be subject to tariffs of 10%. The U.S. president also threatened to find $200 billion more worth of goods if China tried to retaliate against those additional tariffs. China was left with little choice but to respond to the latest decision by President Trump.

A spokesperson from China’s Ministry of Commerce said China would have no choice but to take comprehensive measures in response to the U.S.’s trade moves, the state-run Xinhua News Agency reported.

While the rhetoric has elevated between the two economic superpowers of global trade, there is still time left on the clock for grand negotiations. Several of the most successful investors in the world predicted the two economic superpowers will eventually reach a deal after some short-term saber rattling. Here’s what billionaire Paul Tudor Jones had to say about the subject matter on CNBC recently:

“If Trump is trying to “normalize the tariffs” to match our trading partners, the market impact will be limited. Instead Jones actually predicted the stock market could go “crazy” to the upside into the end of the year. He noted that he is closely watching the situation in case his assessment is incorrect and the trade conflict becomes something much worse.”

Goldman Sachs CEO Lloyd Blankfein agreed the blustery trade rhetoric will not lead to financial disaster.

“I don’t think we’re in a suicide pact on this. So I suspect that we’re not going to cause the economies to collapse,” he said Tuesday at the Economic Club of New York. “This is part of a negotiating pattern.”

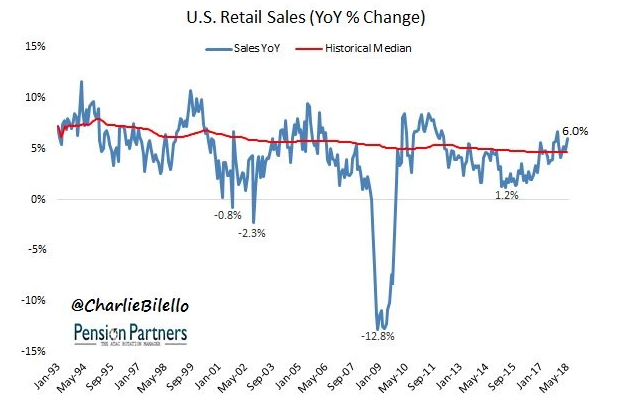

Besides the more optimistic outlook from some seasoned Wall Street veterans, what has also served to minimize the impact on equities from the trade rhetoric is the fundamental economic backdrop of the economy. Much of the economic data coming out during the 2nd quarter has been rather strong. Be it consumer confidence and spending strength or relatively tame inflation data, the economy seems closer to overheating than cooling off. May Retail sales were up 6% year over year as you can see from the chart below. That’s the second highest growth rate in the past 6 years.

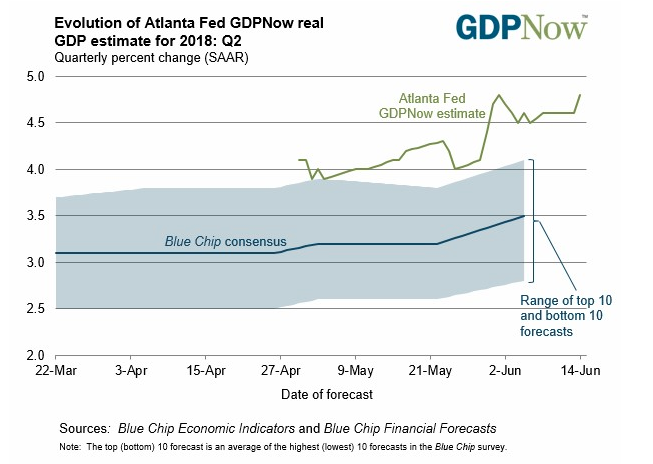

A recent slew of better than expected economic data for the 2nd quarter has pushed economists and analysts to raise their Q2 2018 GDP forecast. Many predictions indicate the Q2 GDP growth will be close to 4 percent. Goldman Sachs’ model expects 4% growth and the average of the estimates in the CNBC rapid tracker is 3.9 percent. The St. Louis Fed Nowcast expects GDP growth to be 3.62 percent. There is a sharp divergence between the NY Fed Nowcast, which expects 2.98% growth and the Atlanta Fed Nowcast, seen in the chart below, which expects 4.8% growth.

A recent slew of better than expected economic data for the 2nd quarter has pushed economists and analysts to raise their Q2 2018 GDP forecast. Many predictions indicate the Q2 GDP growth will be close to 4 percent. Goldman Sachs’ model expects 4% growth and the average of the estimates in the CNBC rapid tracker is 3.9 percent. The St. Louis Fed Nowcast expects GDP growth to be 3.62 percent. There is a sharp divergence between the NY Fed Nowcast, which expects 2.98% growth and the Atlanta Fed Nowcast, seen in the chart below, which expects 4.8% growth.

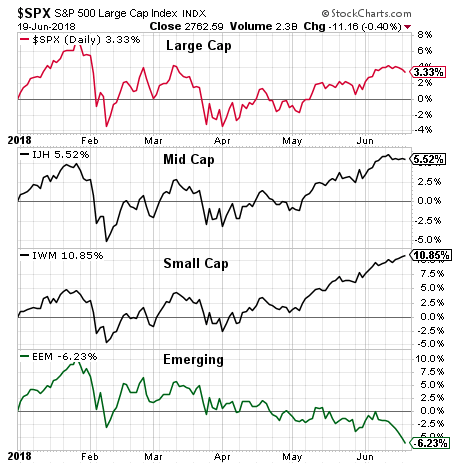

Can we bury our heads in the sand as investors and ignore the geopolitical issues, certainly not! But the headlines of the day that may not impact the economy to any great significance may need to be put into more appropriate perspective and with a long-term view. As such and when step back a little bit to look at the big picture, we come to find that the broader equity market, the S&P 500 (SPX), is doing relatively well as defined in the following charts.

By looking at the charts above, we can see that the S&P Midcap Index (IJH), the S&P Small Cap Index (IWM) and the MSCI Emerging Markets Index (EEM) have performed relatively well despite the numerous headwinds in 2018. The small-cap index is up 10.85% this year. The S&P 500 Index remains up 3.33 percent. Emerging markets have been the weak link and partially due to the tightening monetary policy in the United States.

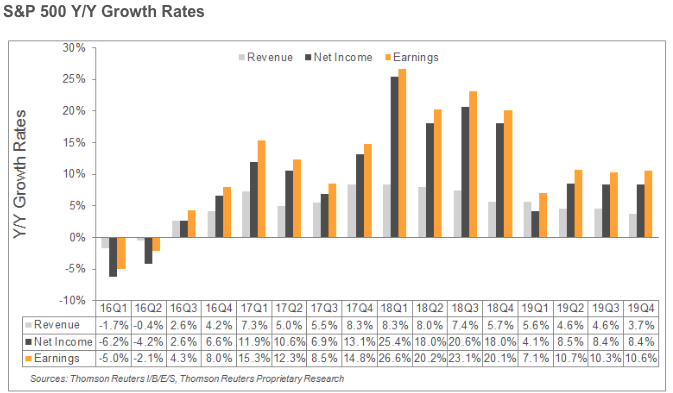

As we enter Wednesday’s trading day, equity futures are largely moving higher. Asian equity markets rebounded overnight and have also served to boost European equity markets in the early hours. There remains a great deal of market uncertainty impacting most every aspect of the market’s performance, which has served to curtail market multiple expansion in 2018. Such curtailment in the face of ever-strengthening corporate earnings growth has offered presumed opportunities for long-term investors. When we’re forced to focus on corporate earnings, the reality is the markets could move considerably higher by year’s end.

The current forecast for Q2 2018 S&P 500 earnings growth is 20.2%, which has been revised higher in each of the last 2 weeks. Finom Group expects this earnings forecast to continue to accelerate higher as earnings season approaches. Most importantly and with all the noise surrounding the markets, ultimately markets follow earnings; it’s just a matter of when, not if!

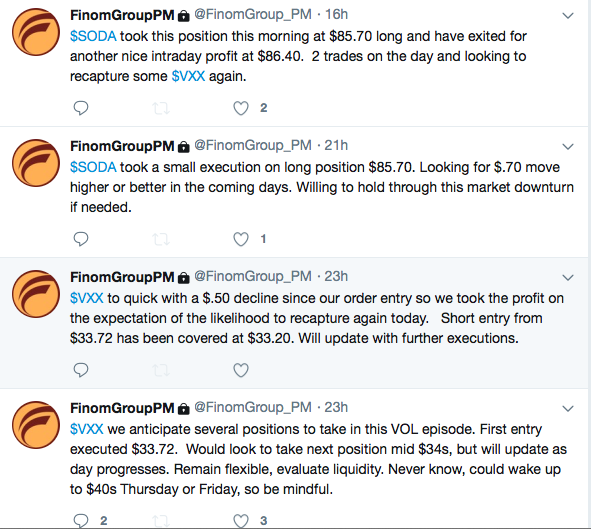

At Finom Group, despite the daily market swings, we continue to trade what the market gives us. With yesterday’s ramp up in volatility and decline in equities, we uncovered and alerted our subscribers to the following trading opportunities and as we executed them profitably in a down market.

There’s always an opportunity in a market downturn and while the media can create a good deal of concerning sentiment, Finom Group continues to trade what the market has to offer on a daily basis. Subscribe today and trade with us, using our daily trade alerts and long-term investment thesis offerings.

Tags: SPX SPY DJIA IWM QQQ VIX VXX XRT