While the Dow Jones Industrial Average finished in positive territory Wednesday, if only slightly, both the S&P 500 and Nasdaq fell as tech leaders made the rounds in Washington. The Nasdaq dropped 1.2%, its worst day since Aug. 15th as Facebook, Amazon, Netflix and Alphabet all dropped. Shares of Microsoft and Twitter also fell to drag the index lower. The S&P 500 declined 0.3% to 2,888.60.

Tech shares fell as Twitter CEO Jack Dorsey and Facebook COO Sheryl Sandberg testified in front of Congress, addressing online election meddling and how to stop abuse on social platforms. Additionally weighing on the tech sector were headlines surrounding Attorney General Jeff Sessions’ interest in probing the probability of tech companies engaging in monopolistic practices. The Justice Department said Sessions will meet with state attorneys general later in September to discuss worries surrounding tech companies that “may be hurting competition and intentionally stifling the free exchange of ideas on their platforms.”

With the tech sectors falling sharply on Wednesday, due largely to Washington probes and interests in certain tech firms, trade discussion carried forward between the U.S. and Canada. The rhetoric didn’t get any more favorable between Canada’s Prime Minster Justin Trudeau and U.S. trade officials. President Trump’s stance on trade is resulting in emerging markets suffering currencies and weighing on both European and Asian equity markets.

“This is putting pressure on the rest of the world to come to terms with Trump’s demands for fairer and more bilateral trade. The risk is that Trump’s policies may be causing a widespread emerging markets crisis,” Yardeni said in a note.”

Despite the many headlines surrounding tech and global trade, the U.S. equity market remains resilient, as September trading gets underway. In Finom Group’s weekly research report, we discussed and outlined the extraordinary aspect of expected moves in the S&P 500 over the last 22 weeks.

“What is also quite interesting about the expected moves since April is that over the last 22 weeks of trading, we’ve only crossed over the expected move 3 times. This means that 86% of the time we have been within 1 standard deviation of the expected move.”

- Firstly it is clear that the market is being moved in part, a large part by quantitative finance or “quants”. We can only see such statistics through programed and algorithmic quant trading systems.

- Secondly, the market is lacking liquidity when quants are in play to the degree they are presently moving markets.

- In such an environment where the market is somewhat quant-driven, fundamentals and technicals matter very little. It’s why for every random technician eyeing a severe market correction they’ve been found in error and why for every fundamental concern over the market it’s been found a fruitless sentiment.

- Quants still need corporations to perform in order to lend credence to individual stock and overall market moves.

In each of the past two trading sessions this week, the S&P 500 has expressed a sharp drawdown intraday before rallying back significantly and identifying in some ways the nature of quants. We attribute a great deal of the “buy the dip” activity to relatable quants and algorithmic trading programs that remain with great efficacy in the marketplace. Given the aforementioned, alongside many other bullish factors guiding the principles for such quant trading, the bears have been found with great consternation and futility for quite some time.

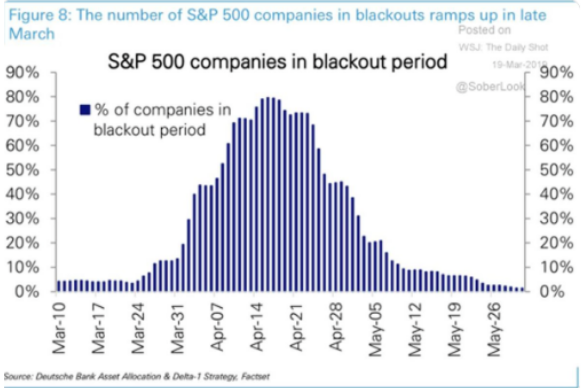

The bulls remain in control of the longer-term narrative and direction of the equity market, supported firstly by the fundamental backdrop of corporate earnings. With that being said, investors should recognize liquidity in the markets is draining, be it by the actions of central banks or the newfound, post Financial Crisis era practices of passive investing. Noted below are the weekly fund flows as offered by Lipper and narrated by Tom Roseen.

“For the second week in three investors were net redeemers of fund assets (including those of conventional funds and ETFs), withdrawing $2.0 billion for Lipper’s fund-flows week ended August 29, 2018. However, fund investors continued to pad the coffers of equity funds (+$2.0 billion), fixed income funds (+$2.2 billion), and municipal bond funds (+$212 million) while being net redeemers of money market funds (-$6.4 billion). Tom Roseen highlights the weekly flows trends for both conventional funds and ETFs in this video series.”

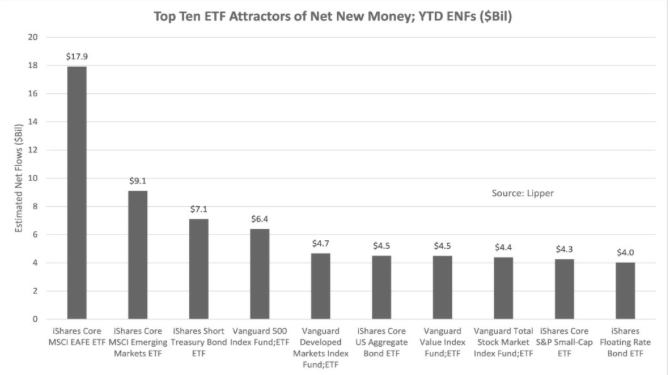

Exchange Traded Funds or ETFs continue to be all the rage since the financial crisis and ever growing due to their low fees and passive investing styles in a bull market that yields strong returns. Equity ETFs have attracted a net $74.7 billion YTD, while taxable bond ETFs have taken in $49.0 billion and municipal bond ETFs have witnessed net inflows of $2.8 billion. Preliminary YTD fund-flow estimates show BlackRock Fund Advisors (+$46.1 billion) as the top attractor of ETF assets, while Vanguard Group Inc. (+$44.0 billion) and Charles Schwab Investment Management Inc. (+$18.7 billion) have received the second and third largest amounts in the U.S. ETF space.

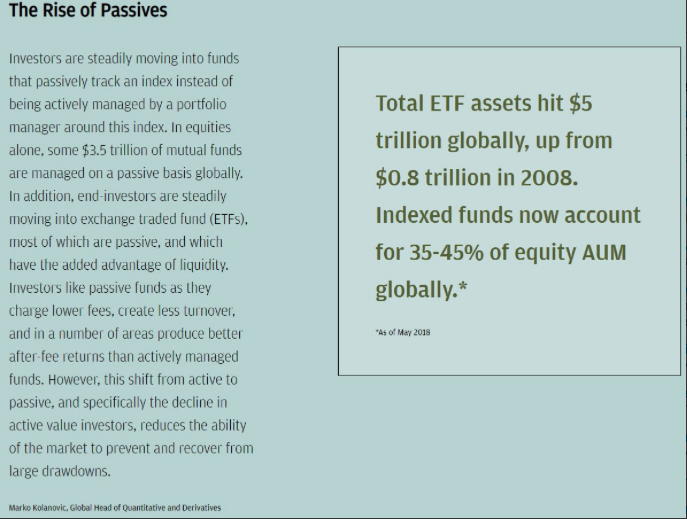

While ETFs continue to grow in both usage and popularity, they are building a potential calamity to come. Given the high concentration and proclivity for using ETFs more so than ever before, the markets can find themselves without the appropriate liquidity measures during times of market strife or when market shocks present themselves. A recent note by J.P. Morgan’s “Quant” team, led by Marko Kolanovic is displayed in the screenshot below. The note outlines the concerns for the over usage or over concentration for ETFs in the marketplace.

What we’ve come to understand about the modern era economy and marketplace is that for every problem there is a solution. The problem with this notion is that the solution is usually not found until after the problem has engulfed the marketplace in a negative cloak of dramatic events.

Marko Kolanovic discussed his concerns over equity ETFs with CNBC as part of a 168-page mega-report, written for the 10th anniversary of the 2008 financial crisis, with perspectives from 48 of the bank’s analysts and economists. Kolanovic describes that the next financial crisis will offer the following characteristics, none of which are appealing to investors or society.

- Sudden, severe stock sell-offs sparked by lightning-fast machines.

- Unprecedented actions by central banks to shore up asset prices.

- Social unrest not seen in the U.S. in half a century.

At the center of Kolanovic’s forecast and predictions for the future is market liquidity. The seismic shift from active to passive managed investments has removed a pool of buyers/liquidity who can swoop in if valuations tumble, he wrote. Additionally, Kolanovic states that the rise of automated trading strategies is also a factor because many quant hedge funds are programmed to automatically sell into weakness. Together, index and quant funds now make up as much as 2/3s of assets under management globally, and 90% of daily trading comes from those or similar strategies.

“Basically, right now, you have large groups of investors who are purely mechanical,” Kolanovic said. “They sell on certain signals and not necessarily on fundamental developments, such as increases in the VIX, or a change in the bond-equity correlation, or simple price action. Meaning if the market goes down 2%, then they need to sell.”

For all the aforementioned variables and market concentration on passive investing, index funds, ETFs and quant finance/mechanical trading, Kolanovic names the future crisis The Great Liquidity Crisis.

“Suddenly, every pension fund in the U.S. is severely underfunded, retail investors panic and sell, while individuals stop spending,” Kolanovic said. “If you have this type of severe crisis, how do you break the vicious cycle, the negative feedback loop? Maybe you stimulate the economy by cutting taxes further, perhaps even into negative territory. I think most likely is direct central bank intervention in asset prices, maybe bonds, maybe credit, and perhaps equities if that’s the eye of the storm.”

Despite the longer-term outlook and dire predictions from the J.P. Morgan quant team, their forecast remains positive for equity markets and the economy, at least through mid 2019. Finom Group encourages investors to read the report by J.P. Morgan linked. Moreover and possibly more importantly, Kolanovic likens his research and reporting as a warning rather than a prediction.

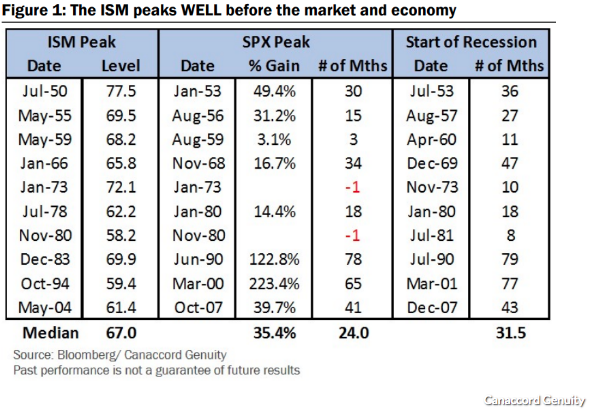

With less pomp and drama, Tony Dwyer of Canaccord Genuity recently focused his thoughts on the market that is 2018. He reiterated his S&P 500 2018 target of 3,200 in his recent CNBC “Fast Money” appearance. For 2018, he projected the index to rise to 3,360, highlighting his view that a much-feared recession isn’t lurking anywhere close.

“The Institute for Supply Management showed that the manufacturing sector remains on very solid ground.” History shows that since 1950, the ISM typically peaks well before the economy enters recession or the S&P 500 hits the cycle high, especially over the past three levered economic periods. The ISM is yet another widely followed economic indicator that suggests a recession likely remains years away.”

The Institute for Supply Management said its manufacturing index jumped to a 14-year high of 61.3% last month from 58.1% in July. Economists surveyed by MarketWatch had forecast the index to total 57.9%. The ISM’s new-orders index climbed 3.2 points to 65.1% and the employment gauge rose 2 points to 58.5%. Some 16 of the 18 industries tracked by ISM reported expanding in August.

The Institute for Supply Management said its manufacturing index jumped to a 14-year high of 61.3% last month from 58.1% in July. Economists surveyed by MarketWatch had forecast the index to total 57.9%. The ISM’s new-orders index climbed 3.2 points to 65.1% and the employment gauge rose 2 points to 58.5%. Some 16 of the 18 industries tracked by ISM reported expanding in August.

The economy remains on solid footing and the expansion era is widely viewed and projected to grow through 2019. Beyond that may be anybody’s best guesstimate. As it is with any expansion era and bull market cycle, poor participation exercises develop during such times of wealth creation and prosperity and the repercussions bear little consideration. Kolanovic’s warning, if history is any guide, will likely prove prescient. Based merely on the human condition, the length of the expansion cycle and bull market may prove the deeper recession and bear market to come.

Tags: AMZN FB GOOGL SPX VIX SPY DJIA IWM QQQ TVIX TWTR UVXY VXX XLK